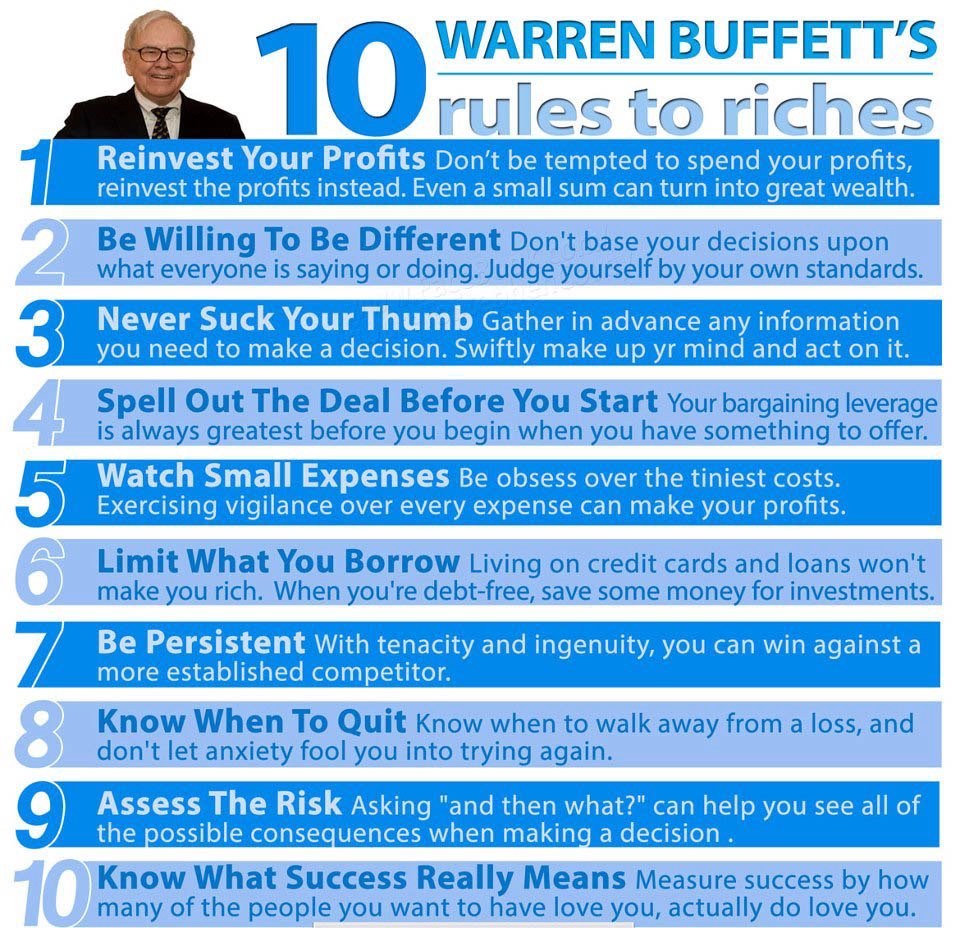

Warren Buffett's 10 wealth rules

Havard students get near-perfect SAT scores. These are smart, smart kids. So they shouldn’t have trouble with a simple logic question, right?

Try the following puzzle:

A bat and ball cost $1.10.

The bat costs one dollar more than the ball.

How much does the ball cost?

Scroll down for the answer … (more…)

