1. Number of winning vs losing trades

The success rate of your trades is an important number to have in order to monitor improvements in other areas of trading.

There’s a general view that you’ll want to win more often than you lose – but there are many successful traders out there who’ll take lots of small losses and fewer bigger winners. What matters is how this figure balances with your average win/loss size (see number 3 below).

2. Largest number of consecutive winners and losers

Take a look at when these happened – what were the market conditions at the time?

This will give you a picture of what markets you’re good at trading, and which ones you should be wary of. How can you protect yourself against the poor market conditions, and maximize the benefits of the good conditions?

3. Average win size vs average loss size

I often bang on about how the 2:1 risk-reward principle should be viewed as an ‘aim’ rather than a ‘rule’.

Achieving double the reward on winners than the loss on losers is a tough call for any trading strategy to maintain – it’s certainly a lot harder than many trading gurus would have you believe.

However, if your losses are too big and keep wiping out all your gains –you’ve got a problem. This figure needs to be carefully balanced with your success rate (number 1, above) to achieve profitability.

4. Largest and longest draw-down periods (more…)

Archives of “futures contract” tag

rss10 Characteristics of Successful Traders

1) The amount of time spent on their trading outside of trading hours (preparation, reading, etc.);

2) Dedicated periods to reviewing trading performance and making adjustments to shifting market conditions;

3) The ability to stop trading when not trading well to institute reviews and when conviction is lacking;

4) The ability to become more aggressive and risk taking when trading well and with conviction;

5) A keen awareness of risk management in the sizing of positions and in daily, weekly, and monthly loss limits, as well as loss limits per position;

6) Ongoing ability to learn new skills, markets, and strategies; (more…)

This Never Happens

You know what never happens? This never happens:

Exponential acceleration in the direction of a trend is never followed by stabilization at a new plateau. It does not matter if the chart represents Gold futures, or house prices, or population levels: extreme moves are followed by collapses, not by plateaus.

The difficulty, of course, lies in picking the top. The graves are filled with the ruined balance sheets of those who tried to pick the top too early.

Steven Drobny, The Invisible Hands (Book Review )

In his preface to the new edition of The Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real Money (Wiley, 2014) Steven Drobny contends that “real money investors rem

ain stuck in their antiquated ways. They will view their investments from a notional allocation standpoint, and diversify their holdings by asset class names, not by underlying risk characteristics.” Investors are unprepared for another crisis, despite the fact that “quantitative easing is coming to an end, and tremendous uncertainty exists everywhere.” Hence the renewed timeliness of the interviews, conducted in the spring of 2009, with traders who managed to navigate the financial crisis of 2008.

With the exception of Jim Leitner, who was also interviewed for Drobny’s Inside the House of Money, the managers—ten who run global macro hedge funds and one real money manager—remain anonymous. Drobny “chose the anonymous route to increase candor as well as keep the focus on the ideas as opposed to the personalities.” (p. xxx)

The Invisible Hands is a terrific book even though many of the strategies described in it are difficult if not impossible for the individual investor to implement. But the thinking behind these strategies and the way their risk is managed are often so compelling that everyone who is active in the markets can learn a tremendous amount from the interviews. Moreover, even though most of the contributors are anonymous their life stories are fascinating, sometimes even inspiring. (more…)

Just Avoid These 7 Words -If U Are A Trader

Be careful how you use the following words and phrases as they become road blocks or worse take you down the wrong path.

Should– Phrases include: “The market should have” and “I should have”. Those phrases are often used to socialize losses. They are a strong signal something is off. They should be used to aid you in correcting your vision not make you feel better.

Must– Phrases include: “The market must…”, “I must make money”, or “I must trade”. The market does not have to do anything and either do you. When you use the word “must” it is hardly ever from a position of strength. The market knows when you are desperate and will take full advantage of you. Keeping your expenses as low as possible will make it easier to not make those statements.

Will– Phrases include: “The market will..” and “I will make money”. Once again the market does not like to be told what to do. It is the bratty kid screaming at the tops of his lungs. The word “will” relaxes your mind, similar to “should”, people use it to be lazy instead of a black background in an otherwise light picture. You can do everything right and still lose money. That is why trading is so effective at diminishing confidence. In most every activity, if you do everything right you are going to get the desired result. Doing the “right” things is bare minimum. Of course, over time you will get paid for doing the right things but it is never when you think it should be and hardly how much you anticipated. (more…)

