Latest Posts

rssOn this day in 1998: Microsoft became more valuable than GE. Today, it’s 20 times more valuable.

IEA’s Birol says rise in gas prices could continue for weeks

Remarks by IEA executive director, Fatih Birol

- $100 crude prices would be a surprise this year

There’s increasing concern about the energy crisis in Europe especially going into winter, which is what Birol is alluding to with his headline remark. It is going to be a key spot to watch in the weeks ahead in case the fallout reverberates.

Trading Seminar on Technical Analysis and Trading Psychology ,November 2021 = By #ANIRUDHSETHI

TRADING SEMINAR by ANIRUDH SETHI

Month : November 2021 (DATE will confirm next week )

PLACE : BARODA (Gujarat )

100 Seats

Last Date to Enroll :21st Sept

One Day Seminar

To know more send e-mail

A warning to Evergrande that a bailout won’t be a given

Global Times’ editor-in-chief, Hu Xijin, delivers a warning

The Global Times is a sounding board for Chinese authorities and one of the key figures in delivering key messages is via its editor-in-chief, Hu Xijin, who said on his WeChat account that Evergrande should turn to the market for any salvation, not the government.

Adding that Evergrande’s potential downfall is unlikely to trigger a systemic risk akin to that of Lehman Brothers i.e. downplaying the assumption that the company was “too big to fail” and that the government will eventually bail them out.

While not necessarily a confirmation of what to expect, it does fit with the current line of thinking surrounding China at the moment. My thoughts from yesterday:

Evergrande is the name that stands out as the poster boy for all of those worries, as the company is being made an example of the broader crackdown that China is trying to push forward with across most, if not all, major industries right now.

Don’t get me wrong. China has the tools at its disposal to easily bail out Evergrande and prop up the economy. It just isn’t choosing to do so at this moment for one reason or another, be it debt worries or just plain power consolidation

North Korea expanding facility used to produce weapons-grade uranium

CNN with a report on new satellite images revealing North Korea is expanding a key facility capable of enriching uranium for nuclear weapons

- “likely indicate the country plans to significantly ramp-up production at this once-dormant site in the near future, according to experts who analyzed the photos.”

- Could allow North Korea to increase production of weapons-grade nuclear material by as much as 25%

- the ongoing construction is consistent with previous efforts to add floorspace at the facility, allowing it to house more centrifuges and thus, enrich more uranium

—

Earlier in the week NK fired off test missiles:

Biden, Pelosi and Schumer all agree Trump tax cuts must be repealed

US President Biden, leader of the House and leader of the Seanate all agree.

Not surprising given they are all on the same side of the aisle.

Tax hikes ahead For the US … the question is the magnitude. There is A LOT of negotiation still to be done on this. Trump’s side, the Republicans are not going to be easy to convince, and some Dems lean the same way.

World Bank leaders found to be favouring China … “Doing Business”

An internal committee of the World Bank managed to launch an independent investigation into top brass …

The World Bank ethics committee commissioned a law firm to sniff out what was going on.

Their report found that World Bank leaders, including then-Chief Executive Kristalina Georgieva, applied “undue pressure” on staff to boost China’s ranking in the bank’s “Doing Business 2018” report:

- Georgieva, and a key adviser, Simeon Djankov, had pressured staff to “make specific changes to China’s data points” and boost its ranking at a time when the bank was seeking China’s support for a big capital increase.

- The report raises concerns about China’s influence at the World Bank, and the judgment of Georgieva – now managing director of the International Monetary Fund – and then-World Bank President Jim Yong Kim.

- Georgieva said she disagreed “fundamentally with the findings and interpretations” of the report and had briefed the IMF’s executive board.

Kristalina Georgieva now heads the IMF. Oh dear.

Even Russia’s central bank head says inflation is transitory (hopes 7% will be the top!)

ArticleBody Governor of the Central Bank of the Russian Federation (better known as the Bank of Russia) Elvira Nabiullina remarks:

- says annual inflation could hit around 7% in September, we hope this will be its peak

- inflation could significantly deviate from our 4% target for a prolonged period

- says we “act carefully” when making key rate decision in times of uncertainty

- says inflation to return to 4% target in second half of 2022

Speaking in an interview.

Headlines via Reuters

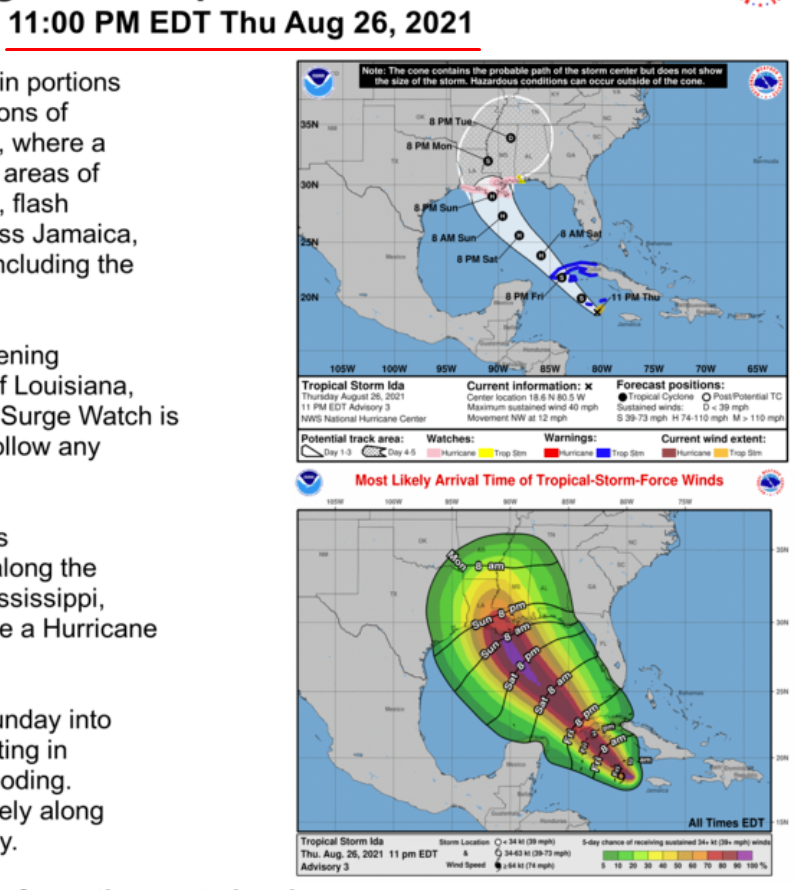

Just under 30% of gulf crude remains offline after hurricanes Ida and Nicholas

An update via Platts on Gulf of Mexico producers, they peg 28% of production yet to return and note that there are still 2 months left of the hurricane season.

- 95% of US Gulf oil and gas production was shut in near the end of August as Category 4 Ida made a Louisiana landfall

- The return of natural gas supplies continued to lag a bit more than oil

- Category 1 Nicholas, which hit the Texas Gulf Coast Sept. 13, had a much more modest impact on the Western Gulf and on slowing restoration activities.

For the update, check out the piece at the link here.

Ida in late August: