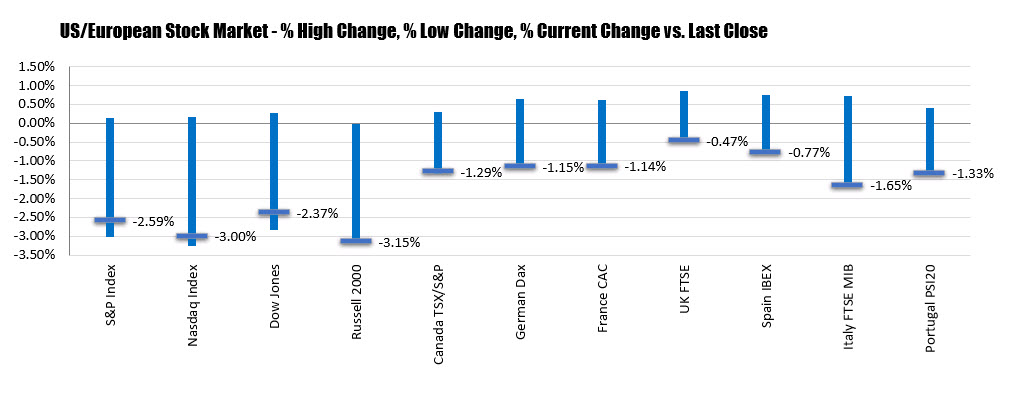

…but off lows for the day

- The S&P fell -20.02 points or -0.69% at 2906.27

- The Nasdaq fell -88.72 points or -1.11% at 7874.16

- The Dow fell -285.26 points or -1.08% at 26118

Looking at the point changes, the Dow was down -745 points at the lows.

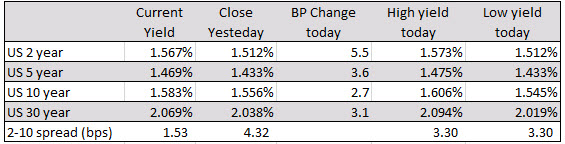

Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.

Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.

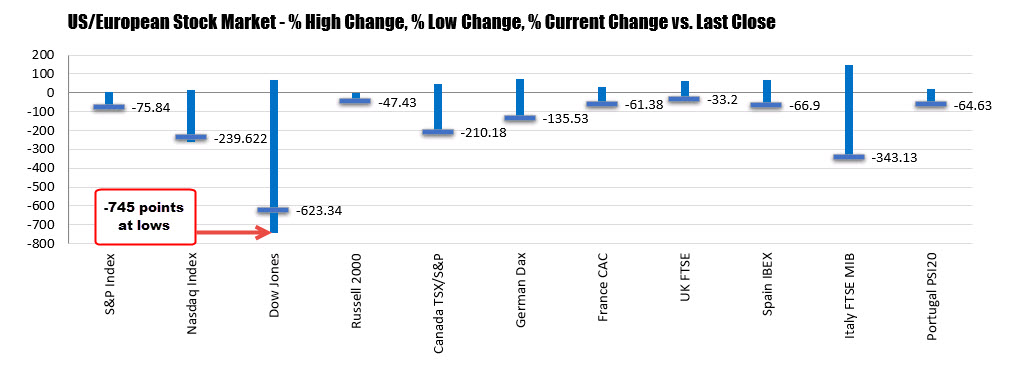

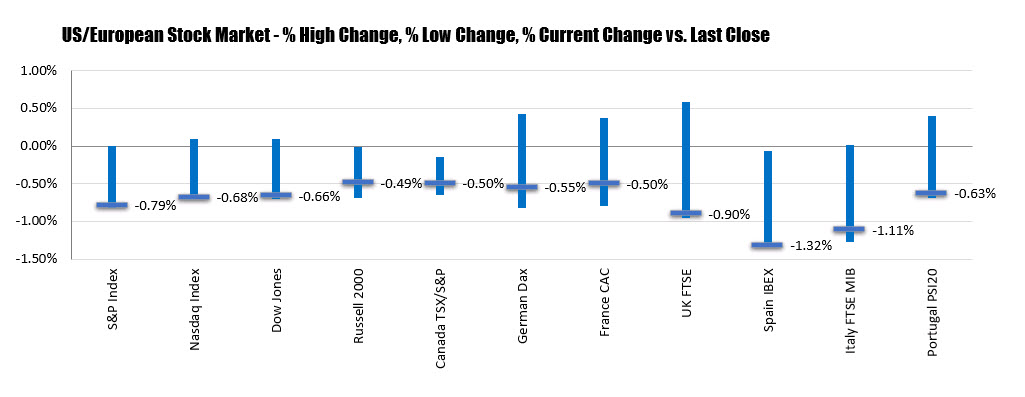

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.Losers included:

