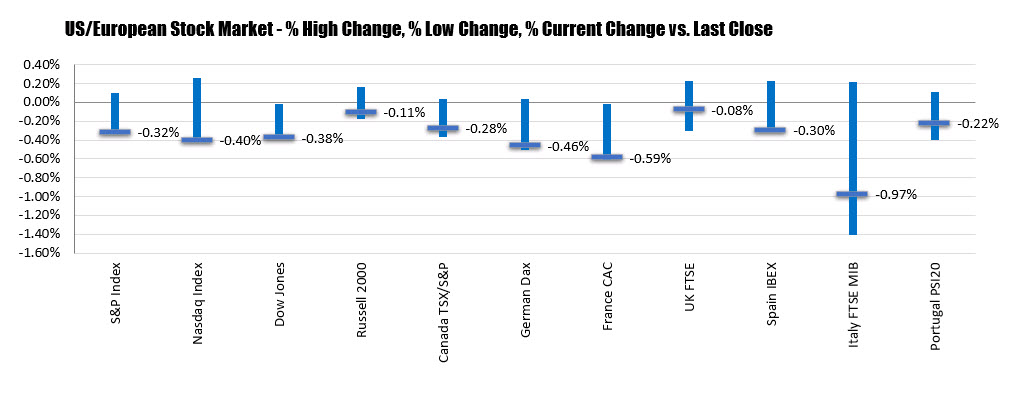

US-China trade and Brexit worries will not go away despite some improvement in their respective rhetoric at the moment

We’re getting closer to a Phase One trade deal and Boris Johnson just won big in the UK election last week. Two of the biggest risk factors that has plagued markets this year appear to be finding some form of conclusion, but are they really?

US-China trade war

As great as the Phase One trade deal is and will be, it isn’t the “be all, end all” deal that will see US-China relations significantly improve.

This is merely a temporary ceasefire at best and at worst, it’s just a delusion to keep some hope that both sides are not yet ready to engage in a full-blown trade and geopolitical war.

The Phase One deal will include tariffs rollback by the US in exchange for China purchasing more farm products – to try and reach $40 to $50 billion annually – as well as some “firm” commitments on technology transfer, currency and opening up of its economy.

The catch here is that it will include some subjective way of determining how both sides will live up to their respective end of the deal. That tells me that ultimately, this will eventually lead to either one of them calling the other out when the time is right.

As such, don’t expect the hostilities and trade worries to die down just because the Phase One deal has been signed – if it even does that is. This is a worry that will haunt markets for many more years to come and 2019 is but a taste of what it can be like.

Brexit

Boris Johnson got his much sought after majority in parliament – quite comfortably as a matter of fact – and now he can get his Brexit deal across the finish line. Easy-peasy.

Sadly, this is just merely the starting point in the whole Brexit process.

Once Johnson gets his deal through the legislative hurdles in parliament in January next year, he will have to then go on to negotiate a future trade relationship with the EU.

And for the uninformed, they will only have until the end of next year to finalise a deal and to try and implement it thereafter. Otherwise, the UK will leave the EU without a deal.

Yes, a no-deal Brexit is still on the table as long as the UK and EU cannot agree to a trade deal during the transition period next year.

That can still be avoided though if the UK requests an extension to the transition period before July next year. However, Johnson has categorically ruled that out repeatedly over the past two months in what looks to be a gambit to pressure EU leaders during talks.

We’ll see how all of that plays out but it is clear as day that both sides won’t get a deal done before 31 December 2020. That is all but a pipe dream.

As such, we will have to see if Johnson will find it sensible to negotiate further in the coming years – prolonging the Brexit uncertainty – or opt to crash out of the EU without a deal, wasting all the time we have spent extending the Brexit deadline since March.