NASDAQ has its worst day since August. Fears about coronavirus send major indices lower.

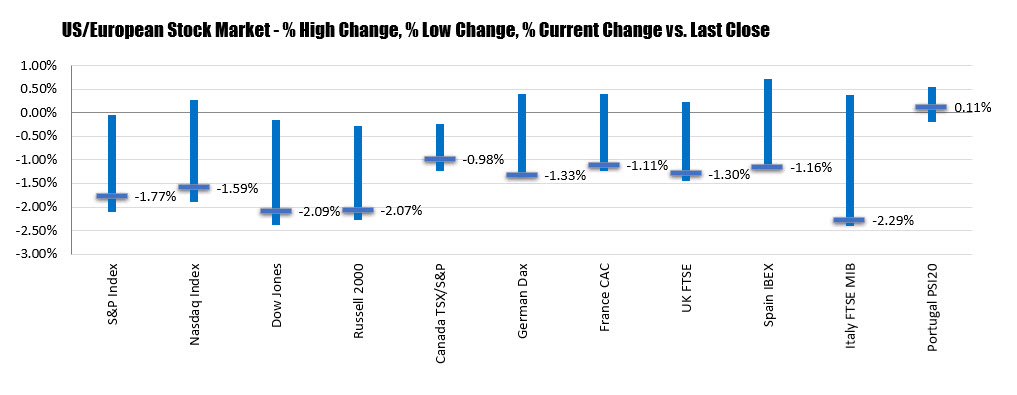

Major indices are ending the session sharply lower. The Dow and S&P had their worst day since October. The NASDAQ index fared even worse with its worst day since August.

The final numbers are showing:

- S&P index -51.89 points or -1.57% to 3243.57. The high reached 3258.85. The low extended to 3234.50 (early in the session).

- NASDAQ index fell -175.60 points or -1.89% to 9139.30. The high reached 9185.449. The low extended to 9088.043.

- Dow industrial average fell -453.93 points or -1.57% to 28535.80. The high reached 28671.79. The low extended to 28440.47.

Some losers on the day included:

- United Airlines, -5.26%

- Schlumberger, -5.06%

- Broadcom, -4.69%

- Nvidia, -4.12%

- Intel, -4.07%

- Micron, -4.04%

- Alibaba, -3.78%

- Intuitive Surgical, -3.65%

- FedEx -3.65%

- DuPont, +3.4%

- Delta airlines -3.38%

- Caterpillar, -3.35%

- American Express, -3.32%

- Disney, -3.05%

- Apple -2.93%

Winners in a huge down day included:

- Beyond Meat, +4.43%

- Chewy, +1.79%

- target, +1.29%

- Walmart, +1.28%

- Gilead, +1.12%

- Pfizer, +0.8%

- Procter & Gamble, +0.42%

- Walgreens Boots, +0.35%

- Stryker, +0.16%

- Merck, +0.16%

Whirlpool is reporting and beat of $4.91 versus estimate of $4.27. Revenues fell short of expectations at 5.38 billion versus 5.52 billion estimate. Whirlpool shares are trading at $149 per share that’s up $0.77 or 0.52%.

Earnings releases pickup tomorrow with 3M, Starbucks, Apple, Pfizer and Lockheed Martin as some of the key releases.

Other key releases this week include:

- Wednesday: Tesla, McDonald’s, Microsoft, Boeing, Facebook

- Thursday: Amazon, UPS, Coca-Cola, Electronic Arts, Biogen

- Friday: Chevron, Honeywell, Caterpillar, Exxon Mobil, Colgate-Palmolive