If you got Pennington to find any valuable info when you asked him to develop quantitative analogies between forest life cycles and those of corporations to find some profitable trades you could certainly do the same in finding some numerical formula that could identify trade opportunities by analyzing baseball.

If you got Pennington to find any valuable info when you asked him to develop quantitative analogies between forest life cycles and those of corporations to find some profitable trades you could certainly do the same in finding some numerical formula that could identify trade opportunities by analyzing baseball.

Each team– a stock, the aggregate teams– the market, each player– a corporate division, each salary– an investment made in the division and the company, each relevant performance statistic– a relevant performance statistic. Identify the right decision mix that makes teams perform better over time and improve over time and analyze similarities in companies doing the same.

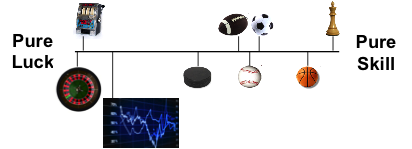

The greatest liability is also the greatest asset– human decision and performance permeate the game of baseball from start to finish and one could question whether it’s possible to find a truly consistent system as a result. I would argue that this complexity makes it a perfect analogy to market/company performance. It moves based on imbedded and sometimes unexplainable intellect and experience of its participants. The chaotic human decision making process is pervasive in both.

There is no perfection in trading as far as making money on every trade or having a perfect system. All you can hope to be perfect at, is following your system, rules, and trading plan. A winning trade should be measured as one in which you followed all your preset guidelines. Even the best traders only average about a 50%-60% win rate at best over long periods of time. The key is having bigger winners than losers, not being perfect. Like in baseball where a .300 hitter can get into the hall of fame. A .500 trader in the market can become wealthy if his wins outpace his losses.

There is no perfection in trading as far as making money on every trade or having a perfect system. All you can hope to be perfect at, is following your system, rules, and trading plan. A winning trade should be measured as one in which you followed all your preset guidelines. Even the best traders only average about a 50%-60% win rate at best over long periods of time. The key is having bigger winners than losers, not being perfect. Like in baseball where a .300 hitter can get into the hall of fame. A .500 trader in the market can become wealthy if his wins outpace his losses. Once, there were two farmers who lived in the desert. Both desperately needed to acquire water so they could survive the desert and support their families. After working together to search the area, they concluded there was water somewhere in the area but they were not sure where. So, they set out to find a water well. They started digging in similar locations between their properties. After they both dug for several days, the second farmer finally struck water. As soon as this happened, the first farmer could see it from a distance and ran over to the second farmer. Seeing that he had stuck a huge water well, he asked the farmer, “You and I had the same tools for digging and have been digging in similar locations. How did you find water and I did not?”

Once, there were two farmers who lived in the desert. Both desperately needed to acquire water so they could survive the desert and support their families. After working together to search the area, they concluded there was water somewhere in the area but they were not sure where. So, they set out to find a water well. They started digging in similar locations between their properties. After they both dug for several days, the second farmer finally struck water. As soon as this happened, the first farmer could see it from a distance and ran over to the second farmer. Seeing that he had stuck a huge water well, he asked the farmer, “You and I had the same tools for digging and have been digging in similar locations. How did you find water and I did not?”  The biggest obstacle to successful trading is failing to recognize that losses are part of the game, and, further, that they must be accommodated. The perfect trading system that allows for only gains does not exist. Expecting, or even hoping for, perfection is a guarantee of failure. Trading is akin to batting in baseball. A player hitting .300 is good. A player hitting .400 is great. But even the great player fails to hit 60% of the time! Remember, you don’t have to be perfect to win in the markets. Practically speaking, this is why you also need an objective money management system.

The biggest obstacle to successful trading is failing to recognize that losses are part of the game, and, further, that they must be accommodated. The perfect trading system that allows for only gains does not exist. Expecting, or even hoping for, perfection is a guarantee of failure. Trading is akin to batting in baseball. A player hitting .300 is good. A player hitting .400 is great. But even the great player fails to hit 60% of the time! Remember, you don’t have to be perfect to win in the markets. Practically speaking, this is why you also need an objective money management system.