Latest Posts

rssThe Stock Trader's circle of Sucess and Failure

The following graphic describes two types of traders. The first (the circle on the left) describes what I believe to be the characteristics of all beginning traders, most of which end up quitting. There is a progression here from bad to worst. However, if the beginning trader can break through this cycle somewhere around undisciplined fear (#3) and paralysis of analysis (#4), the chances of his success improves exponentially.

THE LOSER’S CYCLE OF DESPERATION

Simply put, a trader enters the stock market with little if any knowledge about what to expect. How can he? No experience = no knowledge. Not only that, but his expectation of untold riches distorts his perception of reality. Once in the market he seeks the holy grail that will make him rich. When he doesn’t find it he continues his search as fear begins to shackle his feet. The fear leads to paralysis of analysis or the thinking that the more indicators and patterns and candlesticks etc. that he uses the more likely he will win. Wrong! (more…)

The beginning of real success as a trader starts with knowing yourself.

“Know yourself. – You can’t improve on something you don’t understand”.

Vince Lombardi Leadership Rule#1

One common trait amongst nearly all successful traders is that they have a very high understanding of who they are and how they operate. As an example, leading traders realise that they are not in control of the market; they tend to view the market almost as a force of nature without a personality, and with no agendas, the only thing they can do is control their own actions, activities and emotions. In other words they understand the way they work, what drives them and their performance, how their mind operates, and their emotions. Not necessarily on a conscious level, but nonetheless they have an understanding of how it all works.

As an analogy considers a competitive yachtsman, he has to take account of the conditions of the sea and the winds; however, it is his own actions and decisions that will deem how successful he is. He can not blame the sea or the wind for failure, he has to put all his efforts in to his sailing, making correct decisions and performing the correct actions. (more…)

Buffett answering a college student's question…

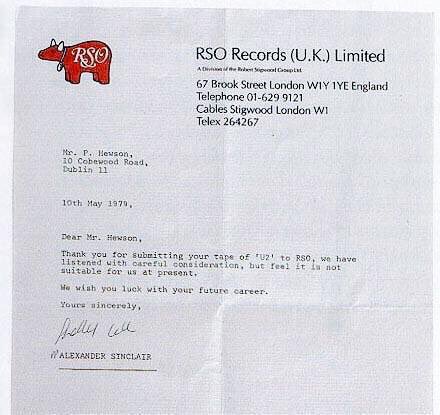

A rejection letter that U2 received in 1979.

Trading Wisdom For Traders

Twenty Six Market Wisdoms from Warren Buffett

1. It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.

2. Chains of habit are too light to be felt until they are too heavy to be broken.

3. Risk comes from not knowing what you’re doing.

4. Only when the tide goes out do you discover who’s been swimming naked.

5. If past history was all there was to the game, the richest people would be librarians.

6. I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.

7. It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price

8. We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful

9. Time is the friend of the wonderful business, the enemy of the mediocre. (more…)

3 Quotes For Traders

Don't look for others to give you permission to be yourself.

TRADE WHAT IS NOT WHAT YOU THINK SHOULD BE

Trade what is… for in doing so your trading is based on fact, substance and reality. It provides clarity, confidence, manageability, and useful feedback for consistent success where appreciation for winning, and respect for losing, keeps you in the game.

Do not trade what you think should be….for in doing so your trading is based on egotism, a false sense of foresight, the desire for validation and approval, and the “win at all cost” mentality, which leads to confusion, anxiety, anger, and despair…not to mention the inability to trade another day.