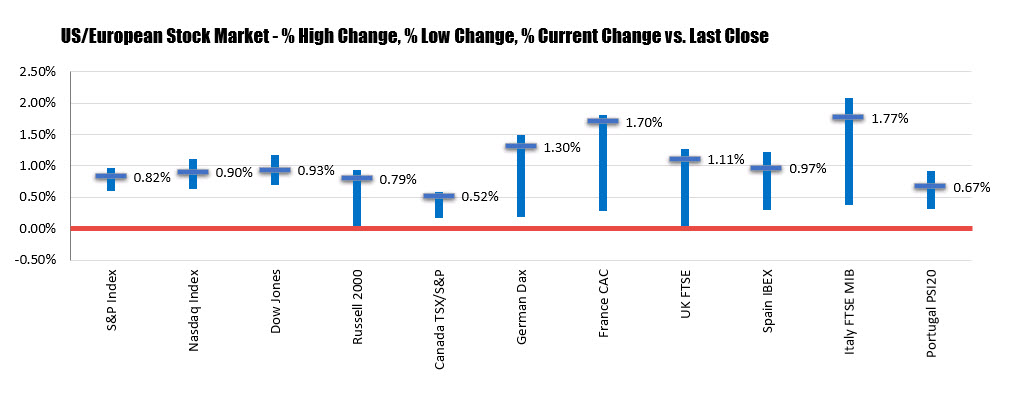

Technology stocks led the advance for the broader US market as investors kept an eye on the strained geopolitics of the Gulf.

The S&P 500 finished 0.3 per cent higher on Monday, with an afternoon rally at one point putting up as much as 0.5 per cent. That also saw the Dow Jones Industrial Average turn positive and close fractionally higher, but it was tech names that led the way, with the Nasdaq Composite rising 0.7 per cent.

Brent crude, the international oil marker, was up 1.5 per cent to $63.43 a barrel, although that left it off earlier highs that took it up as much as 2 per cent after Iran seized a British-flagged tanker in the Gulf on Friday. Furthermore, Libyan output was interrupted after an unidentified group sabotaged production at the country’s largest field, according to its state oil company.

The S&P 500 energy sector was up 0.5 per cent, lagging only tech, as major producers including ExxonMobil, Chevron and ConocoPhillips turned positive during the afternoon session. Halliburton topped the leaderboard with a 9.2 per cent advance following an earnings beat.

European energy stocks fared better earlier on Monday, with a gain of 0.5 per cent for the Stoxx index tracking the sector standing out against a 0.1 per cent rise for the Europe-wide Stoxx 600. London’s FTSE 100 rose 0.1 per cent and Frankfurt’s Xetra Dax 30 was up 0.2 per cent. BP was among the top performers on the main UK index, with the oil major’s shares rising 1 per cent.

Bets that the Fed will aggressively cut rates at its policy meeting this month were being pared back. Bloomberg data showed that under 20 per cent of economists polled were forecasting a 50 basis point cut, down from about 40 per cent late last week. That followed confusion on Friday after the New York Fed clarified that an ultra-dovish speech from John Williams, its president, should not be seen as a guide to future policy.

Investor caution towards geopolitical issues in the Gulf, as well as debate over the prospect for monetary easing from the Federal Reserve, on Friday pushed gold to a six-year high. On Monday afternoon the metal was flat at $1,424.49 an ounce.

Wall Street notched fresh record highs in cautious trading on Monday as investors awaited the first onslaught of quarterly earnings reports.

The S&P 500 bounced off session lows seen in afternoon trading to gain about half a point at 3,014.30. The Dow Jones Industrial Average ticked 0.1 per cent higher, and the Nasdaq Composite rose 0.2 per cent.

The modest rally extended a record run on Wall Street that was fuelled last week by expectations for looser monetary policy at the Federal Reserve. The benchmark S&P 500 secured its third closing high in as many sessions, while the Dow and tech-heavy Nasdaq set records for a second consecutive day.

Citigroup offered the opening salvo in a busy week of bank earnings. Goldman Sachs, JPMorgan Chase and Wells Fargo will file on Tuesday. Bank of America’s financials will arrive a day later.

Citi’s shares fell 0.1 per cent, paring a gain of 1.5 per cent made last week in the run-up to its numbers.

A number of further corporate reports due throughout the week will start to reveal if the US is on course for its first earnings recession since 2016, playing into investors’ perceptions of the outlook for the economy as the Trump administration’s trade dispute with Beijing continues.

Growth data from China published on Monday showed the country’s rate of quarterly expansion was its slowest in 27 years at 6.2 per cent, but there was relief that the tariff battle between the world’s two biggest economies had not taken a deeper toll on the data.

Early gains on Wall Street helped European bourses consolidate gains after an uncertain showing in the region. The international Stoxx 600 rose 0.2 per cent.

Frankfurt’s Xetra 30 was up 0.5 per cent. London’s FTSE 100 rose 0.2 per cent, with its gains underpinned by miners.