Tesla, 20th largest by market cap, trades at 300+ times earnings.

Archives of “IMG (company)” tag

rssEuropean indices end the session lower on the day

German DAX, -0.54%, UK’s FTSE 100 -0.96%

The major European indices are ending the day lower. The provisional closes are showing:

- German DAX, -0.54%

- France’s CAC, -1.28%

- UK’s FTSE 100, -0.96%

- Spain’s Ibex, -1.42%

- Italy’s FTSE MIB, -0.74%

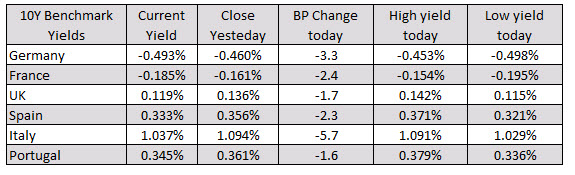

The 10 year yields showed meaningful moves to the downside. Italian yields fell the most at -5.7 basis points. German yields declined by -3.3 basis points

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:- spot gold continues its move to the upside with a gain of $19.60 or 1.07% at $1861.50. Sobers doing even better with a $1.09 gain or 5.13% to $22.39.

- WTI crude oil futures for September delivery are down $0.57 or -1.36% at $41.35. Inventory data confirmed the private data with a build of 4.892M barrels. The expectations was for a -2.2M draw.

In the US stock market the major indices are mixed:

- S&P index is up 4.9 points or 0.15% at 3262.69

- NASDAQ index is down -1 point or -0.1% at 10679.30

- Dow industrial average is up 82 points or 0.31% at 26923.

In the forex market, the EUR is the strongest while the JPY is the weakest of the majors. The US dollar is down vs. all the major currencies with the exception of the JPY. It is near unchanged vs. the GBP and has recovered losses of around 90 basis points at the London morning session lows.

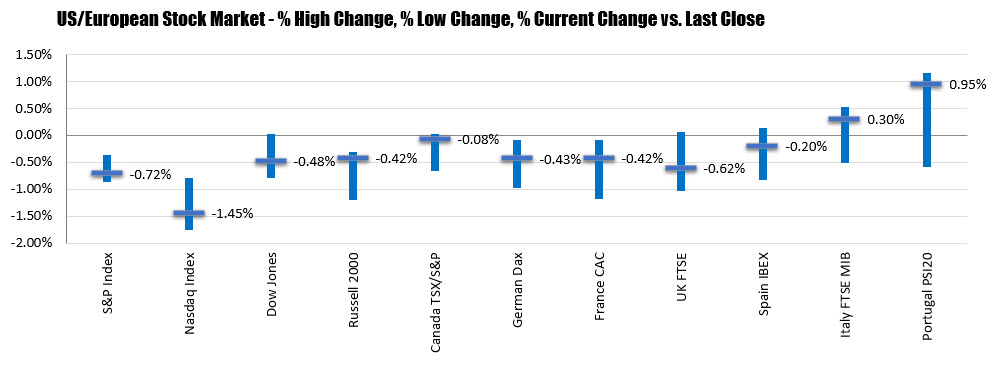

European shares end the session with mixed results

Italy and Portugal indices move higher

the major European indices are ending the session with mixed results. Germany, France, UK and Spain show declines while Italy and Portugal eked out gains. The closes are showing:

- German DAX, -0.43%

- France’s CAC, -0.42%

- UK’s FTSE 100, -0.62%

- Spain’s Ibex, -0.2%

- Italy’s FTSE MIB, +0.3%

- Portugal’s PSI 20, +0.95%

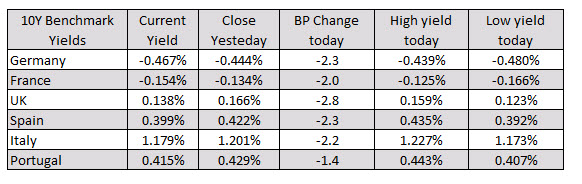

In the European debt market, benchmark 10 year yields fell across the board with UK yields down the most at -2.8 basis points.

