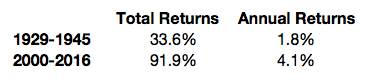

From the peak of the tech bubble in early 2000 the returns on the stock market have been underwhelming. In fact, if you line up the peak of the market in 2000 with the peak of the market in 1929 just before the stock market collapsed, the returns aren’t that far off:

Although the Great Depression was far more severe than what we experienced during the Great Recession, there are some similarities that these time frames share. There were two massive bear markets in the 1930s along with two recessions that saw stocks fall over 80% from 1929-1932 and another 50% in 1937. In the latest period, stocks were cut in half in both the 2000-2002 and 2007-2009 bear markets.

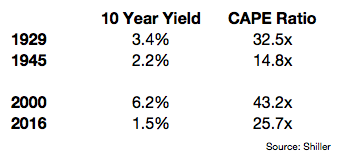

Here’s the breakdown of how government bond yields and long-term valuations changed over each period as well:

Owning a strong domain name can be a valuable asset, due the the fact that a good name can receive a lot of direct ‘type-in’ Internet traffic, bypassing search engines. Here is a list of leading domain names and the publicly trade stocks that own them them.

Owning a strong domain name can be a valuable asset, due the the fact that a good name can receive a lot of direct ‘type-in’ Internet traffic, bypassing search engines. Here is a list of leading domain names and the publicly trade stocks that own them them.