Our Mantra at ASR

Making an important decision is never easy, but making the right decision is even more challenging. Effective decision-making isn’t just about accumulating information and going with what seems to make the most sense. Sometimes, internal biases can impact the way we seek out and process information, polluting the conclusions we reach in the process. It’s critical to be conscious of those tendencies and to accumulate the sort of fact-based and unbiased inputs that will result in the highest likelihood that a decision actually leads to the desired outcome. In this video, Michael Mauboussin, Credit Suisse’s Head of Financial Strategies, lays out three steps that can help focus a decision-maker’s thinking.

Make the Right Choice: Three Steps to Effective Decision Making

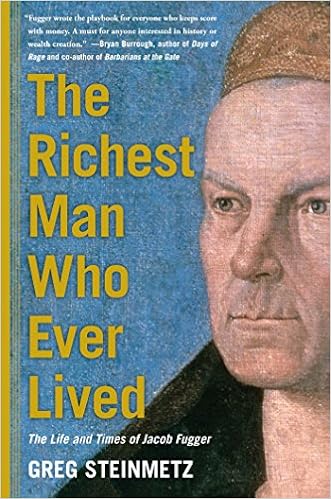

Well, maybe. The other day I read that Mansa Musa, who ruled West Africa’s Malian Empire in the Middle Ages, was the richest person in history, with a personal net worth of $400 billion at the time of his death. Greg Steinmetz’s The Richest Man Who Ever Lived (Simon & Schuster, 2015) isn’t about Mansa Musa, however, but about Jacob/Jakob Fugger (1459-1525), the groundbreaking banker and mining magnate from Augsburg, Germany.

Well, maybe. The other day I read that Mansa Musa, who ruled West Africa’s Malian Empire in the Middle Ages, was the richest person in history, with a personal net worth of $400 billion at the time of his death. Greg Steinmetz’s The Richest Man Who Ever Lived (Simon & Schuster, 2015) isn’t about Mansa Musa, however, but about Jacob/Jakob Fugger (1459-1525), the groundbreaking banker and mining magnate from Augsburg, Germany.

In support of his “richest man” claim, Steinmetz used a metric that he admits is flawed: comparing a person’s net worth with the size of the economy in which he operated. An alternative method, measuring Fugger by his worth in gold, “a method that has the virtue of adjusting for inflation, chops him down to a mere $50 million, making him no wealthier than, say, a successful real estate developer or a multilocation car dealer. That’s not right either.” (p. 202)

Fortunately, for the merit of Steinmetz’s book–which is quite a good read, especially for anyone interested in economic history–Fugger’s rank among the richest really doesn’t matter. Fugger was important not only because he was so rich but because he helped make lending a mainstream capitalist tool and because he was influential in shaping European politics.

Steinmetz summarizes Fugger’s business career:

Amateurs attempt to make a forecast while professionals manage information to make decisions based on probabilities. Dr. Alexander Elder compares this to a Doctor that received a patient with a knife stabbed in his chest. The family will ask, “will he survive?” and “when can he go home?” But the Doctor is not forecasting, he must prevent the patient from dying, remove the knife, saturate the organs and carefully watch for an infection. He monitors the health trend of the patient and takes measures to prevent any complications. He is managing, not forecasting. To profit in trading you do not need to forecast the future, you need to derive from the market whether the bulls or bears are in control. You need to practice money management techniques for long term survival. You trade against the sharpest mind in the ocean-like markets. Mental discipline is an undivided part of trading. Please remember the following points: Understand you are in the market for the long term, that you want to be a trader in even 20 years from now Develop your trading strategy, either technical or fundamental analysis. If “x” happens then “y “is therefore likely to take place. You may need different tools for trading a bull or a bear market Develop a money management plan, with the first goal being long term survival. Secondary goal is steady money growth and third goal would be high profits. Successful traders do not concentrate on the profit itself but maintaining successful trades regardless of the earned amount. Winners feel, think and act different than losers. Look inside yourself, eliminate the illusions and change the way you have been thinking and acting. Changing is hard but could pave the way to becoming a successful trader. |