BlackRock is the world’s largest asset manager (circa $7.4 trillion in assets under management)

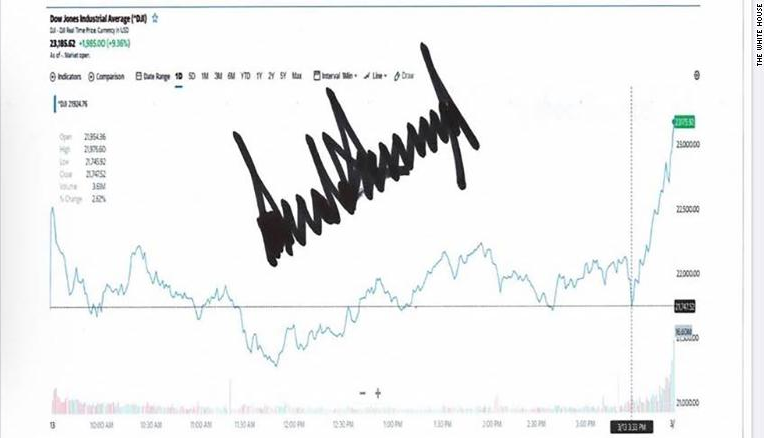

Given the surging equity markets (more ion this in just a moment) the comments from their latest update might appear stale (ps. these below relate to a credit view, not equities) :

- Unprecedented policy actions to limit the coronavirus shock and sharply lower valuations have improved the outlook for credit, in our view.

- Major central banks are committed to keep rates low and greatly expand their balance sheets.

More specifically on stocks (bolding mine):

- We previously downgraded global equities to neutral. The coronavirus outbreak is disrupting economic activity and supply chains. The outbreak also poses risks to corporate earnings, in our view. Accommodative monetary policy is a support. We now favour rebalancing back toward benchmark weights as markets fall.