1995 – 80 million (1% penetration) 2014 – 5.2 billion (73% penetration)

Buying stocks with borrowed money doesn’t make anything a better investment or increase the probability of gains.

It merely magnifies whatever gains or losses may materialize. And then, leverage brings destruction if things go bad…really bad. And they often do.

Nassim Taleb says that we should judge people by the costs of the alternative, that is if history played out in another way.

As he wrote in his brilliant book Fooled by Randomness – “Clearly, the quality of a decision cannot be solely judged based on its outcome, but such a point seems to be voiced only by people who fail (those who succeed attribute their success to the quality of their decision).”

In the same way, be very careful of judging your stock market success by the outcome you achieve, but by the decision you made.

“Leverage can help me magnify my returns” is a great statement to make. But more often now, leverage – which is a result of arrogance created by good short-term returns or a result of survivorship bias, which is concentrating on the people or things that “survived” some process and inadvertently overlooking those that did not – will not only your destroy your savings and sleep, it will also destroy your reputation. (more…)

Conclusion:Isolate yourself from the opinions of other people. Make trading decisions your own. Focus on proper execution. Have the courage to do the right thing because it is right.

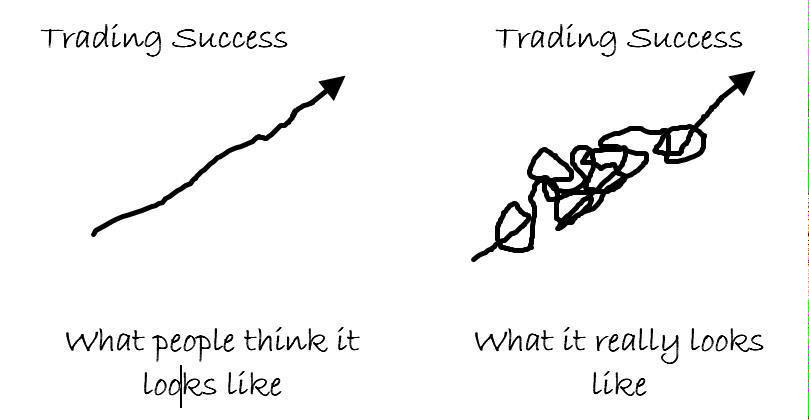

Successful traders are always students of markets, always learning, and always adapting. They have periods of feast and famine, and they learn to keep themselves afloat during the lean times so that they can participate when things get better. In that context, learning when to not trade is a crucial component of trading success.

Successful traders are always students of markets, always learning, and always adapting. They have periods of feast and famine, and they learn to keep themselves afloat during the lean times so that they can participate when things get better. In that context, learning when to not trade is a crucial component of trading success.

One of the most common mistakes traders make is that they address performance problems by thinking harder. Like the insomniac who stays awake longer and longer thinking about trying to get to sleep, the trader who analyzes and worries about performance loses that “zone” in which probability distributions present themselves implicitly.

People make money in markets two ways: by investing and by trading. Investing means generating a big picture view and riding out short term noise en route to seeing that view materialize. Investors are top-down thinkers: they’re analytical and their skill lies in putting pieces of research together to form a picture that others haven’t yet seen. Traders are bottom-up thinkers: they recognize patterns as they form and act on them quickly. Where the investor thinks deeply about opportunity over time, the trader thinks broadly about what’s happening in markets at a given time

I’ve seen this study making the rounds on several websites now as a type of neuroeconomic confirmation of Buffetological principles…

Perhaps procedure might be slightly useful as a means of seeing physical brain improvement by training– such as that found through meditative practices.

“Traders who buy more aggressively based on NAcc signals earn less. High-earning traders have early warning signals in the anterior insular cortex before prices reach a peak, and sell coincidently with that signal, precipitating the crash. These experiments could help understand other cases in which human groups badly miscompute the value of actions or events.”

“Neuroeconomists Confirm Warren Buffet’s Wisdom”:

“Seeing what’s going on in people’s brains when they are trading suggests that Buffett was right on target,” says Colin Camerer, the Robert Kirby Professor of Behavioral Economics at Caltech.

That is because in their experimental markets, Camerer and his colleagues found two distinct types of activity in the brains of participants—one that made a small fraction of participants nervous and prompted them to sell their experimental shares even as prices were on the rise, and another that was much more common and made traders behave in a greedy way, buying aggressively during the bubble and even after the peak. The lucky few who received the early warning signal got out of the market early, ultimately causing the bubble to burst, and earned the most money. The others displayed what former Federal Reserve chairman Alan Greenspan called “irrational exuberance” and lost their proverbial shirts.

If you don’t see anything, you don’t initiate a new position. You take risk only when you see an opportunity. Make it a habit to ask yourself for each trading or investing decision – do you have an edge or do you just hope to be right. Hope is not a strategy.

If you don’t see anything, you don’t initiate a new position. You take risk only when you see an opportunity. Make it a habit to ask yourself for each trading or investing decision – do you have an edge or do you just hope to be right. Hope is not a strategy.