A look at vaccine developments and its impact on the stock market

Moderna

Source: Bloomberg

Source: Bloomberg

Yes, we’ve heard it already – both statements. Of course, from a humane point of view, it’s good to hear there is progress with the vaccine development. But it increasingly looks like by the time it is ready, most people indeed will already have immunity to the virus. In the meantime, Moderna is enjoying spikes of investor attention.

The latest update is that it got one step closer to the vaccine pushed its stock from the rage of $60 to $75. Needless to say, if the reports informed us tomorrow that another testing stage is cleared, we would see this stock already somewhere at its recently made all-time high above $85. Trajectory zone 2 would be the channel of movement in this case.

In fact, Moderna’s stock may well get to those highs anyways: fundamentally, the interest for anti-virus business will keep its momentum months or even years ahead, even if tomorrow is no virus at all. So Moderna will see its rise, just it will be a slow case scenario – the one that corresponds to trajectory zone 1.

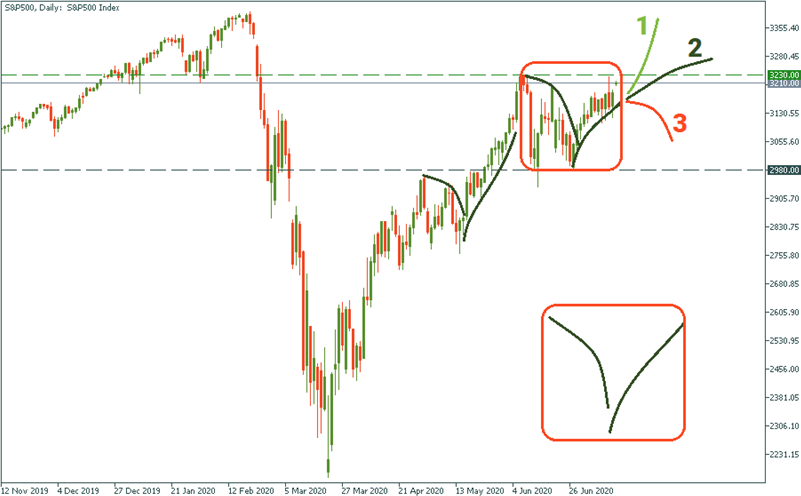

S&P 500

For the stock market, the vaccine hope seems to be the only “joy” that keeps the optimism on the stage. With the S&P, currently, we are almost exactly at the previous high of 3 320, and in an obvious consolidation. Meaning, the market is not really sure what to look at more: still spreading infections in the US of the vaccine hopes. Today, it seems the latter is taking the upper hand. What the next step is going to be?

An optimistic scenario suggests we will see Trajectory 1 giving the green light to bulls and repeating the pattern of the previous upward wave the S&P followed in May. How probable is that? Quite probable, given that the reports about vaccine developments keep coming more often.

A pessimistic scenario as per Trajectory 3 suggests that we are actually at the tip of another “inside wave” which will bounce down from the resistance of 3 230. How probable is that one? Also very probable: clearing testing processes is good, but we don’t have the vaccine yet. It may take months before we finally see it.

A moderate scenario presumes that the market will overlook the absence of the vaccine and take on a more positive mood. That will be Trajectory 2.

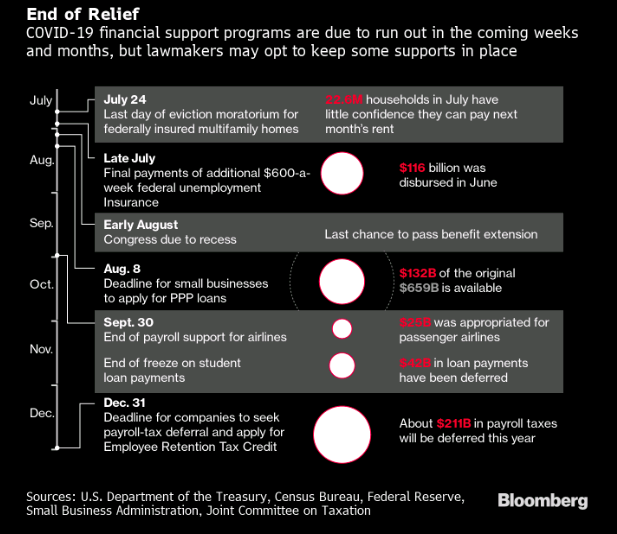

The thing is that, indeed, it may be not until the very end of 2020 when the vaccine eventually gets done. Everyone knows that. If the S&P was only waiting for the vaccine to finally get developed, then it would be going sideways between 2 980 and 3 230 for months from now. Is that likely? No. Regardless of the vaccine process, the more we move into the future, the more the market becomes insensitive to the reality of infections and, therefore, independent from the vaccine hopes. Why? Because with the vaccine or without it, life goes on. And even the virus is now on the rise in the US – again – it will slow down pretty soon. So the question is not “if” but “when”. And the market is bored waiting.

This post is written and submitted by FBS Markets for informational purposes only. In no way shall it be interpreted or construed to create any warranties of any kind, including an offer to buy or sell any currencies or other instruments.

The views and ideas shared in this article are deemed reliable and based on the most up-to-date and trustworthy sources. However, the company does not take any responsibility for accuracy and completeness of the information, and the views expressed in the article may be subject to change without prior notice.

Source: Bloomberg

Source: Bloomberg