Latest Posts

rssJesse Livermore :The Legend

The legend and romance surrounding the famed stock plunger Jessie Livermore has long held a fascination among traders. Livermore has become somewhat of a cult in recent years and there are several books that purport to reveal his secrets for making a fortune in the stock market. None of them can hold a candle to the book which Livermore himself commissioned (written by journalist Edwin LeFevre) entitled Reminiscences of a Stock Operator.

This book is essentially an autobiographical account of Livermore’s trading career as told to LeFevre. It chronicles his meteoric career starting with his early days as a small time operator in “bucket shops” and culminating with his heyday as a big Wall Street mover and shaker. Market students have for years combed this book hoping to find the “hidden secret” to Mr. Livermore’s successful career as a speculator but their efforts have largely been in vain. Livermore left no abiding set of rules for consistently beating the stock market. In fact, he himself fell victim to Mr. Market as he won and lost a fortune on more than one occasion. His life and career came to an inglorious end when he killed himself in the cloakroom of a Manhattan hotel at the age of 63.

The fact that Livermore was never able to crack the secret code of the stock market hasn’t stopped his legions of fans from their endless pursuit of the market’s “Holy Grail.” Had they listened to Mr. Livermore himself, however, they would realize that there is no Holy Grail when it comes to forecasting the stock market with consistent accuracy. (Tragically, Livermore himself seems to have forgotten his own advice on occasion). (more…)

Apple sold 577 iPhones every 60 second in the last quarter (74.8 million).

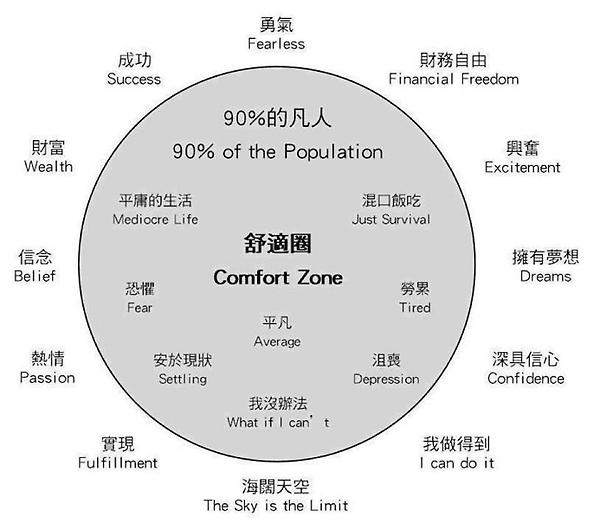

How To Master Any Game (Including ) The Game of Life

Ten Core Ideas of Trading Psychology

1) We are most likely to behave in inhibited or impulsive ways, violating trading rules and plans, when we perceive events to be threatening;

1) We are most likely to behave in inhibited or impulsive ways, violating trading rules and plans, when we perceive events to be threatening;

2) What we perceive to be threatening is a joint function of events themselves and how we think about those events;

3) A key to gaining control over trading and maintaining consistency is to be able to reduce the threat associated with market events and process adverse outcomes in normal, routine ways;

4) We can reduce the threat associated with adverse market events through proper money management (position sizing) and through proper risk management (limits on losses per position);

5) We can reduce the threat associated with adverse market events by training ourselves to respond calmly to adverse outcomes (exposure methods) and by restructuring how we think about those outcomes (cognitive methods);

6) Optimal skill development in trading will occur in non-threatening environments in which learners can sustain concentration, optimism, and motivation;

7) A proper mindset is therefore necessary to the development of trading skills, but does not substitute for such development;

8) The cultivation of trading expertise is a function of the amount of time and effort devoted to learning and the proper structuring of that time and effort;

9) Proper structuring of learning involves the setting of specific, doable, cumulative goals and the provision of rapid feedback and correction regarding the achievement of those goals;

10) Practice does not make perfect in trading or anything else; perfect practice makes perfect. Training must gradually build competencies and correct deficiencies in a manner that sustains a positive mindset and optimal concentration and motivation.

The signals that we have been trading for 15 years make no sense

"Some Rules for Living Applied to Trading"

I ran across these rules for living, and thought they apply beautifully to the process of trading successfully. They are as follows:

I ran across these rules for living, and thought they apply beautifully to the process of trading successfully. They are as follows:

- Show up.

- Pay attention.

- Live your truth.

- Do your best.

- Don’t be attached to the outcome.

Show up. Woody Allen has said 90% of the story is showing up. And I think that can be true for trading. Showing up means being prepared and ready before the market opens. It means getting your entry and exit orders in the market in a timely fashion. You’ve done your research, and you’re clear about your intentions.

Pay attention. Watch the price action. Be cognizant of what your chosen indicators are saying. Know what news is breaking, and watch the market’s reaction to the news. Be alert to twists and turns in market direction. Don’t wander off mentally or physically.

Live your truth. Your truth could be fundamental or technical or a combination of the two. But if you don’t trade in accordance with your guidelines, you can get yourself on the wrong side of the situation and yourself. Be who you say you are as a trader. Are you honest, perceptive, courageous, steady, and disciplined? Are you trading in the manner you have chosen or committed to trade.

Do your best. Honestly, all you can do is your best. But your best can get better as you practice and learn. Learn from your mistakes, and forgive yourself past digressions. Each day is a new day, and each day brings new opportunities. It’s your job to capture what you can of the opportunities even as you rigorously protect your capital.

Don’t be attached to the outcome. This is the hard part, and this is the essential part. The results of any given trade or trading day are really not indicative of whether or not you will be profitable. One trade or day is simply not the measure of success, and is really irrelevant. If you’re showing up, and paying attention, and living your viable truth, and doing your best, you can accept whatever outcome develops. Of course, if the outcome is disastrous over time, you need to go back to the drawing board and develop better methods.

All Global Equity Indices -Now Below 200 Day Moving Average

How are you living your trading life?

Not everything has to be 'disruptive'