China to the rescue?

If there were a moment for a surprise rate cut from the PBOC, this might be it.

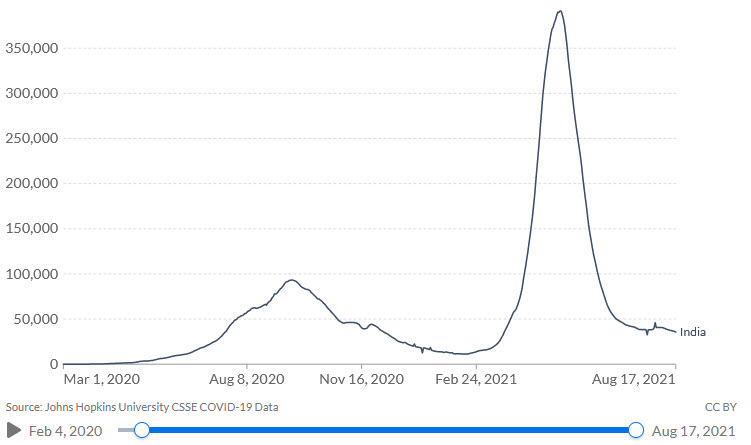

Chinese tech stocks have been crushed this month and there are new economic worries after weak industrial production and retail sales data. In addition, delta outbreaks have caused disruptions on the ground and that will undoubtedly continue.

Today is PBOC decision day, with an announcement due at 0130 GMT.

The spots to watch are the one-year and five-year loan prime rate (LPR), which is a main lever the PBOC pulls. Less likely is a shift in the LPR.

Reuters has picked up a shift in expectations in a snap poll of economists and traders. Of 32 surveyed, 25 see no change but 7 now see a move. It will be a small one with 6 of those seeing just a 5 bps cut while the remainder sees 10 bps. The current 1-year rate is 3.85%.

Even a minuscule shift would be a powerful signal that China isn’t prepared to tolerate a slowdown. Moreover, central banks don’t get the opportunity to surprise often and the timing is plum.

Even if there’s no hike today, a dovish shift from the PBOC could have a similar impact.