So much for that hope

The major European indices are now close for the day and indices are closing lower but well off the lows for the day. The provisional closes are showing:

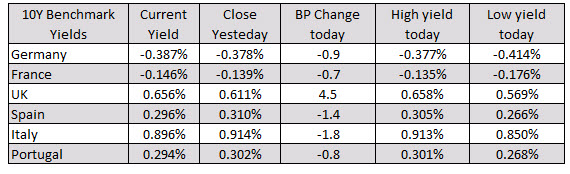

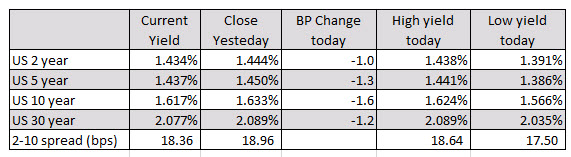

In other markets:

In other markets:

The sources say that most OPEC members agree on the need to cut oil output further and that they are considering to have a meeting on 14-15 February now. Just one to keep in mind as such a move may provide some relief to oil prices in the near-term.

The price of of equities spike higher before the announcement then fell back down. We are currently trading near mid range of that volatile range.

What’s wrong with the picture if the World Health Organization has to pander to China during a potential buyers outbreak?

The spokesman also said that Tedros has met up with top Chinese officials and discussed measures to protect Chinese and foreigners in areas affected by the coronavirus. They are also said to have discussed possible alternatives to evacuations.

The popularity of Cryptocurrency is on the rise and more and more skeptics are investing in digital assets each day. With people losing trust in central banks, coupled with the allure of investing in a digital currency which could appreciate, these factors have contributed to an industry boom.

What is even more exciting is the options available surrounding Cryptocurrencies nowadays. In the past, investors would simply buy a coin and wait/hope for the value to increase whilst running the risk of having value wiped out of an investment in a volatile market. This is avoidable now thanks to Crypto trading. Much like traditional Forex trading, Crypto enthusiasts can now trade on the projected performance of a coin without necessarily purchasing that asset.

The option of trading Crypto can be far more appealing than investing which comes with constantly monitor price performance. Thanks to leveraged trading on broker platforms, traders can concentrate on: going long and short on a range of Cryptocurrencies opposed to just investing and HODL-ING.

In this article, we will explore some of the major Cryptocurrencies which will suit day traders, scalpers, and swing traders. First of all, let’s consider some factors which contribute to a good Cryptocurrency to trade

Trade over 30 Cryptocurrency pairs with access to leverage of up to 1:100 for digital currency at new broker EagleFX. (more…)