How Blue Channels Technical Analysts Look at Chart ?

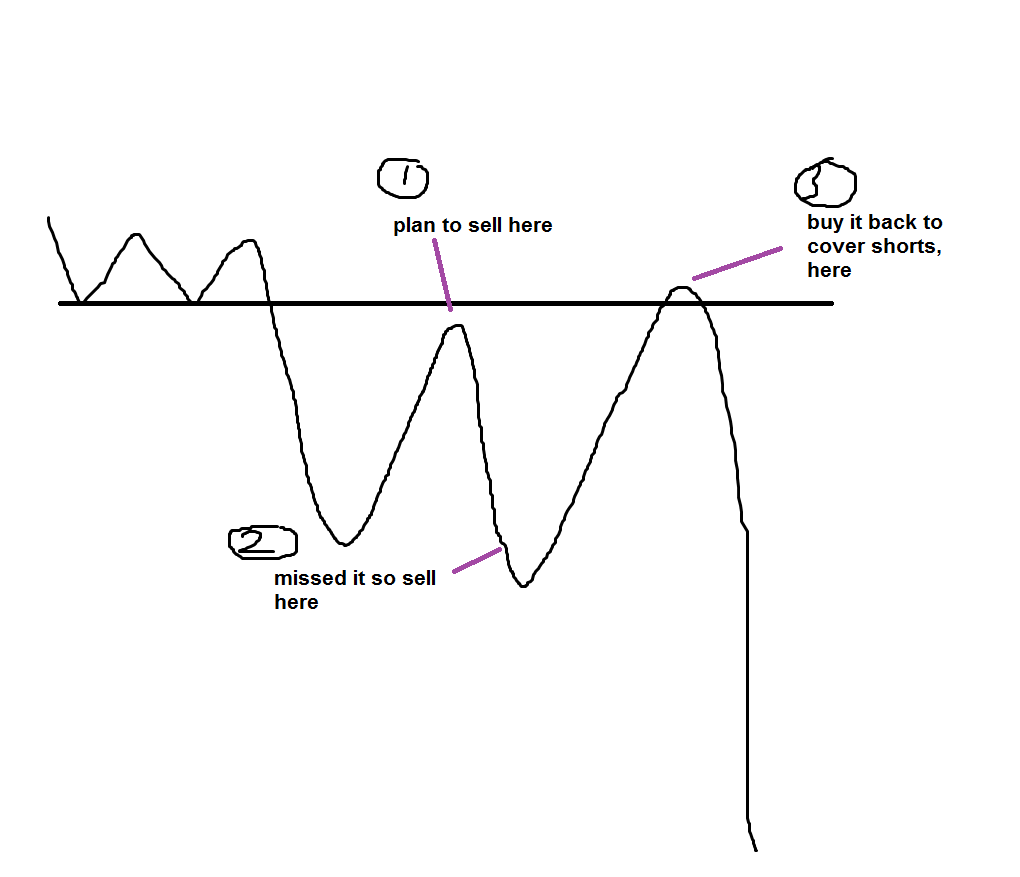

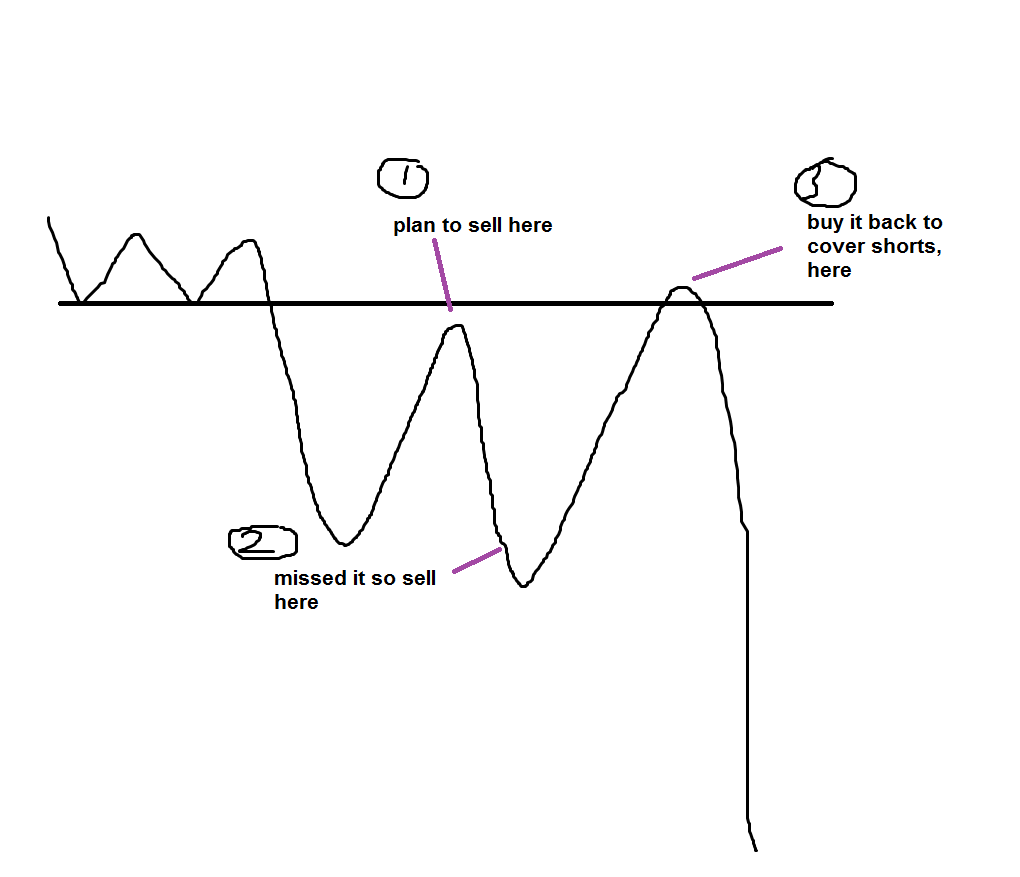

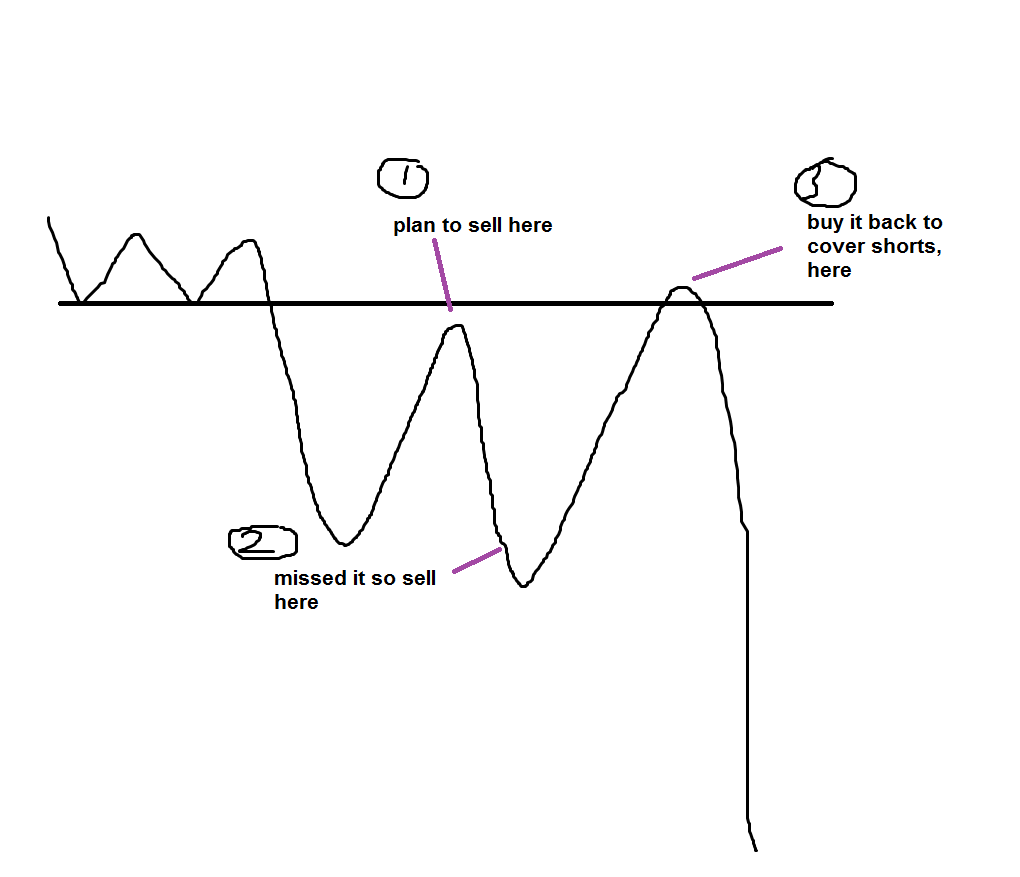

If you are a disciplined, follow the rules trader, then I am sure you are familiar with the many and various ways the stock market can play tricks on you. For instance, a disciplined, technical trader will adhere to a particular strategy based on current market conditions. In so doing, trades are assessed and entered based on specific criteria, usually by combining mechanical and discretionary means.

Technical traders base their current trade decisions on past price action, noting distinct historical patterns that have the possibility of replication. However, the outcome of two strategically similar trades are never exactly alike if for no other reason than those trading a specific stock now are not the same ones who traded it two months, or even two weeks or two days previous. The elements of uncertainty (e.g., changes in sentiment and differences of opinion) exert such an influence on stock prices that exact replication is impossible. Therefore, the market enjoys a “King Jester” status. (more…)

Earlier research has recommended that the vast majority are truly overconfidence in their responses to general information questions. Overconfidence is generally reported in mental research and in budgetary research for traders. Trading choices frequently flummox scientists with regards to human basic leadership and consistent market models. Pomposity in trading is regularly connected to one-sided self-attribution i.e. our insight and choices are in charge of the result and