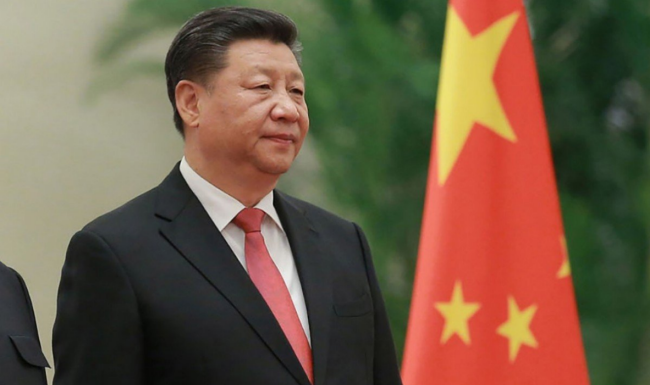

Comments by China president Xi Jinping

- Will strive to make up economic losses caused by coronavirus pandemic

- Will strive to achieve good results for economic growth this year

- Will make fiscal policy more proactive, prudent monetary policy more flexible

- Will continue to cut taxes and fees

There isn’t much of anything new here from Xi, but this just reaffirms that China will continue to maintain the current set of policies and keep bolstering the economy for many more months as they deal with the fallout from the virus outbreak earlier in the year.