1) Trading Without Context – Many traders will enter positions with little more than a chart-based “setup” or a hunch that the market is heading lower. They don’t locate where the market is trading with respect to its daily range and often can’t identify where the relevant ranges are located. Is the most recent market move gaining or losing volume/participation? Are most sectors participating in the move? Without context, traders trade reflexively, not proactively.

1) Trading Without Context – Many traders will enter positions with little more than a chart-based “setup” or a hunch that the market is heading lower. They don’t locate where the market is trading with respect to its daily range and often can’t identify where the relevant ranges are located. Is the most recent market move gaining or losing volume/participation? Are most sectors participating in the move? Without context, traders trade reflexively, not proactively.

2) Trading Without Targets – Focused on entries, traders often don’t explicitly identify where they would harvest profits. They hold trades too long, exiting in a panic after reversals, or they take profits quickly, missing opportunity. They don’t factor current volatility into estimates of how far the market could move on their time frame, and they often don’t explicitly look for targets based upon prior moves and ranges.

3) Trading Without Reflecting – The slow times of day are excellent opportunities to review trading for the day, reformulate market views, correct mistakes, and set goals going forward. Many traders, however, never stop looking for the next trade, lured by the siren’s promise of breakout. Without the benefit of reflection, they compound errors, turning mistakes into blowups and blowups into slumps.

Archives of “Financial economics” tag

rssThe Disciplined Trader: Developing Winning Attitudes by Mark Douglas

Intro

- Reaching the level of success they desire as traders will require them to make at least some, if not many, changes in the way they perceive market action.

- The markets have absolutely no power or control over you, no expectation of your behavior, and no regard for your welfare.

- There are only a few traders who have come to the realization that they alone are completely responsible for the outcome of their actions. Even fewer are those who have accept the psychological implications of that realization and know what to do about it.

- The nature of the markets made it easy no to have to confront anything that otherwise might be perceived as a problem because the next trade always had the possibility of making everything else in one’s life seem irrelevant.

- I CREATED MY LOSSES INSTEAD OF AVOIDING THEM SIMPLY BECAUSE I WAS TRYING TO AVOID THEM.

- Unsuccessful Trading Behaviors

- Refusing to define a loss.

- Not liquidating a losing trade, even after you have acknowledged the trade’s potential is greatly diminished.

- Getting locked into a specific opinion or belief about market direction. I.E. “I’m right, the market is wrong.”

- Focusing on price and the money

- Revenge-trading to get back at the market from what it took from you.

- Not reversing your position even when you clearly sense a change in market direction

- Not following the rules of the trading system.

- Planning for a move or feeling one building, then not trading it.

- Not acting on your instincts or intuition

- Establishing a consistent patter of trading success over a period of time, and then giving your winning back to the market in one or two trades.

Your Trading Method-10 Points

1.“Trade What’s Happening…Not What You Think Is Gonna Happen.” – Doug Gregory

2. Go long strength; sell weakness short in your time frame.

3. Find your edge over other traders.

4. Your trading system must be built on quantifiable facts not opinions.

5. Trade the chart not the news.

6. A robust trading system must either be designed to have a large winning percentage of trades or big wins and small losses.

7. Only take trades that have a skewed risk reward in your favor.

8. The answer to the question, “What’s the trend?” is the question, “What’s your timeframe?” – Richard Weissman. Trade primarily in the direction that a market is trending in on your time frame until the end when it bends.

9. Only take real entries that have an edge, avoid being caught up in the meaningless noise.

10. Place your stop losses outside the range of noise so you are only stopped out when you are likely wrong.

Life's Unanswered Questions

Help me out here…

Why do you check your stocks twice a day but your cholesterol twice a decade? The former is killing your emotions and the latter is killing you.

Why do companies still provide paper receipts? My grandma discovered email 15 years ago.

Why do companies limit the number of sick days employees can take? If you can’t trust me when I say I have bronchitis, you shouldn’t trust me to be your employee.

Why is 2008’s 35% market crash so memorable, but 2013’s 33% rally so forgettable?Answer this and you’ll be a better investor.

Why is it so much easier to fool yourself than other people? It is amazing to watch smart investors convince themselves of something that clearly isn’t true. (more…)

Skill Vs Luck

Michael Mauboussin, head of Global Financial Strategies at Credit Suisse, has written extensively on the role of skill vs. luck in many endeavors … mostly for business, sports and investing.

He is well worth paying attention to.

