Indices close near lows for the day

- German DAX, -0.5%

- France’s CAC, -1.4%

- UK’s FTSE 100, -1.1%

- Spain’s Ibex, -1.7%

- Italy’s FTSE MIB, -0.7%

- German DAX -4.0%

- France’s CAC -3.49%

- UK’s FTSE 100, -3.25%

- Spain’s Ibex, -5.7%

- Italy’s FTSE MIB, -4.9%

- German DAX, unchanged

- France’s CAC, -3.1%

- UK’s FTSE 100, -4%

- Spain’s Ibex, -4.9%

- Italy’s FTSE MIB, -1.46%

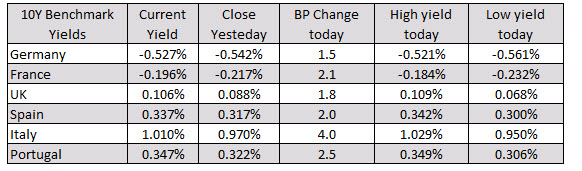

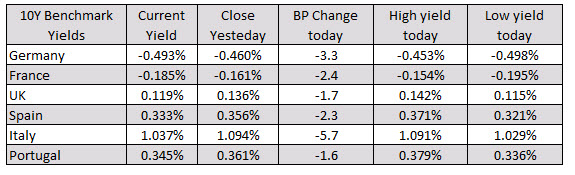

In the benchmark 10 year yields today, yields have moved back higher after being negative at the start of the North American session

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

The deal will also involve the International Monetary Fund and is expected to include 22 billion euros of funding for Greece, sources said.

The deal will also involve the International Monetary Fund and is expected to include 22 billion euros of funding for Greece, sources said.

The latest targeted leak in the European “stress” tests is that according to German bank sources, the discount on Greek debt will be in the 16-17% ballpark. This compares to an earlier rumor leak of a 10% discount on Greek debt which however did not sufficiently spike the market, leading to rumor #2 which so far has done a good job at pushing the AUDJPY (aka stocks) higher. The quid pro quo however, is to take not only German but now French bonds, will be out of the “stressed” picture. As

The latest targeted leak in the European “stress” tests is that according to German bank sources, the discount on Greek debt will be in the 16-17% ballpark. This compares to an earlier rumor leak of a 10% discount on Greek debt which however did not sufficiently spike the market, leading to rumor #2 which so far has done a good job at pushing the AUDJPY (aka stocks) higher. The quid pro quo however, is to take not only German but now French bonds, will be out of the “stressed” picture. As