“Once you can clearly spot the rising of disappointment or excitement as Objects separate from yourself, you become less identified with those objects and they have less effect on you”!.

“Once you can clearly spot the rising of disappointment or excitement as Objects separate from yourself, you become less identified with those objects and they have less effect on you”!.

Latest Posts

rssPrice vs Value

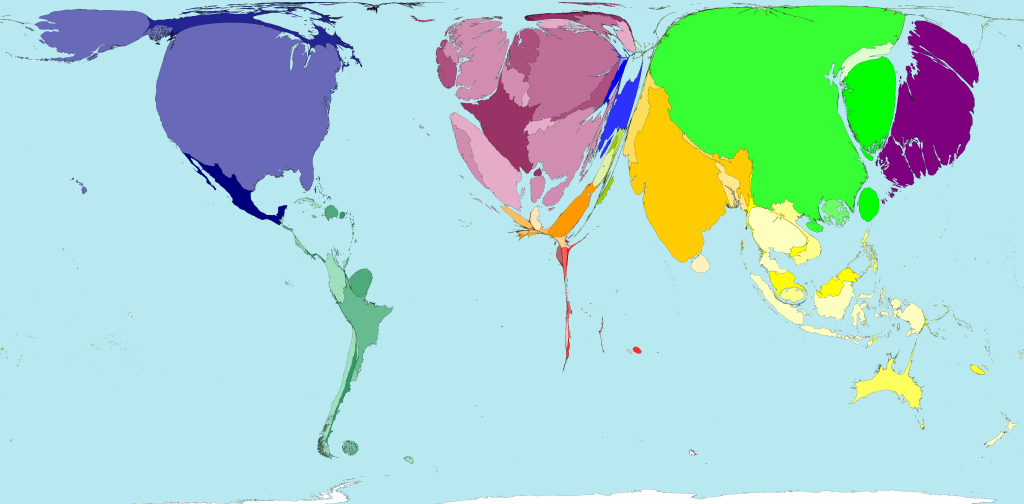

Growth in Wealth from 1975 to 2002

Two thirds of the territories in the world have experienced a growth in their wealth from 1975 to 2002. The biggest absolute wealth increase has been in China. Eastern Asia has experienced the largest proportional increases in wealth, averaging a growth in Gross Domestic Product (GDP) of 8% a year.

Unfortunately those territories with the smallest GDPs have, at best, only experienced a very small proportion of worldwide increases in wealth. Although distributions of wealth do change, the map shows wealth growth in places that are already relatively wealthy. The territories with the largest increases in GDP, when taking local prices into account, were China, the United States, Japan, India and Germany.

Source: Worldmapper

The legendary Jack Bogle

The Face of a Creditor

Twenty ‘Ifs’ for a Winning Attitude

- If you have the desire, you are halfway there.

- If you do your best, don’t mind the rest.

- If you can’t control the wind, adjust your sail.

- If you are headed in the wrong direction, God allows U-turns.

- If you can imagine it you can achieve it. If you can dream it, you can become it.

- If you don’t stand for something, you’ll fall for anything.

- If you aim at nothing, you’ll hit it every time.

- If you have much, give of your wealth; if you have little, give of your heart.

- If you always do what you always did, you’ll always get what you always got.

- If you depend on others to make you happy, you will be endlessly disappointed. (more…)

China Stunner: Real GDP Is Now A Negative -1.1%, Evercore ISI Calculates

With Chinese data now an official farce even among Wall Street economists, tenured academics, and all others whose job obligation it is to accept and never question the lies they are fed, the biggest question over the past year has been just what is China’s real, and rapidly slowing, GDP – which alongside the Fed, is the primary catalyst of the global risk shakeout experienced in recent weeks.

One thing that everyone knows and can agree on, is that it is not the official 7% number, or whatever goalseeked fabrication the communist party tries to push to a world that has realized China can’t even manipulate its stock market higher, let alone its economy.

But what is it? Over the past few months we have shown various unpleasant estimates, the lowest of which was 1.6% back in April.

Today we got the worst one yet, courtesy of Evercore ISI, which using its own GDP equivalent index – the Synthetic Growth Index (SGI) – gets a vastly different result from the official one, namely Chinese growth of -1.1% annually. Or rather, contraction.

To wit, from Evercore:

Our proprietary Synthetic Growth Index (SG!) fell 1.1% mim in July, and was also down 1.1% y/y. No wonderglobal commodities are so weak. The most recent 18 months have been much weakerthan the 2011-13 period. Even if we adjust our SG I upward (for too-little representation of Services — lack of data), we believe actual economic growth in China is far below the official 7.0% yly. And, it is not improving, Most worrisome to us; the ‘equipment’ portion of Plant & Equipment spending is very weak, a bad sign for any company or country. Expect more monetary and fiscal steps to lift growth.

And here is why the world is in big trouble.

Toyota apologises before the US Congress

10 Most Ridiculous Things Bought By Billionaires-VIDEO

Poker and Trading…Some Rules Applicable to Both.

Pay Attention…and It Will Pay You. Concentrate on everything when you are playing/trading. Watch and listen; remember to do both and relate the two.

Pay Attention…and It Will Pay You. Concentrate on everything when you are playing/trading. Watch and listen; remember to do both and relate the two.

Understand When to Play Aggressively…It’s the Winning Way. Don’t be a tight or a loose player/trader; be a solid one and recognize when it is time to press your bets/positions. To attain superior returns in poker and investing over the long run, grind it out (in stocks until you are up 30%-40%, and then if you have convictions, go for a 100% year). If you can avoid losing and put together a few 100% years, you can achieve outstanding long-term investment performance.

Tells: Look For Them and You Will Find Them. Poker players and stock markets have tells — giveaway moves that are very revealing. Learn to recognize them. History is your textbook.

ESP…It’s a Jellyroll. In those rare instances when all your card knowledge and market judgment/knowledge leaves you in doubt, go with your strong feelings and not against it.

Honor: A Gambler/Trader’s Ace-in-the-Hole. A good reputation and respect from others will put you in good stead.

Be as Competitive as You Can Be. Go into a poker game and into a trade with the idea of completely destroying your opponent or scoring a major investment coup. If you win a pot or make a successful trade, nearly always play the next pot or make the next trade shortly thereafter — within reason. Although the cards and trades might break even in the long run, rushes do happen and momentum often feeds upon itself. When you earn the right to be aggressive, you should be aggressive. When one has a tremendous conviction in a poker hand or trade, you have to go for the jugular.

Art and Science…It takes Both. Both activities are more art than science — that’s why they are so difficult to master. Knowing what to do is about 10% of the game. Knowing how to do it is the other 90%.

Money Management. The same sound principles of money control apply to the business of tournament/professional poker and to successful investing. The way to build long-term returns or poker winnings is through preservation of capital and home runs.

The Important Twins of Poker/Investing, Patience and Staying Power. Come to the poker table or to the markets with enough time to stay and play for a while.

Alertness is a Key. You must stay alert at all times.

So is Discipline.

Never Let Your Mind Dwell on Personal Problems. Never play/trade when you are upset. Make a conscious and constant effort to discover any leaks in your play, and then eliminate them.

Control Your Emotions. Allowing your confidence to be shaken can turn a simple losing streak into a terrible case of going bad. Keep your emotions in check. When you lose a pot or make a poor investment decision, get up, walk around the chair or take some deep breaths. Don’t lose your poise. If a trade or poker hand does not work out, walk away from the position/hand. Be confident enough about your ability to win afterwards.