This, in particular:

There is actually a very interesting test to determine if there is any skill in an activity, and that is to ask if you can lose on purpose. If you can lose on purpose, then there is some sort of skill. Investing is very interesting because it is difficult to build a portfolio that does a lot better than the benchmark. But it is also actually very hard, given the parameters, to build a portfolio that does a lot worse than the benchmark. What that tells you is that investing is pretty far over to the luck side of the continuum. That is the first important thing.

From that one paragraph, and the logical conclusions that follow (there is a lot more to it than that one paragraph) … a few important points:

- There is a continuum of luck to skill

- Investing (I’d substitute ‘trading’ in there) has elements of both … “pretty far over to the luck side of the continuum“

- Given it’s a spectrum, there is skill involved

- Skill can be improved

7 Basic Truths of Trading

- Well-defined objectives. Are you trying to beat a certain return hurdle, like inflation or an index? Are you trying to generate 5% or 50% returns per year? You have to understand what you are trying to do and then bend your investment process around it. The other way around isn’t possible.

- An understanding of the markets that you will be operating in. Stick to what you know. Narrow your focus so as to make the most of your efforts. You need to know everything about the markets where you’re taking positions.

- A clearly defined methodology for getting into and out of positions. This includes which indicators, news items, fundamental data points you look at and when you take action. This is your checklist—you should have it so well defined that you can be sure of the exact steps along the way. You need a game plan so that you stay consistent and disciplined and don’t get flustered under pressure. It should become automatic and engrained.

- This methodology must utilize your strengths and skills and suit your personality. A cerebral, research-driven economist should put that to work, instead of becoming a swing trader based on technical analysis. An adrenaline-fueled athlete should be an intraday trader, not be a long-term trend follower. Remember, every successful trader has a methodology of their own which plays to their strengths and their personality.

- This methodology has a positive statistical expectancy– the gains from winners more than outweigh the losses on losing trades. Use your own statistics and the Kelly Formula for a rough guide as to whether or not you have positive statistical expectancy. On average you want to expect to win on an individual trade, meaning that your expected wins outweigh your prospective losses. That doesn’t guarantee that you will actually profit on each trade, it just means that over a sufficiently large quantity of trades, you will come out ahead.

- A well-stated risk management policy for when you get out of losing positions and how you manage risk overall. Cut losers. Let winners ride. Many people have tried to overthink this rule and ended up losing as a result. Furthermore, you never want to put yourself in a position where you can blow up, so you need to be thinking how you can avoid taking excessive risk in the first place. Just remember Warren Buffett’s Two Rules:A framework for sizing positions. This is related to risk management— obviously, you don’t want to take a position that’s over a certain size, ever. But you may also want to size positions according to certain specific critieria, such as your conviction in the position or volatility in the market. Or they could all be the same size. Nonetheless, your methodology has to be able to address it and come up with a well-reasoned answer.

- Never Lose Money.

- Never Forget Rule #1.

- A framework for sizing positions. This is related to risk management— obviously, you don’t want to take a position that’s over a certain size, ever. But you may also want to size positions according to certain specific critieria, such as your conviction in the position or volatility in the market. Or they could all be the same size. Nonetheless, your methodology has to be able to address it and come up with a well-reasoned answer.

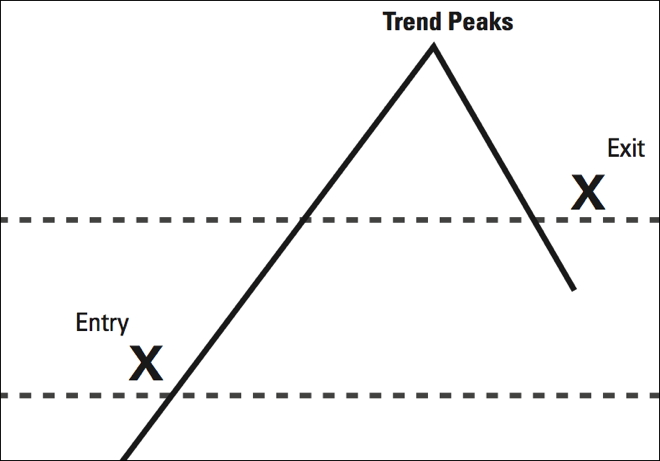

Trend Following Goes for the Middle Meat

Consider an illustration that can make you rich:

Trend following does not pick bottoms or tops. You always get into a trend late, and get out late. You cannot predict a trend. That chart might not seem like a great strategy at first glance, but it is the foundation of one of the most profitable insights in the history of market speculation: capture the middle meat and you can make a fortune.

