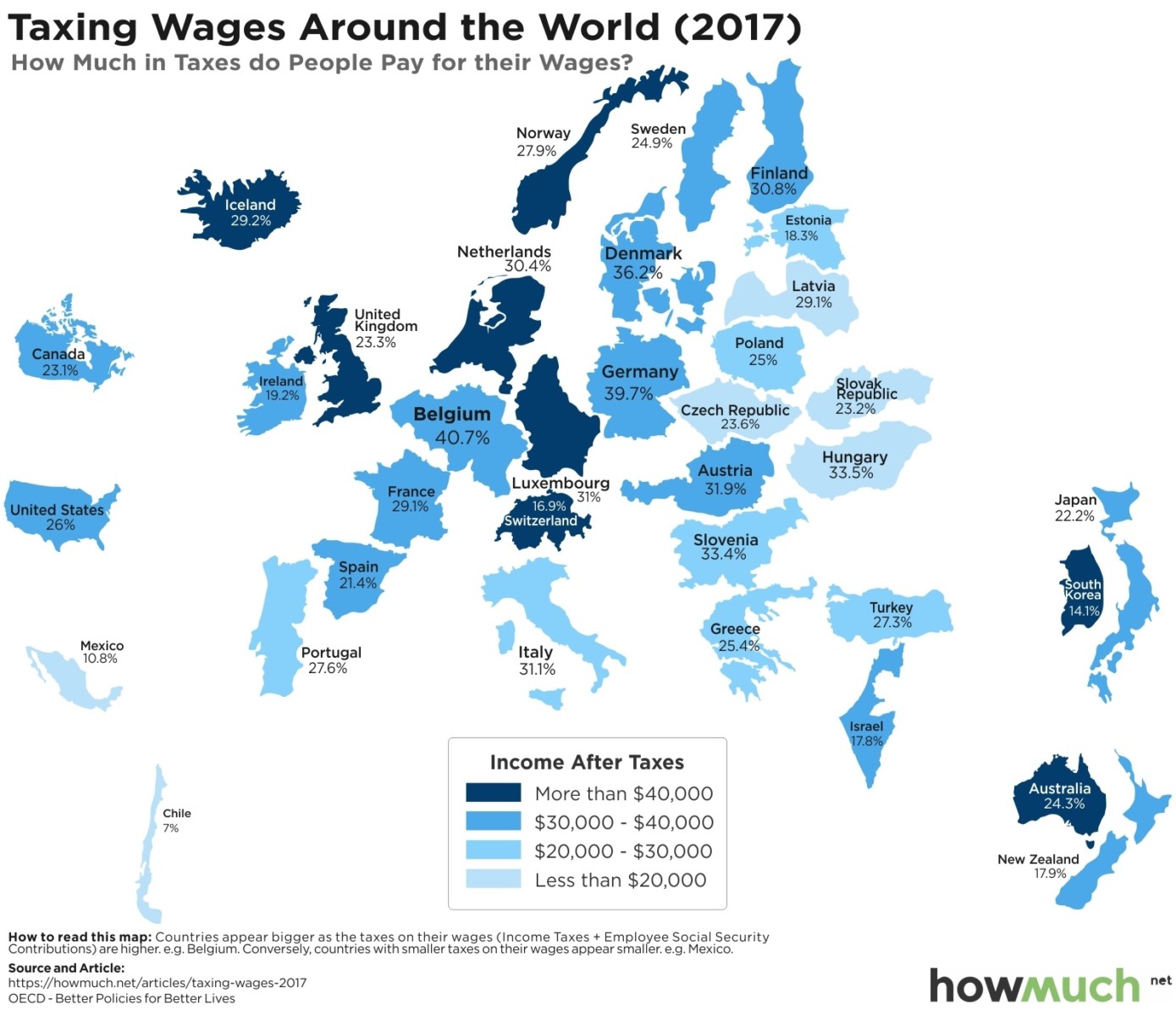

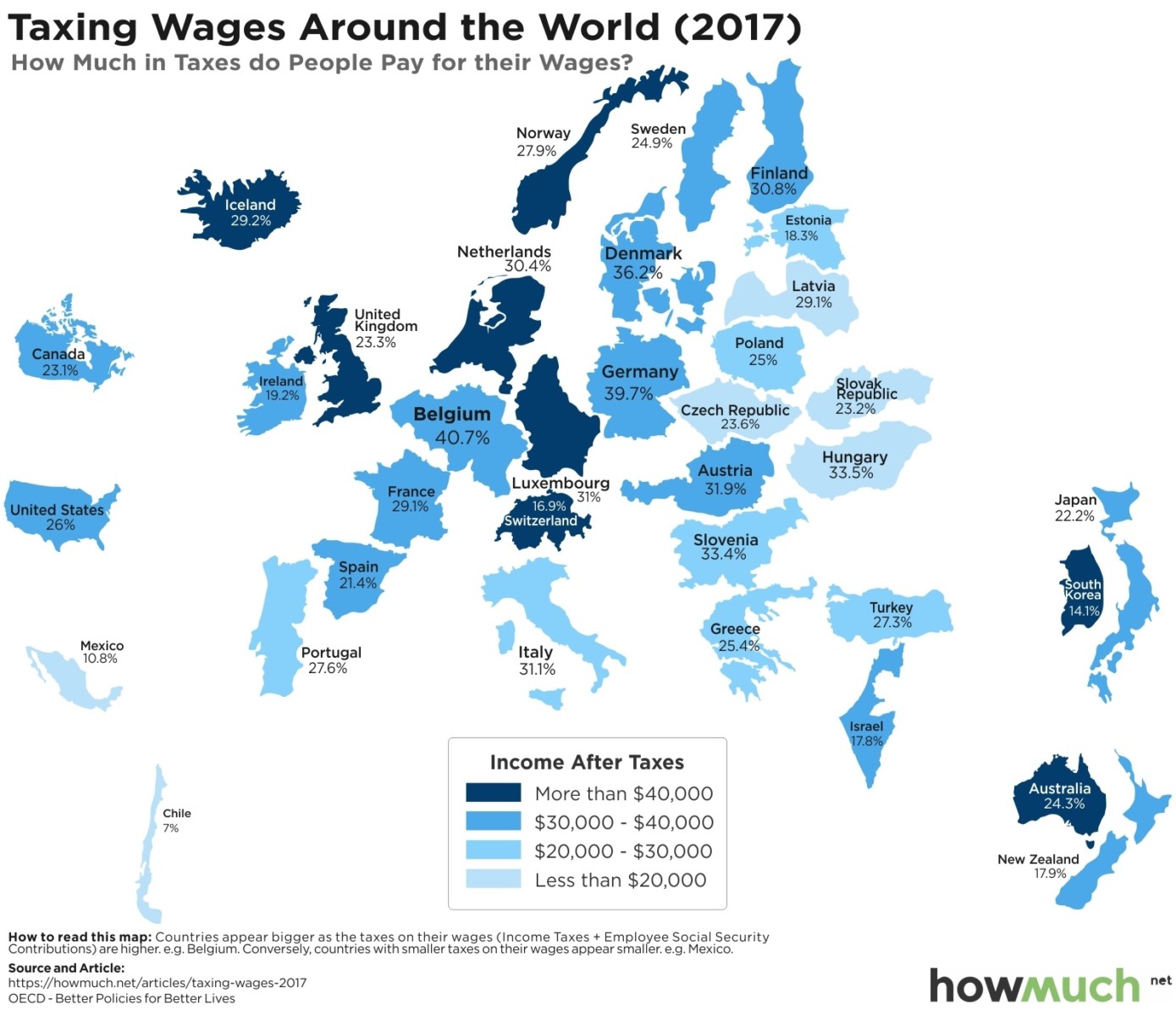

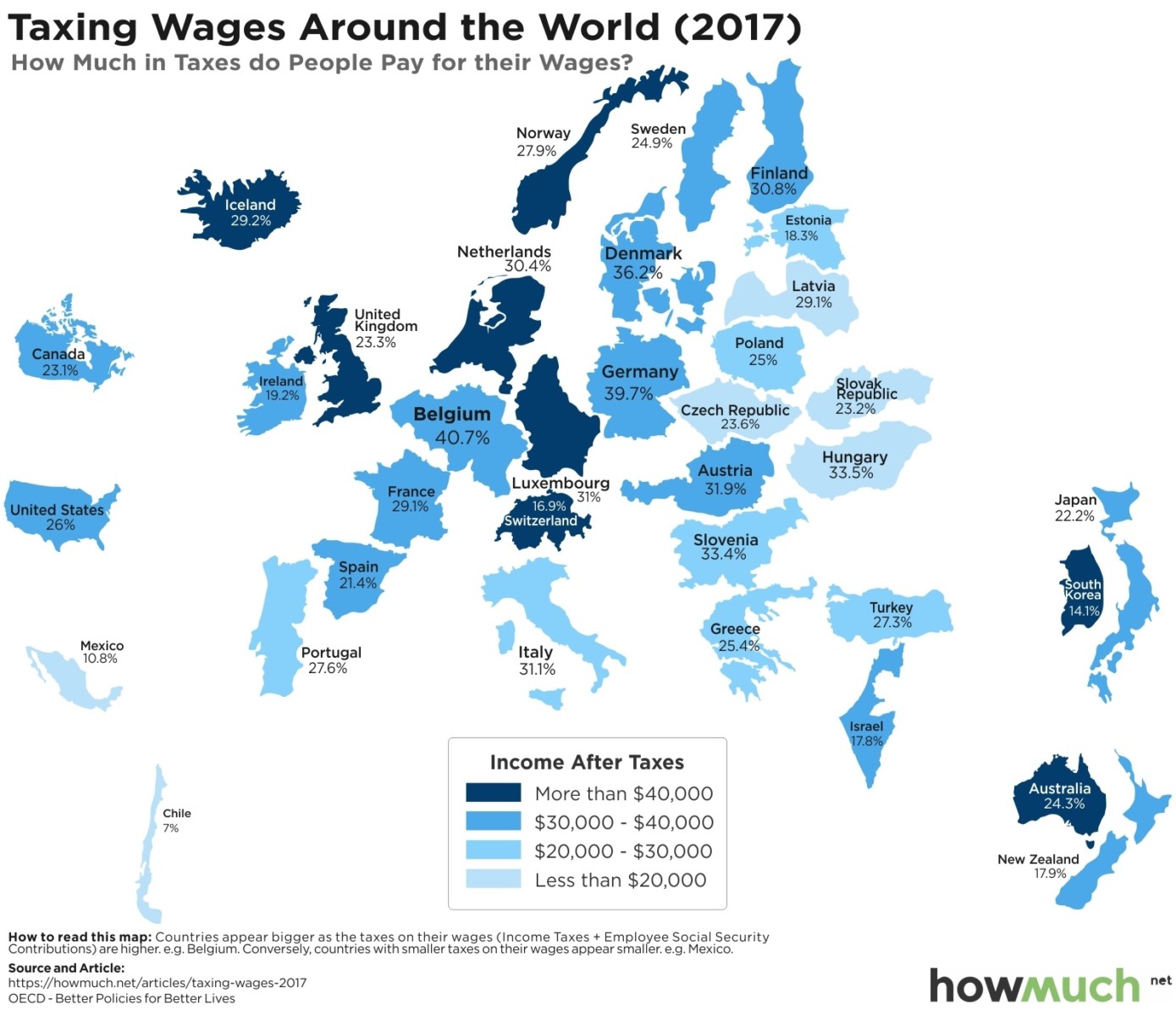

How Much Does the Tax Man Take From Your Paycheck?

“The essential element is having a core philosophy. Without a core philosophy you’re not going to be able to hold on to your positions or stick with your trading plan during really difficult times. You must fully understand, strongly believe in, and be totally committed to your trading philosophy.”

– Richard Driehaus

How does one confirm an effective core philosophy? Here is one simple test. Imagine a wealthy businessman — a friend of the family perhaps — will give you $5 million to manage upon reasonable convincing, over the course of a light lunch, that you have a viable strategy for profiting in markets.

Without notes or power point, could you sell this person on your methodology, explaining in plain English what it is and why it works? Could you confidently defend against devil’s advocate criticisms?

If the honest answer is “no,” work hard on making it “yes” and your core philosophy will emerge…

Positive words carry less information than negative words

We show that the frequency of word use is not only determined by the word length [1] and the average information content [2], but also by its emotional content.We have analysed three established lexica of affective word usage in English, German, and Spanish, to verify that these lexica have a neutral, unbiased, emotional content. Taking into account the frequency of word usage, we find that words with a positive emotional content are more frequently used. This lends support to Pollyanna hypothesis [3] that there should be a positive bias in human expression. We also find that negative words contain more information than positive words, as the informativeness of a word increases uniformly with its valence decrease. Our findings support earlier conjectures about (i) the relation between word frequency and information content, and (ii) the impact of positive emotions on communication and social links.