Don't be a monster…

No particular reason to post this except that all fundamental analysis sounds the same regardless of decade

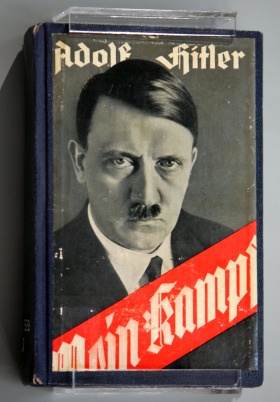

The great masses of the people will more easily fall victim to a big lie than to a small one. Adolf Hitler Mein Kampf |

| The personification of the devil as the symbol of all evil assumes the living shape of the Jew. Adolf Hitler Mein Kampf |

| Was there any form of filth or profligacy, particularly in cultural life, without at least one Jew involved in it? If you cut even cautiously into such an abscess, you found, like a maggot in a rotting body, often dazzled by the sudden light – a kike! Adolf Hitler Mein Kampf |

| I believe that I am acting in accordance with the will of the Almighty Creator: by defending myself against the Jew, I am fighting for the work of the Lord. Adolf Hitler Mein Kampf |

| The broad masses of a population are more amenable to the appeal of rhetoric than to any other force. Adolf Hitler Mein Kampf |

| The [Nazi party] should not become a constable of public opinion, but must dominate it. It must not become a servant of the masses, but their master! Adolf Hitler Mein Kampf |

| There must be no majority decisions, but only responsible persons, and the word ‘council’ must be restored to its original meaning. Surely every man will have advisers by his side, but the decision will be made by one man. Adolf Hitler Mein Kampf |

| Never forget that the most sacred right on this earth is man’s right to have the earth to till with his own hands, the most sacred sacrifice the blood that a man sheds for this earth…. Adolf Hitler Mein Kampf |

| Those who want to live, let them fight, and those who do not want to fight in this world of eternal struggle do not deserve to live. Adolf Hitler Mein Kampf |

| In actual fact the pacifistic-humane idea is perfectly all right perhaps when the highest type of man has previously conquered and subjected the world to an extent that makes him the sole ruler of this earth… Therefore, first struggle and then perhaps pacifism. Adolf Hitler Mein Kampf |

This one is pretty straight forward. I’m taking a profound queue from Michael Jordan, something he realized and adopted early in his stellar career, and applying it to day trading. And anything else you’re into. People don’t reach and stay at the top of their game by accident, without falling down, or undefeated.

Whether it is sports, music, science, software, business, trading, I think a major component of success is learning to fail … successfully.

A timely book here just ahead of opening day, http://tradingbases.squarespace.com/. Peta relates a lifelong love of baseball and statistics, his experiences as an equity desk trader for Lehman Bros. (15 years) and his subsequent battle back from a horrifying injury sustained by being run over in the streets of NY by an ambulance –as if his Lehman experience wasn’t enough to endure. He suffered a “Theisman grotesque” leg break that left him depressed and basically rehabbing alone in his NY apartment with wife and family living on the west coast.

His passion for trading snuffed by not being able to work, hopped up on pain meds, and trapped in the apartment leads to him to watching more sports than ever before. A baseball lover at heart and a statistical junkie, Peta finds a reason to wake up in the mornings. He decides to try his hand at making a statistical model that would identify edges for baseball team wins and losses that would provide him with a betting edge over the Vegas Line.

Peta eventually creates a hedge fund that bets baseball games that returns 41% in 2011 with similar daily volatility as the S&P 500. The book outlines Joe’s views on gambling. Baseball is his preferred niche since the juice/spread is the smallest in comparison to other sports, the ability to use statistics to get an edge is available, and the natural alignment between the better and the team– rooting for your team to win versus the convolution of winning and beating a point spread. (more…)