as we as a whole know, we can’t anticipate the business sectors. Traders require trust keeping in mind the end goal to have the capacity to settle on quickly paced choices and hazard money in the trading condition. Be that as it may, overconfidence and been exhibited to prompt entering a larger number of trades than would normally be appropriate and for a few, prompting greater loss. Arrogance has been reprimanded for everything from the sinking of the Titanic to the Great Recession. Research into presumptuousness ensnares it in disabling judgments over a scope of circumstances including financial specialists’ over-trading conduct, Chiefs’ poor gauging, their propensity to present hazardous items, and their inclination to take part in esteem decimating mergers. Arrogance is a standout amongst the most intense subjective inclinations since it is so universal, and makes us settle on essential judgments and choices without a sensible level of thought. Luckily, there are a few systems you can use to diminish presumptuousness. Administrative presumptuousness prompts corporate speculation bends, esteem pulverizing mergers and obligation conservatism. Pomposity has been appeared to cause the overabundance passage in focused markets and to lessen trading execution in test money related markets. The negative ramifications of overconfidence additionally stretch out past the area of simply financial basic leadership.

Earlier research has recommended that the vast majority are truly overconfidence in their responses to general information questions. Overconfidence is generally reported in mental research and in budgetary research for traders. Trading choices frequently flummox scientists with regards to human basic leadership and consistent market models. Pomposity in trading is regularly connected to one-sided self-attribution i.e. our insight and choices are in charge of the result and as we as a whole know, we can’t anticipate the business sectors. Traders require trust keeping in mind the end goal to have the capacity to settle on quickly paced choices and hazard money in the trading condition. Be that as it may, overconfidence and been exhibited to prompt entering a larger number of trades than would normally be appropriate and for a few, prompting greater loss. Arrogance has been reprimanded for everything from the sinking of the Titanic to the Great Recession. Research into presumptuousness ensnares it in disabling judgments over a scope of circumstances including financial specialists’ over-trading conduct, Chiefs’ poor gauging, their propensity to present hazardous items, and their inclination to take part in esteem decimating mergers. Arrogance is a standout amongst the most intense subjective inclinations since it is so universal, and makes us settle on essential judgments and choices without a sensible level of thought. Luckily, there are a few systems you can use to diminish presumptuousness. Administrative presumptuousness prompts corporate speculation bends, esteem pulverizing mergers and obligation conservatism. Pomposity has been appeared to cause the overabundance passage in focused markets and to lessen trading execution in test money related markets. The negative ramifications of overconfidence additionally stretch out past the area of simply financial basic leadership.

