The ECB announces its latest monetary policy decision – 23 January 2020

- Prior decision

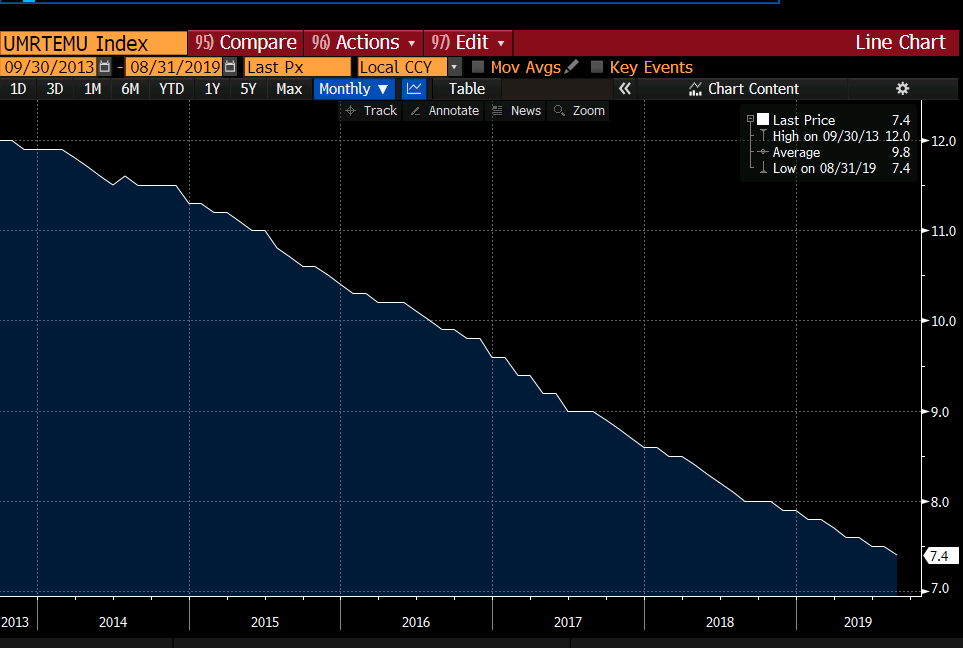

- Deposit rate facility -0.50%

- Main refinancing rate 0.00%

- Marginal lending facility 0.25%

- Rates to remain at present or lower levels until inflation outlook robustly converges to target, reflected in underlying inflation

- Announces first strategic review of policy since 2003

- Further details on scope, timetable of review will be due later at 1430 GMT

- Bond buying to continue until shortly before rates are raised

“At today’s meeting the Governing Council of the European Central Bank (ECB) decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively. The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

The Governing Council will continue to make net purchases under its asset purchase programme (APP) at a monthly pace of €20 billion. The Governing Council expects them to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates.

The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

The Governing Council also decided to launch a review of the ECB’s monetary policy strategy. Further details about the scope and timetable of the review will be published in a press release today at 15:30 CET.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:30 CET today.”