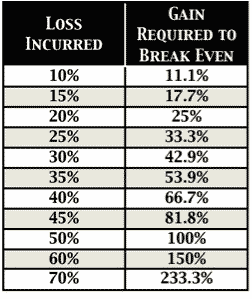

This One Thing that Separates losing traders from the Winners

Making money in the financial markets is not only challenging but just surviving an account blow up is also a win for many new traders. There is one thing that ultimately determines your success in the markets. It is not your stock picking skills, your trend following or even trading a robust method. The dividing line between the winners and the losers in trading and investing is risk management. If you trade all in and risk it all over an over you will eventually blow up your account, and the funny thing is that it will likely be on your ‘can’t miss’ trade that is just way to obvious to everyone and is a crowded trade. Traders that believe have 10 losing trades in a row are impossible will discover it is very possible. Each trade should be large enough to return enough to make it worth your while, but small enough to make it inconsequential to your results in the long term. Trading small not only eliminates the financial risk of account ruin that is ever present in a market environment that is not conducive to your methodology but small risks also keep your logical brain in control of your trading and your emotions on the side lines.Nothing is more painful in my opinion than to build up an account during a great string of wins only to give it back with a string of losses in a different market environment. Small bets and staying out when he market waves get wild is a great formula to avoid big draw downs. You can still win big when you are right by letting a winner run but always lose small when you are wrong. The bet size on each trade will make or break ever trader at some point usually sooner than later. (more…)

You Might be a Bad Trader if:

You Might be a Bad Trader if:

…You are 100% sure about a trade being a winner so you have no need to manage risk.

…You go all in on one trade and it will make you are break you.

…You like to buy deep out of the money stock options not understanding how bad the odds are on them.

…You love directly giving unsolicited advice to other traders due to not understanding they have different trading plans and time frames.

…You are so new to trading you think it is a place of easy money.

…You think traders that talk about risk management and trader psychology are silly and that you are above that.

…You brag to much about your account size and last trade, it indicates to me you do not understand the long term in the markets.

…You are very loud about your winners but never discuss your losing trades.

…You brag to much.

And You Might really be a bad trader if: If you attack trading principles that you do not even fully understand due to lack of real trading.

Trading Mathematics and Trend Following

Some quick points, to be making money, Profit Factor must be greater than 1.

- Profit Factor (PF)

- = Gross Gains / Gross Losses

- = (Average win * number of wins) / (Average loss * number of losses)

- = R * w / (1-w)

- where R = Average win / Average loss

- w = win rate, i.e. % number of winners compared to total number of trades

Re-arranging, we have

- w = PF / (PF + R)

- R = PF * (1 – w) / w

Sample numbers showing the minimum R required to break-even (i.e. PF = 1, assuming no transaction costs) for varying win rates.

- w = 90% >> R = 0.11

- w = 80% >> R = 0.25

- w = 70% >> R = 0.43

- w = 60% >> R = 0.67

- w = 50% >> R = 1

- w = 40% >> R = 1.5

- w = 30% >> R = 2.33

- w = 20% >> R = 4

- w = 10% >> R = 9

The style of trading strongly influences the win rate and R (average winner / average loser). For example, (more…)

Traders-Are You Guilty?

- re you trading without a plan? Trading without a plan makes you emotional and a gambler.

- Do you ever trade too big for your trading account size? Big trades are bad trades for the emotional engagement and risk of ruin that they entail over the long term.

- Do you risk losing more if you are wrong than you will make if you are right? The biggest driver of profitability in your trading will be big wins and small losses. Big losses and small wins is a sure path to losing your trading capital.

- Have you traded without studying charts to see what has happened historically with similiar price patterns? If you do your homework you can make money understanding possibilities and probabilities from past patterns. Trading your own opinions will usually put you on the wrong side of the market.

- Did you trade a system before you back-tested it?Or are you just trading blindly?

- Have you ever exited a trade due to fear instead of due to hitting your stop loss or trailing stop? The right exit is what determines your profitability and whether your win is a big one or your loss is a big one.

- Have you ever entered a trade becasue of greed without an entry signal? Chasing a trade after the trend is over is a great way to lose money consistently and quickly.

- Have you ever copied someone else’s trade not knowing their time frame or position size? Ultimately you have to trade your own system and your own method that matches your own personality and risk tolerance. Only you can make yourself profitable with faith in yourself and your method.

- Are you that person that loves to short during market up trends and miss a whole up move?The easy money is on the side of the trend in your time frame going against the trend is a great way to lose money.

- Are you that knife catcher that keeps going long at the worn time in a down trend? When everyone is exiting a market that is the worst time to be getting long as wave after wave of holders are leaving.

Trading Should Be Effortless

- Money comes in bunches.

That one says it all. You can’t force trades. You can’t simply work harder in order to be ‘in sync’. Sometimes you are, sometimes you are not. You simply have to accept that as being part of the trading business. What you can do, is to closely monitor if your performance is in sync with the market’s performance. If the markets make new highs and your overall portfolio is going down something is wrong. You need to address that issue. Fast. The best way is to step aside and drastically reduce exposure and risk. That’s what I did.

- Trading should be effortless.

A true piece of wisdom. In my experience when I trade well it is like shooting fish in a barrel. Almost everything works. I don’t need to be overly patient with positions. The money comes in very fast. That’s exactly how trading should be. The exact opposite was the case during the first 2 months of this year. So I did what I had to do. I recognized the situation for what it was and admitted my efforts were not leading my portfolio anywhere. It was like folding when you are dealt a bad hand in poker. So I folded. Now I am waiting for the next hand. If it is a bad one I fold again. If a series of trades start to really go my way I push it hard and increase exposure and trade aggressively. (more…)