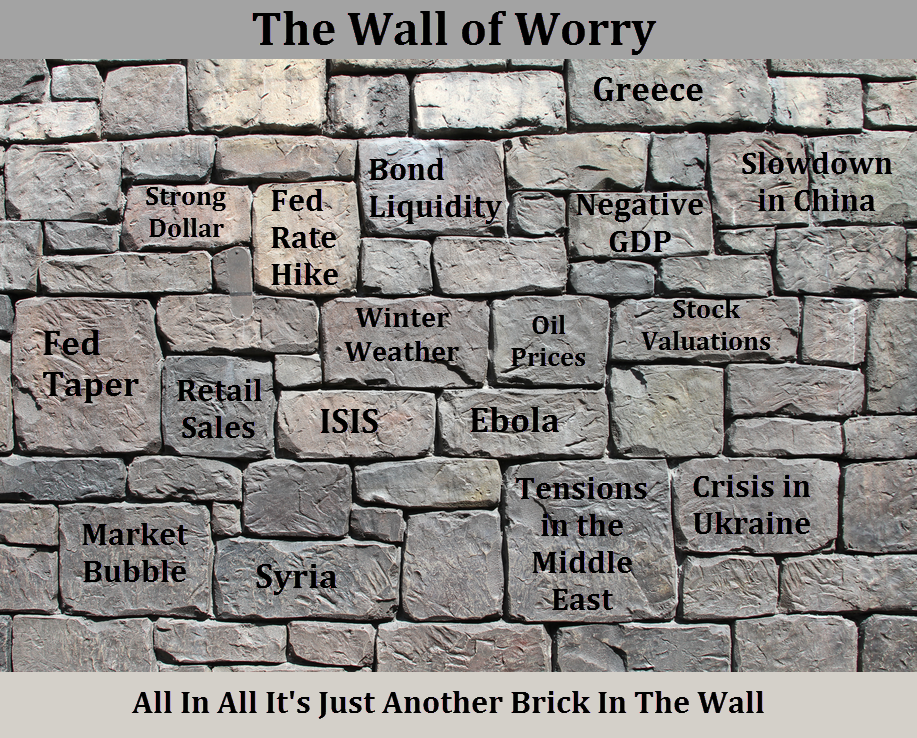

The chapter entitled, “More Thoughts on Human Nature and Speculation”, includes some classic thinking on aspects of human psychology which prevent us from operating profitably in the markets. A passage from Neil on the dangers of greed follows this line of thought:

The chapter entitled, “More Thoughts on Human Nature and Speculation”, includes some classic thinking on aspects of human psychology which prevent us from operating profitably in the markets. A passage from Neil on the dangers of greed follows this line of thought:

“…I have watched traders in brokers’ offices with deep interest, and have tried to learn the traits that crippled their profits. The desire to “make a killing”—greed—has impressed me particularly.

Perhaps this desire to squeeze the last point out of a trade is the most difficult to fight against. It is also the most dangerous. How often has it happened in your own case that you have entered a commitment with a conservatively set goal, which your judgment has told you was reasonable, only to throw over your resolutions when your stock has reached that point, because you thought “there were four more points in the move?”

The irony of it is that seemingly nine times out of ten (I know, for it has happened with me) the stock does not reach your hoped-for objective; then—to add humiliation to lost profits—it goes against you for another number of points; and, like as not, you end up with no profit at all, or a loss.

Maybe it would help you if I told you what I have done to keep me in my traces: I have opened a simple set of books, just as if I were operating with money belonging to someone else. I have set down what would be considered a fair return on speculative capital, and have opened an account for losses as well as for gains, knowing that the real secret of speculative success lies in taking losses quickly when I think my judgment has been wrong.

When a commitment is earning fair profits, and is acting as I had judged it should act, I let my profits run. But, so soon as I think that my opinion has been erroneous, I endeavor to get out quickly and not to allow my greed to force me to hold for those ephemeral, hoped-for points. Nor do I allow my pride to prevent an admission of error. I had rather, by far, accept the fact that I have been wrong than accept large losses…”

This looks like worthwhile study material, so read on and don’t mind the fact that most of the references date back to 1930. Time honored wisdom is the best, and sound practices are applicable in any age.

Books:

I highly recommend “Dark Pools” which is about how we’ve come to the point where trades are measured in picoseconds (a trillionth of a second) in order to remain competitive. Sounds boring, but it’s written in the same style as a Michael Lewis book and if you ever wanted to know how a guy with lizards running around in his server room helped narrow the average holding period for a stock from two years to twenty seconds, well this is the book for you.

I also read “Savages” and it’s prequel (probably not worth reading). This was before I knew Oliver Stone was doing the movie. A cross between Weeds and No Country For Old Men – really very entertaining fiction.

Other books I enjoyed the last six months: Ready Player One, Deer Hunting with Jesus, This Book Will Save Your Life, The George Martin series, Open City (about NYC), 1Q84, Horns: A Novel, The Fear Index, 11/22/63, Smonk, & The Digital Plague. (more…)

There is a very thin line. I maintain that most traders ARE gamblers. They use markets as a substitute for a casino. Here are some of the sign posts that you have crossed the line.

There is a very thin line. I maintain that most traders ARE gamblers. They use markets as a substitute for a casino. Here are some of the sign posts that you have crossed the line.

1. IF you enter trades without a clear trading plan, you just might be a gambler.

2. IF you trade just to be trading, you just might be a gambler.

3. IF your bored and enter a trade, you just might be a gambler.

4. IF you look at potential profit before assessing potential loses, you just might be a gambler.

5. IF you have no impulse control, you just might be a gambler.

6. IF you have no methodology, you just might be a gambler.

7. IF you rely on others for your trading decisions, you just might be a gambler.

8. IF you do not take full responsibility for your trading outcomes, you just might be a gambler.

9. IF you increase your risk due to losses, you just might be a gambler.

10. IF you do not use stop losses or do not adhere to them, you just might be a gambler.

And my all time favorite

11. IF you get an adrenaline rush when your entering trades, you just might be a gambler.

Respect is the first casualty in lost love.

Respect is the first casualty in lost love.

Four industries dominate the economy: hope, escape, protection, and convenience.

Success is the point at which talent and skill meet opportunity.

The aim of all trading education: to encourage trading.

The printing press democratized the acquisition of knowledge; the computer has democratized its dissemination.

Date markets before deciding to marry them.

Anatomy of a bad trade: Hope, then despair.

Love, once present, never dies. It must be killed. (more…)