Overconfidence Prevents from Calculating Conceivable Costs

Overconfidence is normally measured regarding judgment exactness while evaluating a scope of conceivable results. For instance, when making a judgment about BHP Billiton’s future offer value you could presumably envision a scope of conceivable costs inside which you would be genuinely sure the future cost would fall. Researchers call this a ‘certainty interim’. A certainty interim contains two numbers – a lower bound and an upper bound that together make a range that you are, regularly, 80% beyond any doubt will incorporate the genuine answer. For instance, you may figure that BHP shares one year from today will be $25 and deliver an 80% certainty interim with a lower bound of $15 and upper bound of $35. In this case, you would be attesting 80% certainty that BHP partakes in one year will be somewhere close to $15 and $35. In the event that made a request to make number distinctive 80% certainty interims for a few unique inquiries than 80% of these certainty interims should end up being precise and contain the genuine result. Any trader can be arrogant. In any case, inquire about has demonstrated that frequently, the general population is simply the surest are the individuals who are the slightest equipped, though the individuals who are the minimum sure have a tendency to be the most competent– The Dunning-Kruger Effect. In spite of the fact that not trader particular, you’ll perceive how this hypothesis can apply to traders, especially beginner traders who are brimming with fervor and eagerness to incorporate their learning and think they know it all as of now, or traders who haven’t been making it en route and continue going on the grounds that they realize that the following trade could be the one that makes them rich despite the fact that they are making a greater amount of loss than benefit. A few mental components have been offered in the writing to clarify why the presumptuousness predisposition happens. Tying down is considered as an imperative factor that offers ascend to the presumptuousness predisposition, considering the way that certainty interims are set excessively near the “best gauge”. Commonly, notwithstanding, exactness rates are much lower than they ought to be. For instance, in one far reaching study, people groups’ 80% interims contained the right answer only 48% of the time. Along these lines, individuals’ judgments are presumptuous in light of the fact that the scope of results they consider conceivable regularly misses reality. (more…)

“Not risking is the surest way of losing. If you do not risk, risk eventually comes to you. There is simply no way to avoid taking a risk. If a person postpones taking risks, the time eventually comes when he will either be forced to accept a situation that he does not like or take a risk unprepared.”

“Not risking is the surest way of losing. If you do not risk, risk eventually comes to you. There is simply no way to avoid taking a risk. If a person postpones taking risks, the time eventually comes when he will either be forced to accept a situation that he does not like or take a risk unprepared.”

“Anyone who buys or sells a stock, a bond, or a commodity for profit is speculating if he employs intelligent foresight. If he does not, he is gambling.”

“Most successful traders at some stage have a breakthrough, an Aha! experience. Often this is not new information, or a new approach, but the time was just right, they had matured and were ready to ‘see’ in a new way, to apprehend things clearly on a conceptual level, rather than a technical level.”

The search for happiness has a Heisenbergian aspect: the more certain you are about what you want, the less happy you will be attaining it. It seems to happen unexpectedly, and often only in hindsight.

There is also an “aspergian” aspect: like Viktor Frankl’s “The doors of happiness open outward”. I take this to mean searching and engaging with the world (rather than perpetual introspection), but it could also be the joy in helping others (as risky as it may be).

In markets it is very hard to find happiness, and it is probably foolish to look there. A good source of unhappiness, however, is limit orders. You place them with great hope and the market runs away and leaves you behind. Or you get filled and then it takes you way down. Or you’re overjoyed to finally get out with a modest profit, only to find you sold too soon and missed the big one*.

*Holding losers long and selling winners short: the hardest thing not to do.

The more complexity you add to your trading — by looking at more time frames, indicators, currency pairs, systems, at all hours of the day — the more difficult it becomes to actually implement a profitable trading strategy.

Watch More Videos from AnirudhSethiReport

http://www.youtube.com/user/anirudhsethireport

Winners share certain behaviors and beliefs. Check to see if you possess the traits and beliefs of winning traders !!!