U.S. stocks closed higher Tuesday, but off the session’s best levels, after Federal Reserve Chairman Jerome Powell suggested more fiscal stimulus may be needed as the American economy may only make a slow recovery from the COVID-19 pandemic.

Rising coronavirus cases in several U.S. states are also are concern for investors, even though retail sales and industrial production data show the economy is slowly recovering, and progress on the development of potential therapeutic drugs has been reported.

How did benchmarks fare?

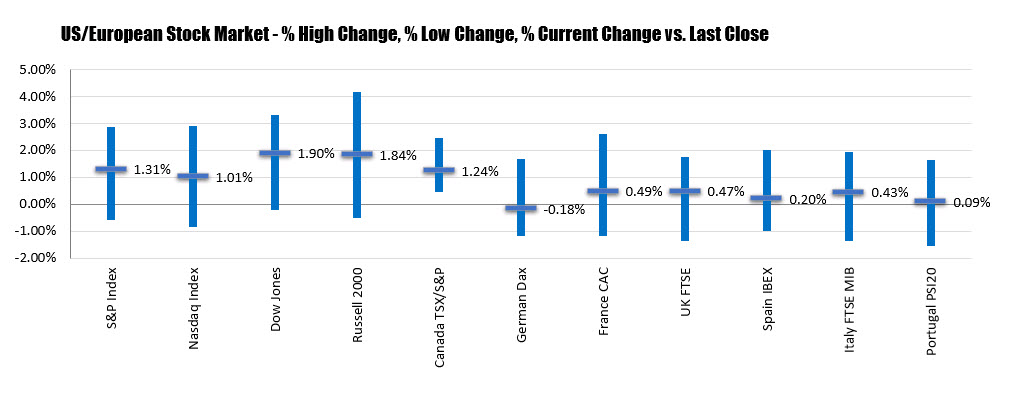

The Dow Jones Industrial Average DJIA, +2.04% rose 526.82 points, or 2%, to end at 26,289.98. The S&P 500 index SPX, +1.89% added 58.15 points to close at 3,124.74, a gain of 1.9%. The Nasdaq Composite Index COMP, +1.74% advanced 169.84 points, or 1.8%, to end at 9,895.84.

All three benchmarks extended their win streak to three straight sessions, but finished below their best levels of the day.

For the week, the major indices all fell with the Dow the weakest.

For the week, the major indices all fell with the Dow the weakest.