It could have been worse.

The US had a semi holiday today in observance of Veterans Day. The bond market was closed, government offices were closed (so no economic news). The US stock markets were open, however.

After opening lower and extending to the downside, a slow grind higher took the Dow into positive territory. The S&P and Nasdaq stilll ended down, but well off the lows.

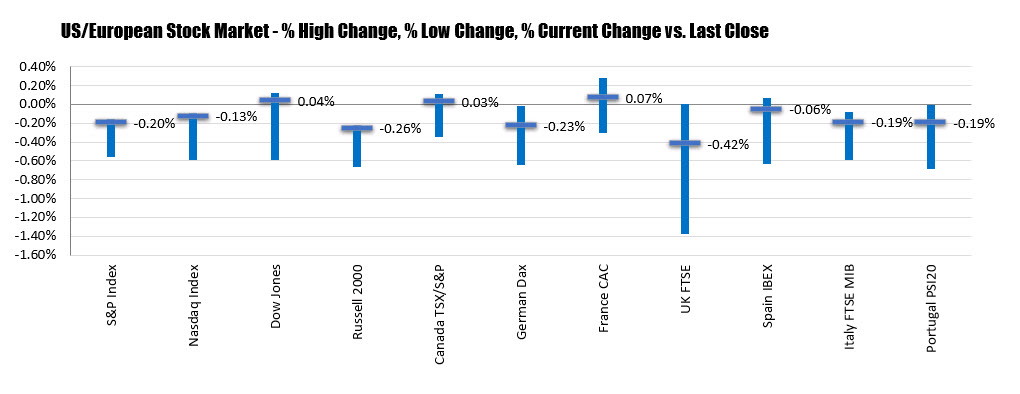

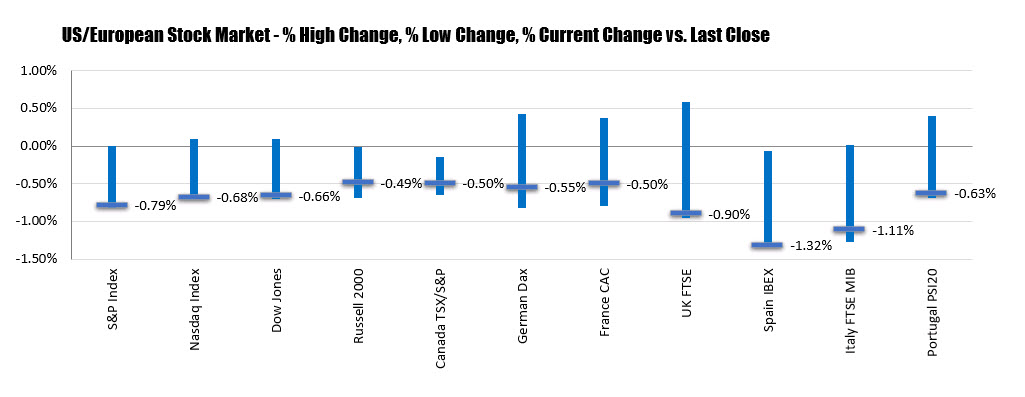

The final numbers are showing:

- The S&P index fell -6.07 points or -0.20% to 3087.01

- The NASDAQ index fell -11.036 points or -0.13% t0 8464.27

- The Dow rose 10.25 points or 0.04% to 27691.49.

The Dow gain was good enough for a record close once again. The S&P and NASDAQ which also closed at record levels on Friday, could not repeat the feat today.

