Latest Posts

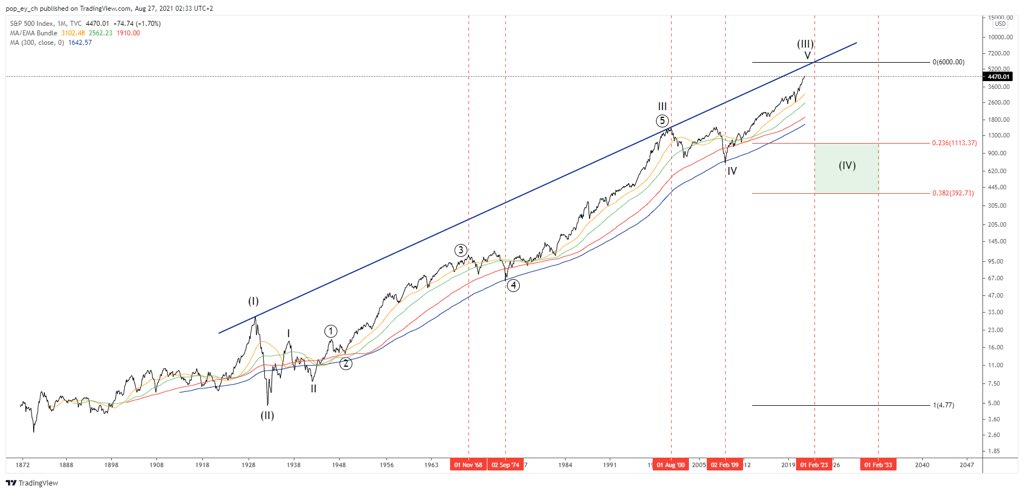

rss$SPX #SPX, the long-term view if you asked Elliott

Dollar a touch softer as the push and pull continues ahead of Jackson Hole

Dollar mildly softer to start the session

The greenback is a little on the backfoot but nothing that stands out all too much once again, as we continue to see more of a push and pull in the past few sessions before getting to Fed chair Powell’s speech at Jackson Hole later in the day.

Overall risk sentiment is holding up modestly but there’s a lack of drive in the market for the time being, awaiting some impetus and catalyst from the Fed later.

The dollar is mildly weaker against the major currencies bloc but narrow ranges are still prevailing for the most part, keeping price action more limited.

EUR/USD buyers are keeping near-term control on a defense of the 100-hour moving average (red line) but there is still a lack of momentum to really get going and test resistance closer to 1.1800 for the time being.

Elsewhere, USD/JPY is sticking close to 110.00 while commodity currencies hold a slight edge against the dollar though nothing that threatens a break from price action that we have seen to kick start proceedings in the early stages of the week.

What’s Your Trading Blood Type? -#AnirudhSethi

Have you ever wondered what your trading blood type is? What about the type of trader that best suits you? What’s Your Trading Blood Type? will help answer these questions and more. It provides a personality quiz that identifies your trading style, as well as an in-depth explanation for each one. The quiz also compares your results to other common types of traders. It’s never been easier to figure out what kind of trader you are!

##What is a Trading Blood Type?:

The ability to observe the experiences of different traders is one of my greatest luxuries. I have learned that it’s possible for brokers in this business, over time, to match certain? blood types? with their correct trading diet. This isn’t meant medically but more figuratively; there are many variables that come into play when dealing with trades and we’ve found a way around these elements by matching blood type (in its metaphorical sense) with trader profile so that they can adopt an appropriate approach without wasting valuable capital or risking too much risk suddenly closing out profitable positions prematurely as well as holding on blindly through losers until all hope seems lost.

“Can’t tell what type of trader you are? That’s ok! It doesn’t take a magician to determine blood types based on personality. This is all about determining your capital, experience level, and risk profile so we can prescribe the perfect diet for just you.”

With the help of a trained expert, it’s not too difficult to prescribe an individual with their best trading type based on their personality. This is done by identifying what they have more success at and then prescribing them food that’ll work for this specific person as well as taking into account factors like capital, experience level, risk profile, and schedule.

##How to determine your blood and diet type?: (more…)

Neuroplasticity: Your Brain and Your Trading – #AnirudhSethi

In Neuroplasticity: Your Brain and Your Trading, we will explore how Neuroplasticity can help traders create a more accurate trading system. Neuroplastic is the ability of your brain to adapt to its surroundings and change through experience. Neuroplasticity is an exciting new area of research in which scientists are studying the ways that our brains change over time with various types of input.

In Neuroplasticity: Your Brain and Your Trading, we will explore how Neuroplasticity can help traders create a more accurate trading system. Neuroplastic is the ability of your brain to adapt to its surroundings and change through experience. Neuroplasticity is an exciting new area of research in which scientists are studying the ways that our brains change over time with various types of input.

Mental training has been shown to be a powerful tool in improving performance on tasks from memory recall, math calculations, motor skills, creativity, decision-making, and many others. Neuroscientists have found that mental training increases gray matter volume in specific areas of the brain responsible for those skills.

##What is neuroplasticity and how does it affect trading?:

In the world of neuroscience, babies are like sponges. They process data twice as fast and their brain is still developing due to new neural connections that form in response to stimuli. The thing about brains—they can adapt! Imagine what it would be like if your left speech center was damaged after an accident or stroke; you could learn how to use your right side instead because they’re always adapting with time (talk about a tough feat).

Your brain is more awesome than we even thought: not only does it have all this processing power but also some cells called “mirror neurons” which help us understand other people’s actions by simulating them ourselves–in short, mirror neurons make imitation easy for our children while giving adults empathy skill.

