so true

“I can’t sleep” answered the nervous one. |

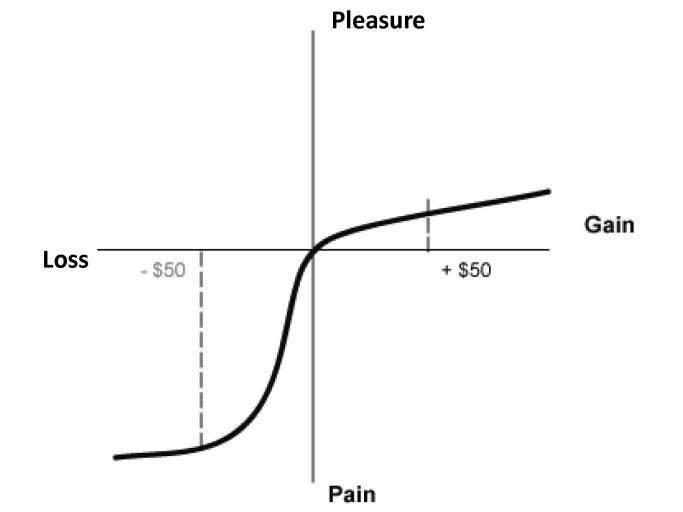

1 Greed, the urge to make as much money as possible, and fear that he will lose it all.

2 Low confidence in himself or his strategy, which makes him enter or exit trades at the wrong time. Low self esteem is also a problem; lots of people are natural victims and believe that they will probably fail, and of course this is what they do.

3 Middle class guilt that makes the trader believe that he should not make super profits because it is morally wrong.

4 Overconfidence. Feeling that after so many winning trades he is invincible.

5 Disbelief. He believes that high rewards cannot possibly be true, and “If trading is that easy, then everyone would be doing it.” He then looks for complicated strategies in the belief that it cannot be easy.

6 Paranoia, believing that the market is conspiring against him.

7 Reward for effort, where he feels that people should be rewarded fairly for the effort that they put in. FX trading does not operate with these rules and that is confusing. The reward can be disproportionately high or can result in punishing losses, and is not dependent on just the work put in.

8 Insecurity, resulting in changing a strategy that is actually winning. All strategies must be tested and then consistently applied in order to engender confidence.

9 The urge to trade simply because he is a trader. This impatience results in entering trades when no real opportunity exists.

10 Low expectation; people with a low expectation of life tend to be less successful. Even though they may be highly intelligent, they aim for less and settle for less. (more…)