Latest Posts

rssBad NEWS Continues For BRAZIL

Brazil’s economic growth continues to disappoint.

Brazil’s economic growth continues to disappoint.

After data in December showed Brazil’s economy shrank in the third quarter of last year for the first time since 2009, the central bank’s IBC-Br index, a monthly proxy for gross domestic product, showed economic activity fell 0.3 per cent in November from a month earlier.

The market had been expecting an increase of 0.1 per cent for November.

The surprise contraction comes just two days after the central bank voted unanimously to raise its benchmark Selic rates by a larger-than-expected 50 basis points to 10.5 per cent.

The aggressive move is aimed at tackling the country’s high inflation, which hit 5.91 per cent last year. (more…)

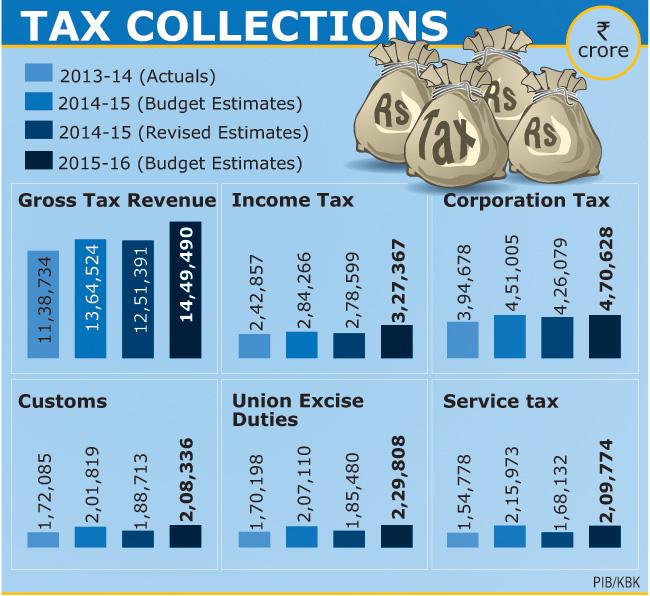

One final look at yesterday's budget tax collection figures.

Black Wednesday – A Documentary about the crash of the pound sterling in 1992

15 points -To Become Effective

1. Every day- Keep Time for the New.

2. Impose on Time & Events on what YOU think is Important.

3. Slough off old Activities before you start a new one- most Important.

4. Set Priorities & Concentrate on the Few Major areas which will Produce OUTSTANDING Results. These are on the Future.

5. The moment you Learn of a Principle, Incorporate it in your Daily Life.

6. Do Difficult Tasks when your Mind works Best.

7. Dispose of your Time in Chunks.

8. Set Posteriorities & Stick to your Decision.

9. Analyze All daily Experiences for Success and Failure, Learn and Act.

10. Plan before you Work or Do. 11. Say No to all things that Waste your Time.

12. Make your Environment Productive.

13. Pick Priorities by Opportunities.

14. Act on the Knowledge you Possess.

15. Focus on Getting the Right Things done. Follow these Principles. You will see a HUGE Difference in your Ability to Produce & Achieve Results.

Trading Without Ego

Make no mistake about it. A trader’s self concept has to be separate from the trading. Who you are as a person began before you ever thought of trading and who you will be as a person will extend beyond your trading. When personal self-worth entwines with trading, it not only damages self esteem, it sabotages the trading.

You hear about it. You read about it. Don’t be misled. Traders tell stories. They write stories. They tell how great they are. Big trades. Big numbers. Big egos. Hubris. And sooner or later, big downfalls. It goes with the territory.

Consider the outsized egos of certain traders who brought themselves and those associated with them to ruin. Nicholas Leeson brought down the Barings Bank. Victor Niederhoffer ran his fund into deficit. John Merriweather threatened the health of our banking system by betting more than fifty times his capital that his strategies were certain to work, that he could forecast with impunity the direction of various bond markets. There’s a pattern here of seeming or real success for a while and then collapse for themselves and for those caught up in blindly following them. (more…)

Winners and Losers: "A winner doesn't talk about what he'll do if he wins…"

Paul Tudor Jones said it best

Thought For A Day

Risk

At some point traders realize that no one can tell you exactly what is going to happen next in the market, and that you can never know how much you are going to make on a trade. Thus the only thing left to do is to determine how much risk you are willing to take in order to find out if you are right or not. The key to trading success is to focus on how much money is at risk, not how much you can make.

At some point traders realize that no one can tell you exactly what is going to happen next in the market, and that you can never know how much you are going to make on a trade. Thus the only thing left to do is to determine how much risk you are willing to take in order to find out if you are right or not. The key to trading success is to focus on how much money is at risk, not how much you can make.