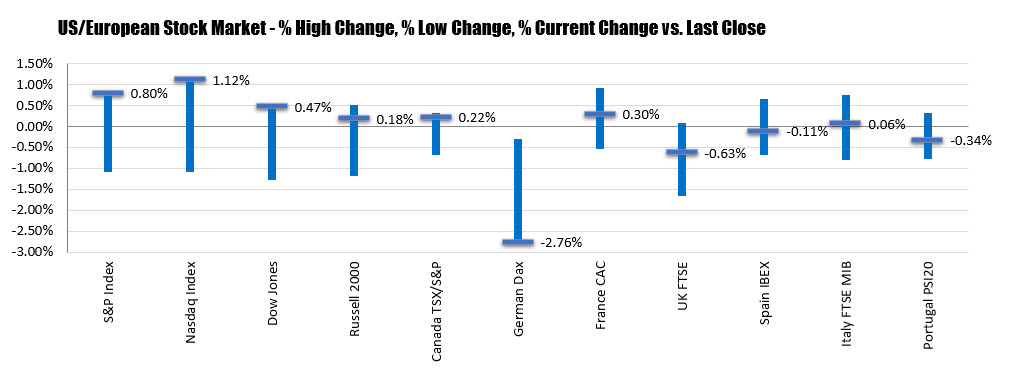

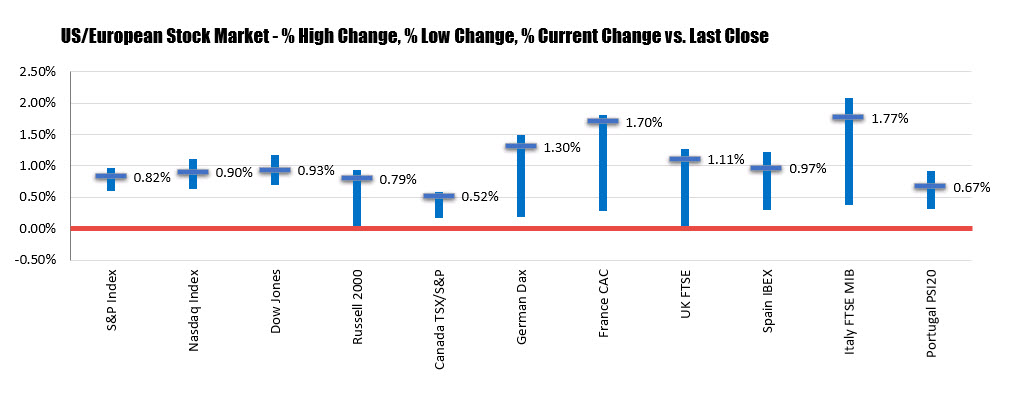

Below is a graphical look at the percentage high, low, and close for the major indices in North America and Europe today.

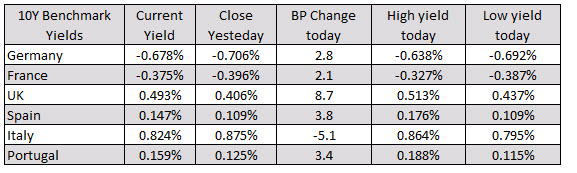

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: A snapshot of the forex market shows that the GBP is still the strongest of the majors (but off earlier higher levels). The JPY and USD remain the weakest. The CAD has gotten stronger on stronger oil and a was dovish Bank of Canada statement.

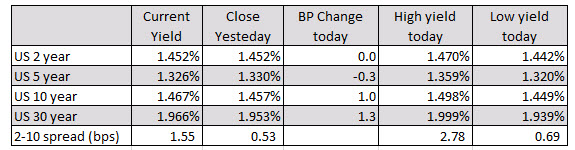

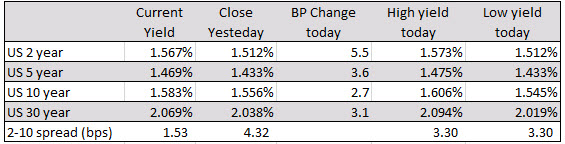

A snapshot of the forex market shows that the GBP is still the strongest of the majors (but off earlier higher levels). The JPY and USD remain the weakest. The CAD has gotten stronger on stronger oil and a was dovish Bank of Canada statement. Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.

Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.