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:- spot gold $-4.25 or -0.23% $1806.05. The high for the day reached $1813.48. The low extended to $1802.97

- WTI crude oil futures fell $0.19 or -0.46% to $41.01. It’s high price reached $41.18 while the low extended to $40.60. The September contract is currently down $0.21 or -0.51% of $41.19

In the forex market,

- GBPUSD. The GBPUSD is trading at new session highs in the currently hourly bar. In the process, the price has moved back above its 200 and 100 hour moving average. That tilted the bias back to the upside in what has been an up and down market over the last 7 or so trading days. On the topside a trendline connecting highs from this we currently comes in at 1.2634. The high from yesterday reached 1.26487. The high for the week on Monday reached 1.26652.

- EURUSD: The EURUSD moved higher in the London session after finding support buyers near the 38.2% retracement of the move up from the Friday low at 1.13759. The high price reached 1.1441. The high price from yesterday reached 1.14512. There is close support at 1.14223 area

A huge Twitter hack appears to be underway

Elon Musk and crypto exchanges targeted

The Twitter accounts of many the largest cryptocurrency exchanges and influences appear to have been hacked, along with Elon Musk and others. They’re directing people to make bitcoin donations. Some on the list:

- Cz

- Binance

- Gemini

- Bitlord

- Coindesk

- Justin sun

- Kucoin

- Coinbase

- Charlie lee(Satoshi lite)

- Gate.io

- Angelobtc

- Tron

- Bitcoin

It’s tough to imagine that the were hacked individually. Rather this looks like it’s something internally via twitter or some third party service involved with twitter. That looks bad for the company.

Let me tell you, if I wanted to make money and could hack Elon’s account, I would be buying TSLA puts/calls, rather than asking for Bitcoin donations.

Update: They got Bill Gates too.

Fauci says will have an effective COVID-19 vaccine by the end of 2020

Anthony Fauci speaking with Reuters on the coronavirus

- Says that US will have an effective coronavirus vaccine by year-end

- Moderna’s vaccine trial results were especially promising

- He does not think China will be first with a vaccine, at least not by much

Trump says he is not interested in speaking with China on another trade deal

Whiny biatch speaking in a CBS interview Sry, damn autocorrect. Trump speaking in a CBS interview.

So far he has been whining about getting schools reopened and various grievances he has with life.

Comment on China the only one really pertaining to markets, so far at least.

More from Trump:

- We can impose massive tariffs on China f we want

- You’ll see more coming on actions towards China

- China is buying a lot of agricultural products

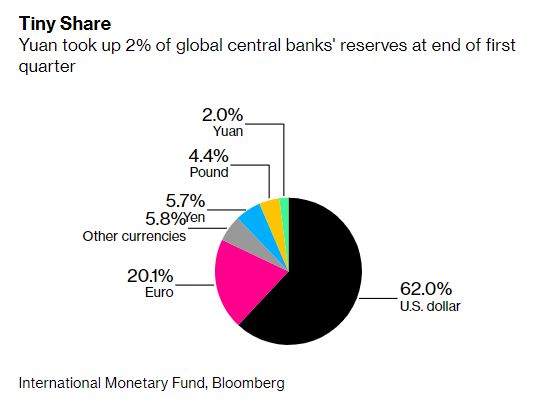

The Chinese Yuan represents 2% of the reserves of the central banks.

AUD/USD to drop back to 0.64 by year end – global economy weakening, China retaliation

A brief summary from a late week Rabobank note on the Australian dollar:

- investors are currently over-estimating the ability of the global economy to bounce back from the pandemic

Combined with:

- any news that China could be targeting Australian exports in retaliation for the government’s political stance would also leave AUD vulnerable

Rabo’s view is thus:

- we see risk of a drop in sentiment by the end of the year

- likely to drag AUD/USD lower

- forecast AUD/USD at 0.64 on a six-month view