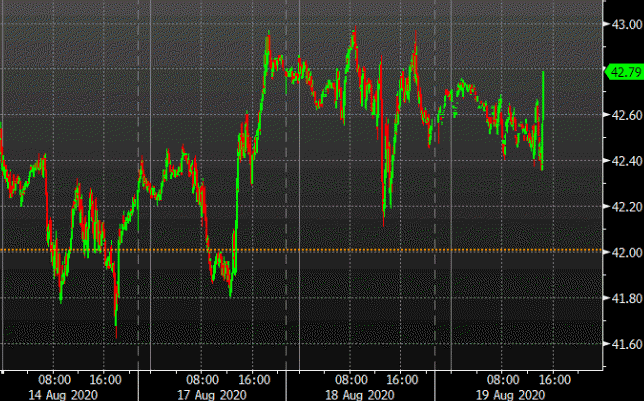

Says excess dovishness at the Federal Open Market Committee increases the risk of a major policy error at the Fed.

Bill Dudley is a past resident of the Federal Reserve Bank of New York (2009 to 2018) and is now at Princeton University’s Center for Economic Policy Studies.

Says Fed officials:

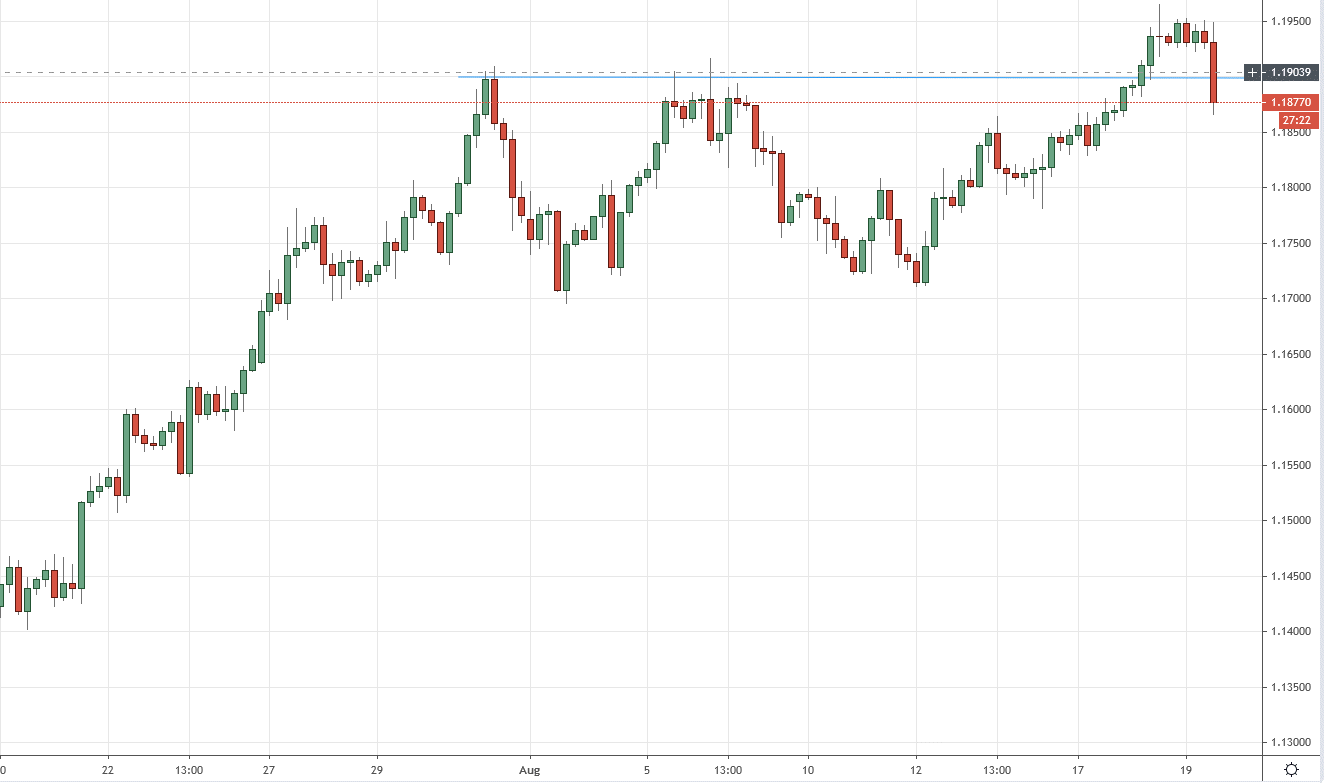

- anticipate that inflation will fall back close to 2% in 2022 … even as supply chain disruptions, energy costs and rising rents threaten to make the current price surge bigger and longer lasting than expected.

- And they expect inflation to keep decelerating in 2023 and 2024

- if inflation proves more persistent than anticipated and even accelerates as the economy pushes beyond full employment, they’ll have to tighten much more aggressively than they expect.

- The result could more resemble what happened from 2004 to 2006 – when the Fed raised its short-term interest-rate target by 4.25 percentage points, to 5.25% from 1%, with quarter-percentage-point increases in 17 consecutive policy-making meetings – than what they currently have pencilled in.

Here is the link to the Bloomberg piece (may be gated) for much more.

Dudley, Yellen and Fischer, all since departed from the Fed: