The ruling did not go far enough

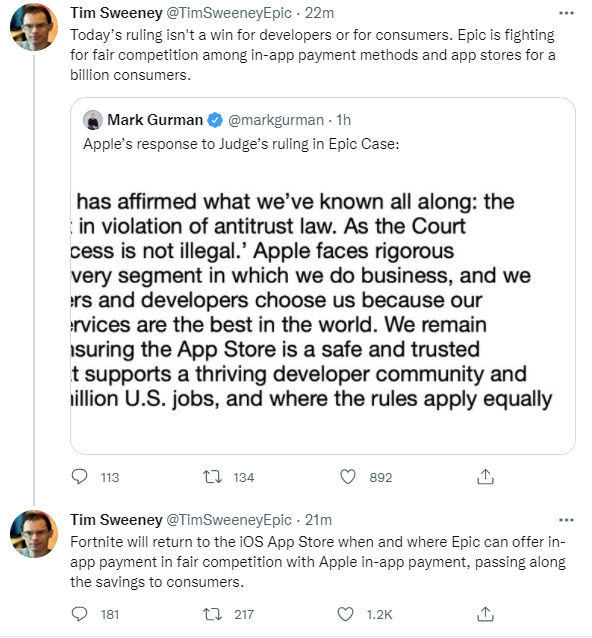

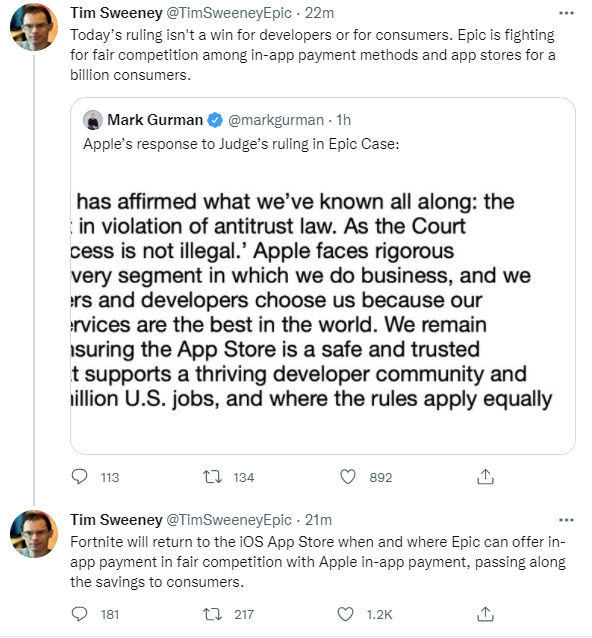

Epic CEO Tim Sweeney is responding to the wrong from the judge on the Apple antitrust case tweeting:

Epic CEO Tim Sweeney is responding to the wrong from the judge on the Apple antitrust case tweeting:

The stocks close at session lows

The stocks close at session lows

Focus on the NOW, don’t be caught up with regret over what you should or could have done with things past.

Focus on the NOW, don’t be caught up with regret over what you should or could have done with things past.

PBOC injects 10bn yuan via 7-day reverse repos