What to expect going into the US July retail sales report later

Risk is leaning towards the softer side in European morning trade, as delta variant concerns continue to make headway with New Zealand entering a fresh lockdown today.

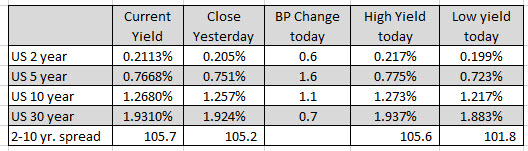

US futures are marked down by around 0.5%, European indices are also down between 0.3% to 0.9% mostly, while 10-year Treasury yields are down 3 bps to 1.225%.

It’s a classic risk off day in the market but can it last through to the end of US trading?

That certainly feels like a tall order these days given the unrelenting dip buying in US stocks over the past few weeks. However, I reckon a lot will rest on the shoulders of the US retail sales report later at 1230 GMT.

While dip buyers managed to carve out victories on Friday and in trading yesterday, another dampener from the US retail sales report today may be one too far to ask for.

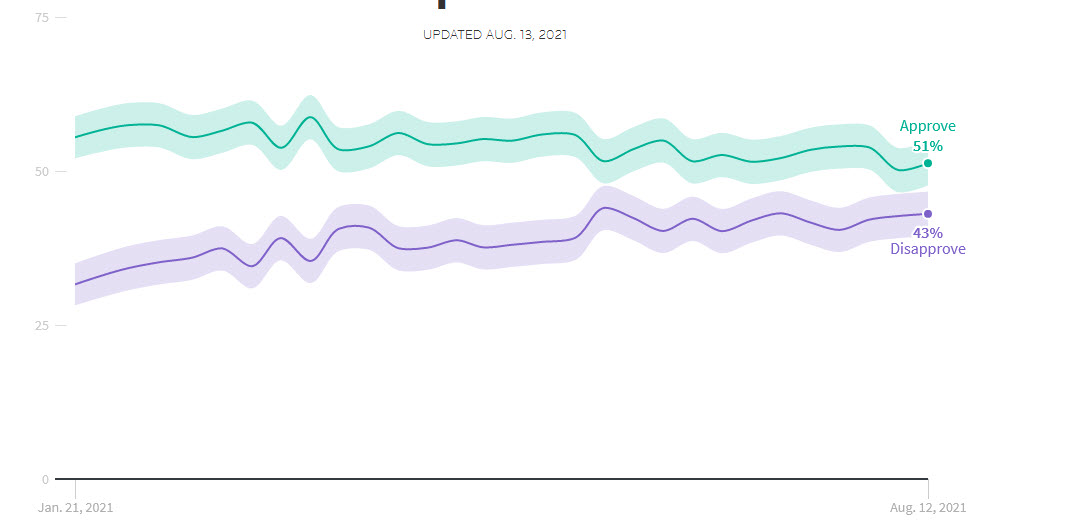

That especially since broader markets are also depicting more sour tones today. That said, the BofA fund manager survey clearly shows how investors are feeling about everything else despite delta variant concerns:

Equity allocation continues to hold up despite a worsening outlook and that reaffirms that the Fed and easy money is still the biggest factor driving sentiment.

I’d be wary that a poor US retail sales report later could sound some alarm bells on risk trades, especially with some looking more vulnerable than others – particularly in FX when it comes to the kiwi and aussie today.

That could trigger broader and deeper risk aversion in the market but when the dust settles, dip buyers will arguably do what they do best and drive stocks higher again.

Even more so if the Fed shows any form of reluctance to take a step towards tapering at Jackson Hole next week.