1. The Process and the Practice: “Confidence doesn’t come from being right all the time: it comes from surviving the many occasions of being wrong” (27).

2. Stress and Distress: “Thinking positively or negatively about performance outcomes interfere with the process of performing. When you focus on the doing, the outcomes take care of themselves” (56).

3. Psychological Well-Being: “We can recognize the happy trader because he is immersed in the process of trading and finds fulfillment from the process even when markets are not open” (72).

4. Steps Toward Self-Improvement: “Your trading strengths can be found in the patterns that repeat across successful trades” (105).

5. Breaking Old Patterns: “Many trading problems are the result of acting out personal dramas in markets” (133)

6. Remapping the Mind: “When we change the lenses through which we view events, we change our responses to those events” (168)

7. Learn New Action Patterns: “Find experienced traders who will not be shy in telling you when you are making mistakes. In their lessons, you will learn to teach yourself” (203)

8. Coaching Your Trading Business: “Long before you seek to trade for a living, you should work at trading competence: just breaking even after costs” (230)

9. Lessons From Trading Professionals: “If you don’t trust yourself or your methods, you will not find the emotional resilience to weather periods of loss” (267)

10. Looking For the Edge: “The simplest [trading] patterns will tend to be the most robust” (311).

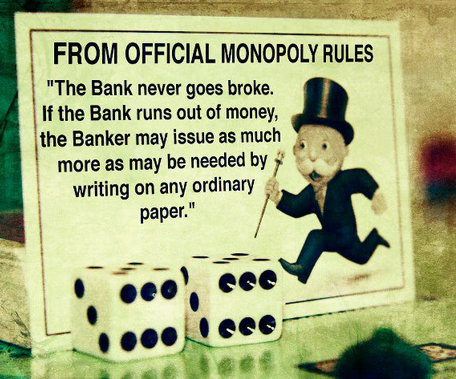

I don’t need to remind you of the frightening economic data Washington doesn’t want you to know — the nearly $13 trillion debt, 90% debt to GDP ratio (that does not even include the off-budget items, such as the $6 trillion owed by Fannie Mae and Freddie Mac, or the $50 trillion of unfunded liabilities for programs like Social Security and Medicare)… And I certainly don’t need to reiterate the urgency of this situation. You know how severe the ramifications will be if we fail to take immediate action

I don’t need to remind you of the frightening economic data Washington doesn’t want you to know — the nearly $13 trillion debt, 90% debt to GDP ratio (that does not even include the off-budget items, such as the $6 trillion owed by Fannie Mae and Freddie Mac, or the $50 trillion of unfunded liabilities for programs like Social Security and Medicare)… And I certainly don’t need to reiterate the urgency of this situation. You know how severe the ramifications will be if we fail to take immediate action