Reuters reports, citing a government official on the matter

No firm date is being given on the matter but earlier in the month, China has said that students will only return to school next month.

No firm date is being given on the matter but earlier in the month, China has said that students will only return to school next month.

ps. this from Apple’s Tim Cook on what is happening with his business in China this week:

Bolding mine.

Multiply the impact on traffic to Apple stores across the economy.

Intel stock is moving sharply higher in after-hours trading after their earnings and revenues beat expectations.

Laggards include:

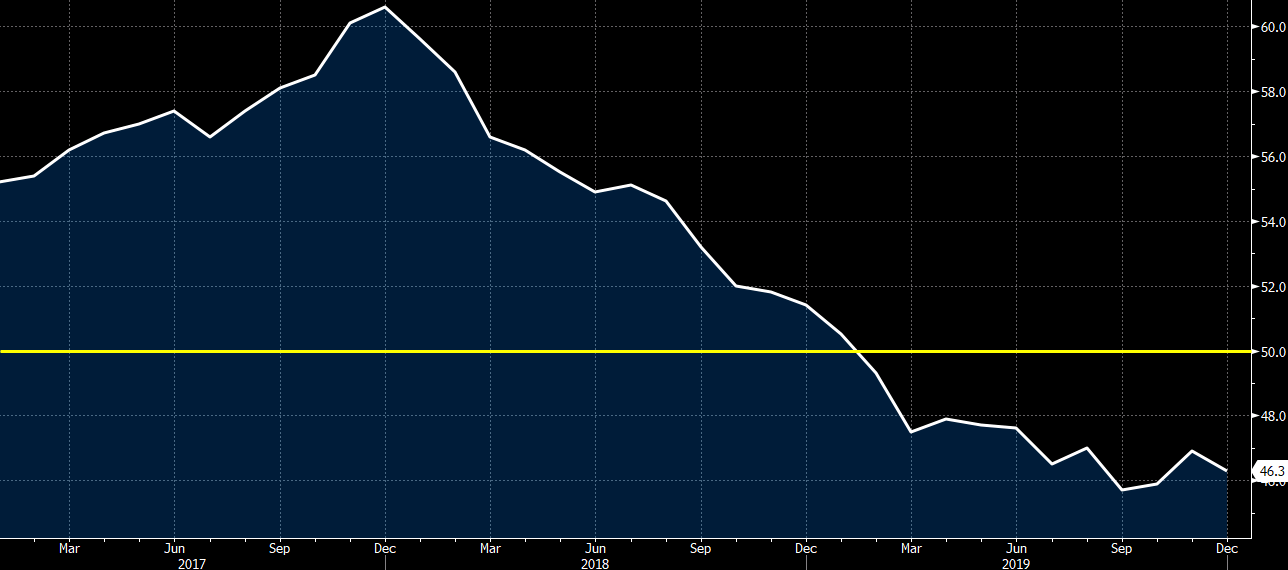

The preliminary release can be found here. The mildly higher revision was predicated by the French and German readings earlier but it is still weaker than the November print.

“Eurozone manufacturers reported a dire end to 2019, with output falling at a rate not exceeded since 2012. The survey is indicative of production falling by 1.5% in the fourth quarter, acting as a severe drag on the wider economy.

Although firms grew somewhat more optimistic about the year ahead, a return to growth remains a long way off given that new order inflows continued to fall at one of the fastest rates seen over the past seven years. Firms sought to reduce inventory levels and cut headcounts as a result, focusing on slashing capacity and lowering costs. Such cost cutting was again also evident in further steep falls in demand for machinery, equipment and production-line inputs.”

Saudi Aramco, Saudi Arabia’s state-controlled oil company, held a record-breaking initial public offering earlier in December, becoming the world’s most valuable listed company, ahead of Apple of the U.S.

The listing on the Riyadh stock market on Dec. 11 gave Aramco a market value of $1.877 trillion. The $25.6 billion raised was also a record, breaking the previous mark set in 2014 by China’s e-commerce leader, Alibaba Group Holding.

The IPO has set off speculation about how the stock flotation will affect other state-owned oil producers, especially in Asia.

According to the International Monetary Fund’s latest forecast, Saudi Arabia will incur a fiscal deficit of 178.5 billion riyals ($47.57 billion) in 2019, staying in the red for the sixth consecutive year. The economy of the kingdom is greatly affected by the price of crude oil, which generates 70% of government revenue. As the world moves toward alternative forms of energy to combat climate change, the risks of relying heavily on oil will grow.

In 2016, Saudi Arabia adopted the Vision 2030 plan aimed at reducing its dependence on oil and creating a sustainable growth model. The listing of Aramco is key to the shift. (more…)

Citi discusses the Fed policy trajectory in light of yesterday’s FOMC minutes from the October meeting.

“Minutes from the October 30th FOMC released overnight are broadly consistent with Citi analysts expectations for disagreement regarding the need to cut, but agreement that on leaving policy rates on-hold. On USD supply to year end (the more interesting part of the Minutes), Fed officials continue to look for ways to make sure funding pressures in the overnight lending market don’t cause a problem again with a “standing repo” seen as the preferred option that would likely provide substantial assurance of control over the federal funds rate (and USD supply). However, Citi analysts do not expect a final decision until H1 2020. ,” Citi notes.

“The Citi analyst view remains for the Fed to stay on hold in December and through 2020 though muted inflation makes hikes in the next year very unlikely. Cuts are possible should domestic activity data indicate a slowdown,” Citi adds.