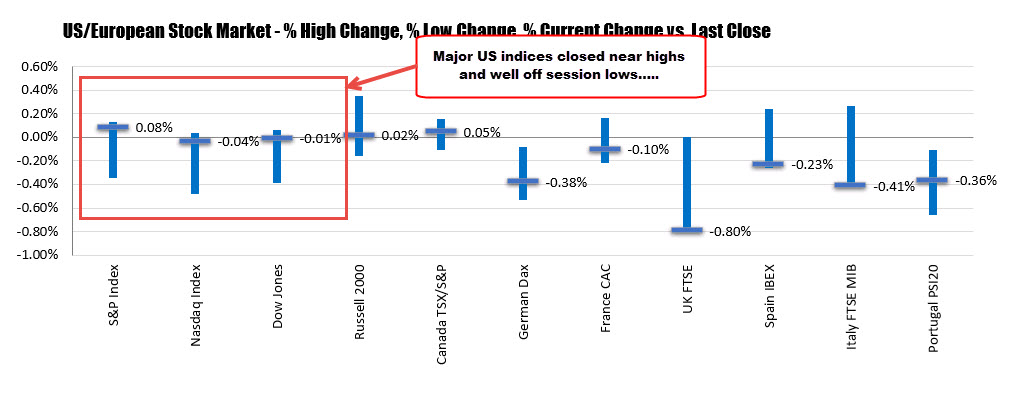

S&P just misses making a new all time intraday high today (short by $0.19)

The US stocks are closing up for the 3rd day in a row.

The NASDAQ index is closing at a session high and reached an intraday all-time high of 9574.936.

The S&P index reached a high price of 3337.58. That was just short of the all-time high price of 3337.77. So it was just short of that level. However, it is closing at an all-time record high taking out the previous high from January 17 at 3329.62.

The Dow is still below its all-time high, but it was the biggest mover today.

The levels at the close are showing:

- S&P index +37.13 points or 1.13% at 3334.71

- Nasdaq index +40.71 points or 0.43% at 9508.68

- Dow up 483.09 points or 1.68% at 29290.73

Big winners for the day included:

- Chubb, +7.06% the

- Unitedhealth, +5.31%

- IBM, +4.85%

- Exxon Mobil, +4.64%

- Emerson, +3.85%

- United Airlines, +3.7%

- Boeing, +3.66%

- Bank of America, +3.24%

- 3M, +3.21%

- Chevron, +3.21%

- travelers, +3.14%

- Citigroup, +3.08%

- Caterpillar, +2.89%

- Intel, +2.89%

- DuPont, +2.64%

- Charles Schwab, +2.48%

- General Dynamics, +2.47%

Losers today the included:

- Tesla, -17.04%

- Ford Motor, -9.54%

- Lyft, -3.82%

- Chipotle, -3.5%

- Square, -3.07%

- Walt Disney, -2.35%

- Gilead, -2.28%

- Twitter, -1.77%

- Chewy, -1.65%

- AliBaba, -1.21%

- Starbucks, -0.93%

- Amazon, -0.52%

- Tencent, -0.45%

I don’t need to remind you of the frightening economic data Washington doesn’t want you to know — the nearly $13 trillion debt, 90% debt to GDP ratio (that does not even include the off-budget items, such as the $6 trillion owed by Fannie Mae and Freddie Mac, or the $50 trillion of unfunded liabilities for programs like Social Security and Medicare)… And I certainly don’t need to reiterate the urgency of this situation. You know how severe the ramifications will be if we fail to take immediate action

I don’t need to remind you of the frightening economic data Washington doesn’t want you to know — the nearly $13 trillion debt, 90% debt to GDP ratio (that does not even include the off-budget items, such as the $6 trillion owed by Fannie Mae and Freddie Mac, or the $50 trillion of unfunded liabilities for programs like Social Security and Medicare)… And I certainly don’t need to reiterate the urgency of this situation. You know how severe the ramifications will be if we fail to take immediate action