The Secret to Trading Success

The most important thing you must learn in every market cycle is where the money is flowing. It is flowing into the companies where the earnings are growing. As long as mutual funds have capital in flows instead of net out flows then they must put new money to work investing in stocks. If you want to make your job as a trader much easier then find where the flow is going. Mutual fund managers can not go to an all cash position they can only move money around. A bear market sinks most stocks because managers have to sell everything to raise money to redeem shares. In an uptrend they have to buy stocks with the incoming money flows. Where does this money go? It goes into the sectors and stocks that are in favor due to increased earnings in a sector and individual stocks that are dominating their sector and changing the world in the process. You want the leaders not the has been. You want the best the market has to offer. Where are consumers dollars flowing into? That is where the money is going. What companies have the best growth prospects? The stock can only grow in price if the underlying company does. Mutual fund managers are the biggest customers in the market when they start buying a stock that increases huge demand and price support.

The most important thing you must learn in every market cycle is where the money is flowing. It is flowing into the companies where the earnings are growing. As long as mutual funds have capital in flows instead of net out flows then they must put new money to work investing in stocks. If you want to make your job as a trader much easier then find where the flow is going. Mutual fund managers can not go to an all cash position they can only move money around. A bear market sinks most stocks because managers have to sell everything to raise money to redeem shares. In an uptrend they have to buy stocks with the incoming money flows. Where does this money go? It goes into the sectors and stocks that are in favor due to increased earnings in a sector and individual stocks that are dominating their sector and changing the world in the process. You want the leaders not the has been. You want the best the market has to offer. Where are consumers dollars flowing into? That is where the money is going. What companies have the best growth prospects? The stock can only grow in price if the underlying company does. Mutual fund managers are the biggest customers in the market when they start buying a stock that increases huge demand and price support.

Your job is to follow the big money, shorting in bear markets, going long in bull markets. Following the trend of what is in favor. Do not fight the action, flow with it.

Quit having opinions and start being a detective looking for the smart money, the fast money, the big money and where it is going now.

Technical Analyst & Fundamental Analyst -Chat

“A technical analyst and a fundamental analyst are chatting about the markets in the kitchen. Accidentally one of them knocks a kitchen knife off the table landing right in the fundamental analyst’s foot! The fundamental analyst yells at the technician, asking him why he didn’t catch the knife? “You know technicians don’t catch falling knives!,” the technician responded. He in turn asks the fundamental analyst why he didn’t move his foot out of the way? The fundamental analyst responds, “ I didn’t think it could go that low.”

16 Rules for Traders

1. Never, Ever, Ever, Under Any Circumstance, Add to a Losing Position… not ever, not never! Adding to losing positions is trading’s carcinogen; it is trading’s driving while intoxicated. It will lead to ruin. Count on it!

2. Trade Like a Wizened Mercenary Soldier: We must fight on the winning side, not on the side we may believe to be correct economically.

3. Mental Capital Trumps Real Capital: Capital comes in two types, mental and real, and the former is far more valuable than the latter. Holding losing positions costs measurable real capital, but it costs immeasurable mental capital.

4. This is Not a Business of Buying Low and Selling High: It is, however, a business of buying high and selling higher. Strength tends to beget strength, and weakness, weakness.

5. In Bull Markets One Can Only Be Long or Neutral, and in bear markets, one can only be short or neutral. This may seem self-evident; few understand it, however, and fewer still embrace it.

6. “Markets Can Remain lllogical Far Longer Than You or I Can Remain Solvent.” These are Keynes’ words, and illogic does often reign, despite what the academics would have us believe.

7. Buy Markets That Show the Greatest Strength; Sell Markets That Show the Greatest Weakness: Metaphorically, when bearish we need to throw rocks into the wettest paper sacks, for they break the most easily. When bullish we need to sail the strongest winds, for they carry the farthest.

8. Think Like a Fundamentalist; Trade Like a Simple Technician: The fundamentals may drive a market and we need to understand them, but if the chart is not bullish, why be bullish? Be bullish when the technicals and fundamentals, as you understand them, run in tandem.

9. Trading Runs in Cycles, Some Good, Most Bad: Trade large and aggressively when trading well; trade small and ever smaller when trading poorly. In “good times,” even errors turn to profits; in “bad times,” the most well-researched trade will go awry. This is the nature of trading; accept it and move on.

10. Keep Your Technical Systems Simple: Complicated systems breed confusion; simplicity breeds elegance. The great traders we’ve known have the simplest methods of trading. There is a correlation here! (more…)