Latest Posts

rssGermany house prices up 75% vs. rents up by 15%. Bubble?

The BOJ meet next week – likely to lower GDP forecast

The Bank of Japan meet July 15 and 16. Thursday and Friday next week.

The policy statement and the Bank’s latest updated forecasts (in its Outlook Report) will be made Friday at the conclusion of the meeting (there is no firmly set time for the announcement, sometime between 0230 and 0330 GMT on Friday is a good bet).

Reports are the Bank is expected to slash this fiscal year’s growth forecast in its latest projections.

Earlier this week the Japan Center for Economic Research said its assessment was Japan’s gross domestic product dipped 0.04% on the month in May (using inflation adjusted data … albeit not much inflation in Japan!).

- the second straight monthly decline, though marginal

- Consumption -0.7%

- Housing investment -1.1%

- capital investment by private companies +0.6%

- Exports -0.2%, imports -2.6%

- reduced production in manufacturing such as automobiles

- “Due to a shortage of semiconductors, passenger vehicle production may have begun to deteriorate”

Earlier this week there was mixed news, BOJ maintains assessment for 5 of 9 Japanese regions in latest economic report:

- two upgrades & two downgrades

In other news, Tokyo will be in a state of emergency right through its Olympics. The city has been dealt an awful hand with these Games and is making the very best of it in the circumstances.

Russia raises its inflation, GDP, capex forecasts

Russian economy ministry issues revised forecasts

- 2021 GDP growth forecast up to 3.8% from 2.9%

- lifts Urals oil price forecast to $65.9/bbl from $60.3/bbl

- 2021 inflation forecast to 5% from 4.3%

- 2021 capital investment growth forecast to 4.5% from 3.3%

- 2021 average dollar/rouble rate to 72.8 from 73.3 seen in April

The ministry comments on the higher forecasts:

- We see the economy is recovering faster than we had expected

- Our experts say the economic recovery potential is not exhausted yet

On the currency:

- We all realise that the rouble price should be different at oil prices of $75 per barrel

- current rouble weakness blamed on sanction risks, OPEC+ uncertainty around global oil output.

Russia’s inflation target is 4%, the latest reading has it at 6.5%. Russia’s central bank is expected to raise its key rate again from 5.5% on July 23.

USD/RUB daily chart:

COMEX copper, silver margins lowered

Chicago Mercantile Exhcnage has announced changes (reductions) in COMEX margins:

- COMEX copper futures maintenance margins lowered by 9.1% to USD 6,000/contract for July,

- COMEX 5000 silver futures initial margins for speculators lowered by 10% to USD 14,850/contract

Info via Newsquawk

More on Chinese stocks being delisted from indexes – this time is MSCI

MSCI move follows this from yesterday: FTSE/Russell says it will delete around 20 Chinese stocks from its indexes

FTSE/Russell said they’ll be deleting around 20 Chinese stocks after feedback on the US Executive Order that halts US investment in firms with links to the Chinese military info

MSCI is similar, will delist from July 26.

China’s abrupt crackdown on Didi hasn’t helped either.

Golden Words by Jesse Livermore

US Indices finish off the lows but the dip-buying impulse was less than usual

Tough day for US stocks

- S&P 500 down 37 points

- Dow -287

- Nasdaq -116

All three main indexes were down 0.8-0.9% in a shift from some of the recent disconnects.

The main story was the bounce from the lows. At midday it looked like it might make the full return trip but it wasn’t meant to be.

Here’s the intraday of the SPX:

Thought For A Day

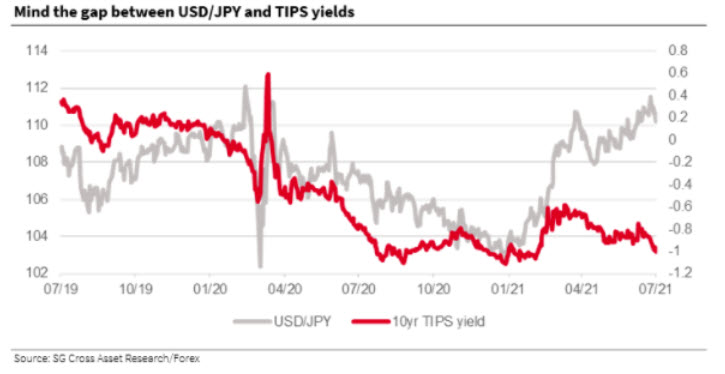

It’s unlikely that USD/JPY move lower is a false dawn – SocGen

USD/JPY down 84 pips to 109.81 today

Societe Generale Research discusses the ongoing move lower in USD/JPY.

“The yen is, after a period of ignoring the fall in US real yields, coming home to them with a bang. The chart shows 10yr TIPS and USD/JPY, which has been very hard to understand since mid-April. Q3 is starting on a much sounder footing. The caveat is that the fall in longer-dated US yields at the start of April saw USD/JPY fall from 111 to 107.50, before the largely unintelligible rally back to 111.60,’ SocGen notes.

“This could be a false dawn especially if TIPS yields turn higher and market volatility leaches away again. But that’s unlikely with Covid concerns, more volatile oil prices, a debate about growth peaking, and with central bank policies diverging,” SocGen adds.