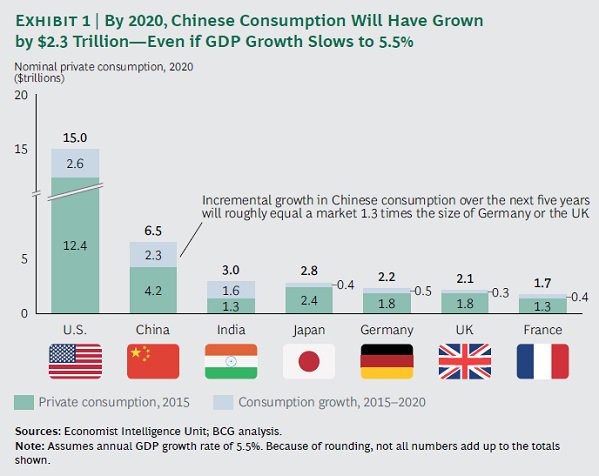

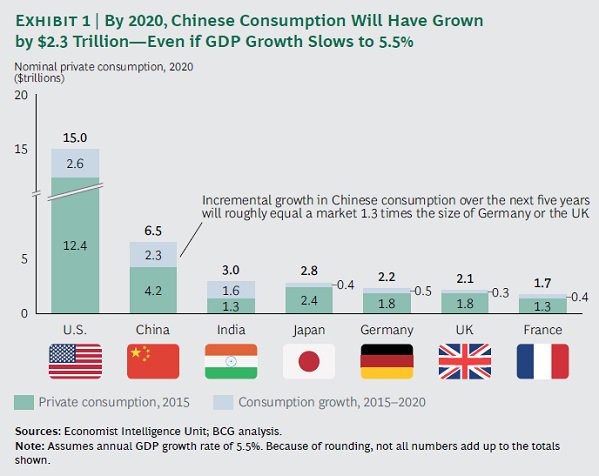

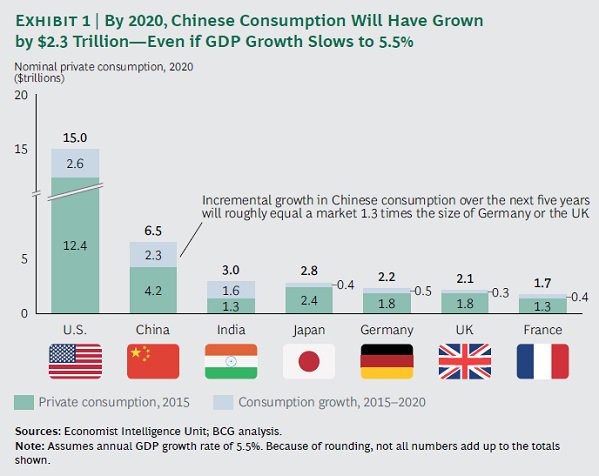

By 2020, China’s consumption will soar 55% to $6.5 trillion—even if GDP slows to 5.5%

Are stocks always the best long-term investment?

Maybe not.

When some obscure Hawaiian stamps from 1851 go up for auction later this month, they are expected to fetch from $50,000 to $75,000 each.

And if they do, that will mean they have almost certainly been a better financial investment — probably a much better investment — over the past 165 years than the U.S. stock market.

The 13-cent so-called “Missionaries” were used by Christian missionaries in the Hawaiian islands to send letters home. At the time, Hawaii was an independent kingdom. The Associated Press reports that the stamps are part of a 77-stamp collection being sold by Bill Gross, the bond market guru. Ten such “Missionaries” in near-mint condition are being sold.

If the stamps sell for $50,000 each, that will represent a compound annual return of 8.1% over the initial 13-cent purchase price. If the stamps sell for $75,000, you can raise that to 8.4%. (more…)

Goldman Sachs is not exactly the number one brand in the world. Admittedly, it’s hard to beat Apple these days in popularity contests. But Goldman doesn’t even come close: on the contrary, it’s a firm that people love to hate. William D. Cohan’s Money and Power: How Goldman Sachs Came to Rule the World (Doubleday, 2011) provides fodder for the Goldman haters, exposing among other things a long history of conflicts of interest.

Goldman Sachs is not exactly the number one brand in the world. Admittedly, it’s hard to beat Apple these days in popularity contests. But Goldman doesn’t even come close: on the contrary, it’s a firm that people love to hate. William D. Cohan’s Money and Power: How Goldman Sachs Came to Rule the World (Doubleday, 2011) provides fodder for the Goldman haters, exposing among other things a long history of conflicts of interest.

Cohan’s long book is not, however, the stuff that tabloids (or Rolling Stone—think of Matt Taibbi’s piece, later expanded into

Griftopia) are made of. It’s carefully researched, with well-crafted portraits of Goldman’s leading players, definitely worth reading.

Since Cohan’s book has been extensively reviewed, for this post I decided to extract some lessons for individual traders from Goldman’s successes and failures. And Goldman, lest we forget, had a lot of failures.

One lesson is to exploit the weaknesses (or laziness) of others. For instance, a Goldman trader recalled that his boss always called Friday “Goldman Sachs Day,” the rationale being that traders at other firms were goofing off on Friday. If the Goldman traders came in on Friday intent on actually doing something while others had their guard down and were less competitive, their focused energy could make a big difference. (more…)

Developing enduring confidence in your real-time trading skills and abilities doesn’t come overnight. It’s a process. And, it’s the process of ‘getting there’ that we focus on to improve and to “be a good trader.”

Confidence comes from mastering the various skills needed to read the market, execute and manage trades. Mastering these skills and abilities is the process of trading and it is this process that brings about confidence.

Confidence really doesn’t come from more winning trades. In fact, more winning trades come from a dedicated focus on the process.