The conventional wisdom once said that we could never recover from the loss of brain cells, but now research has shown that you can grow new ones. For instance, if a senior is injured or ill they will experience significant changes to their neural pathways in response and this makes up for lost neurons by creating more connections between healthy neurons so everything can be sorted out again! (more…)

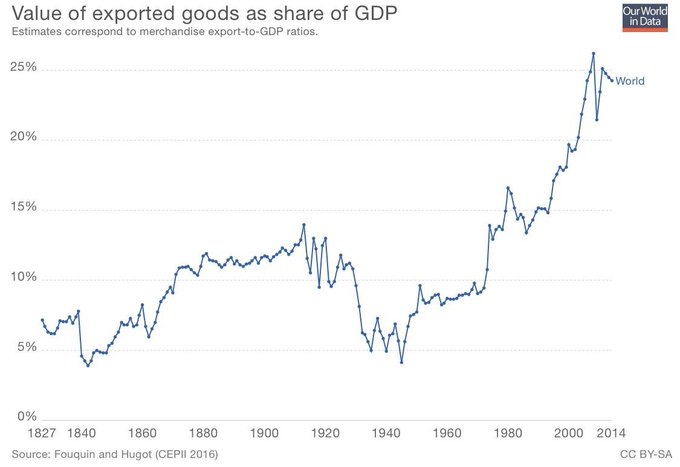

“From the days of Egypt and Rome, history teaches us that the world thrives on increased trade.”

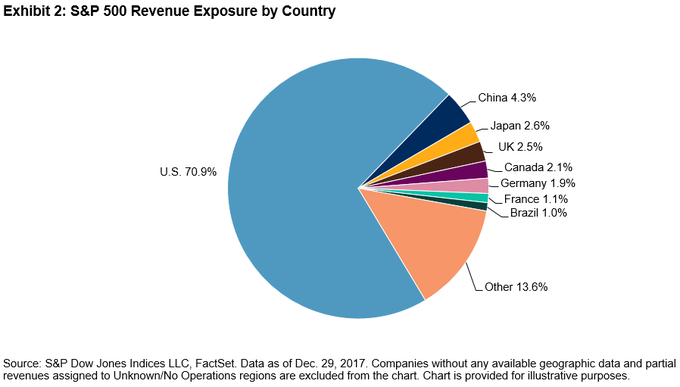

Almost 71% of the S&P 500’s revenue comes from the US.

Here’s the link to the full Jackson Hole central banker speaking schedule

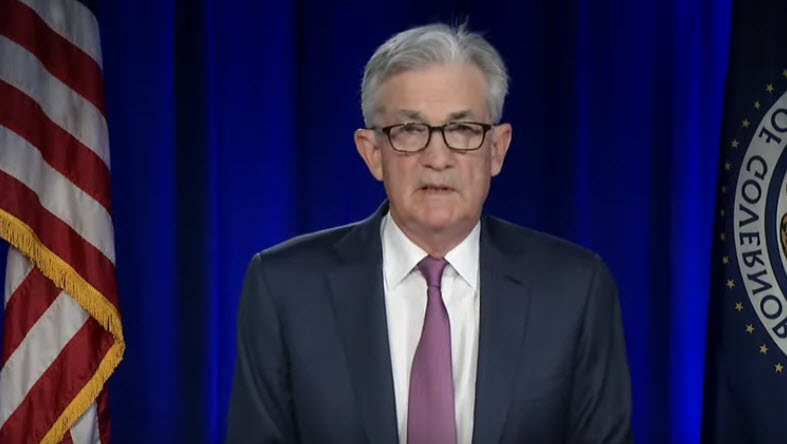

We already had the timing for Federal Reserve Chair Powell’s speech,

- will speak Friday US time on: Macroeconomic Policy in an Uneven Economy

- due at 9 am CT/10 am ET/1400 GMT on August 27

Powell is the main event.

Jackson Hole speakers agenda coming soon

Federal Reserve System Chair Powell will speak Friday US time on: Macroeconomic Policy in an Uneven Economy

Powell may or may not give some taper indications. Ever since it was announced the central banker symposium would be virtual and not live in person expectations for taper talk have fallen.

The agenda for the rest of the event is expected just after 8pm NY time, 0000 GMT.

Japan media says the Australian dollar faces a sell-off risk

Reporting on this piece in Japan’s Nikkei but I’ll add a caveat (the article already does, but I’ll add another).

- The currencies of Australia, South Korea and Brazil — nations reliant on a healthy Chinese economy — are facing sell-offs in the market as fear of an economic slowdown in China spreads.

- “When China sneezes, Australia catches a cold.” So says Tokuhiro Wakabayashi, co-branch manager of State Street Bank and Trust’s Tokyo branch, commenting on the Australian dollar’s sharp depreciation.

Nikkei adds, which is best viewed as a caveat although maybe they didn’t intend it that way:

- The currency touched a roughly nine-month low against the U.S. dollar last week.

- The Australian dollar also recently dipped under 80 yen, marking a year-to-date low.

Yeah … be wary of pieces in mainstream press warning on currency moves ahead. Good of the Nikkei to note AUD is already hitting 9 month lows against the USD … markets tend to take a forward view and the situation on the ground in China (economy losing momentum) and Australia (mounting coronavirus cases recently) has been a hot topic amongst traders for many months already. Not fresh news.

Nikkei piece is here for more (may be gated).

Weekly AUD/USD chart: