Whether you win or lose, you are responsible for your own results. Even if you lost on your broker’s tip, an advisory service recommendation, or a bad signal from the system you bought, you are responsible because you made the decision to listen and act. I have never met a successful trader who blamed others for his losses.

Whether you win or lose, you are responsible for your own results. Even if you lost on your broker’s tip, an advisory service recommendation, or a bad signal from the system you bought, you are responsible because you made the decision to listen and act. I have never met a successful trader who blamed others for his losses.

Latest Posts

rssQuotes from : Reminiscences of a Stock Operator

Thought For A Day

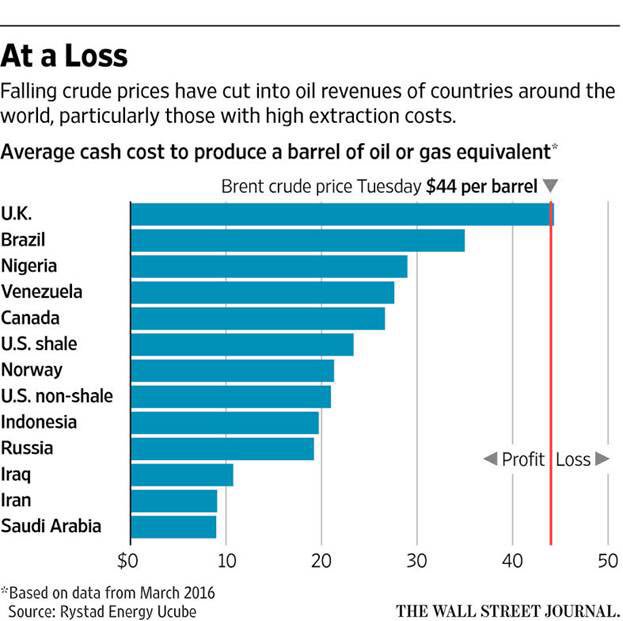

The wildly different cost of producing oil & gas.

Life is a Game of Inches. So is Trading

If you don’t have a plan, you will become part of someone else’s plan. Battles are won before they are fought.

Stay humble or …

Greece posts bumper $2.4bn budget surplus

Here’s something you don’t hear very often. Greece’s public finances are in very healthy shape.

Here’s something you don’t hear very often. Greece’s public finances are in very healthy shape.

Over the first four months of the year, the Greek treasury boasted a primary budget surplus of €2.4bn. This surplus, which does not include debt interest repayments, came in well above a forecast of just €566m, according to the Greek Ministry of Finance.

After more than 16 months in office, the Syriza government is managing to do exactly what its creditors demand – cut spending and raise taxes. The €2.4bn surplus was also better than the €2.1bn reached over the same period last year.

Athens’ coffers were boosted by better than expected tax revenues, which came in €325m above target at €14.11bn from January to April. Spending meanwhile came in at an impressive €2.28bn below target.

Squabbling over the state of Greece’s primary budget surplus has emerged as the latest sticking point between its international creditors. (more…)

Don't value a business ex-cash unless you're buying the entire thing and can take the cash.

PATIENCE & DISCIPLINE

A trader has to have patience & discipline to succeed.

A trader has to have patience & discipline to succeed.

The bottom line is – you need to work out a plan, and then stick to it…regardless.

If you decide on trading only a particular strategy, then you must wait for that setup to occur. In the meanwhile, if price makes some moves, you should not trade those, simply because they do not fit within your plan.

Psychologically, you need a lot of discipline to stick to a plan, because you always feel you are missing out on the moves.

And if you are trading full time, then this becomes a very big issue. Since you keep waiting for a trade & if the opportunity does not occur, then you get tempted to twist your plan & get into the action…..which is the surest way to disaster.

One can make a living from trading…provided it’s done in the correct way.

It’s not an overnight-get-rich-scheme.

It has to be built up slowly & takes a lot of effort & dedication.

Once you accept this fact, it becomes somewhat easier

9 things to give up if you want to be happy