Thought For A Day

Put aside 4 minutes of your day to poke some fun at America’s leading religion: Consumerism.

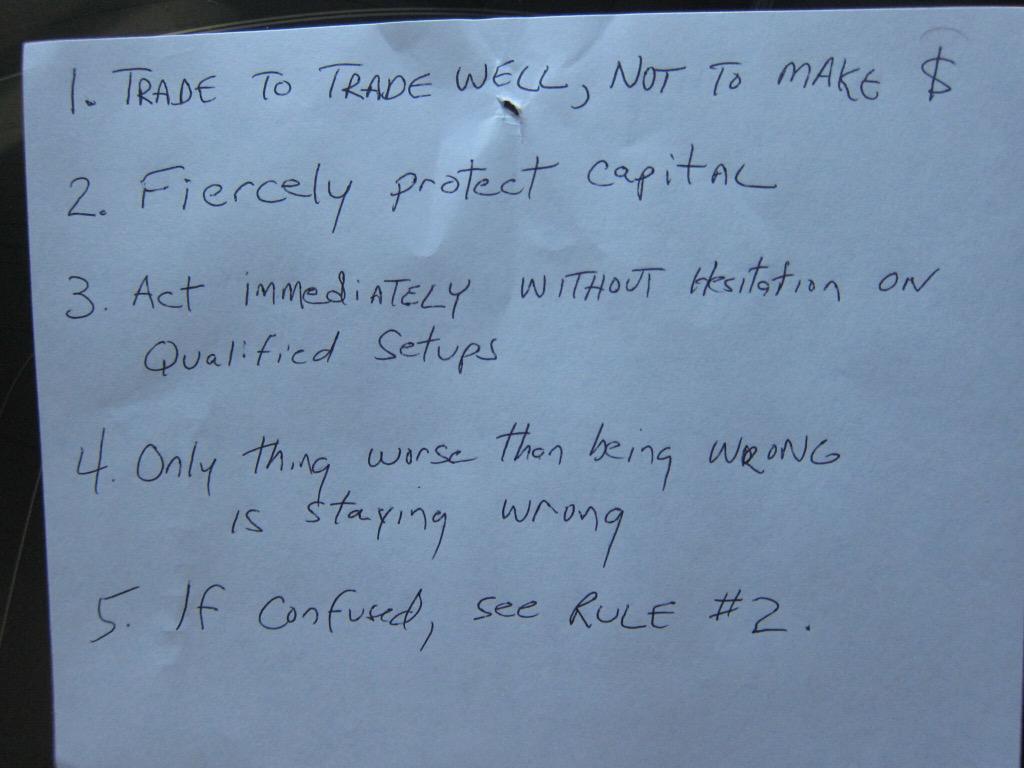

The PlayBook can be applied to all markets. No matter how tempted you might be to think otherwise, markets are markets. There’s a universal trading psychology that applies to all of them. The temptation of a bad trader—perhaps I should be fair and say the unseasoned or untrained trader—to short when you should go long exists everywhere. By the same token, great traders are all alike in the sense that their passion, willingness to invest in their trading future and relentless dedication to learn more and to become better than they currently are is universal. Whether you are a trader in Singapore, London, Russia, Brazil, Australia, or Hong Kong, you can be sure the mindset of your market’s great traders is the same: They find the setups that make the most sense to them, then internalize this knowledge, get bigger in their best setups and then act – trade -on it. This is your path to becoming a “proper” trader.

Initiation- Every trader comes in thinking they will make money, in fact if they have never traded, they probably have convinced themselves fully. They spend time looking for all the answers in charts but it is in the process. It seems like easy money. It is not easy but it is probably the best way to make money. The best of anything takes more work.

Wearing off of novelty– This is a critical time for any trader. This is where the hole gets deeper or ideally the trader stops and starts to work more efficient. Process and not charts. This is the motivation to understand what trading really is and who they really are.

Trough of sorrow- This is also a critical point. Now you have done some work but it has not paid off yet. Do you keep working? Do you get some help? Can you continue to improve? (more…)

In January 2018……………One Day Seminar only on Fibonacci !!

More Details soon ,Send me mail at :[email protected]

10) Those who are willing can be taught almost anything. And the number one lesson: 1) The market is bigger, stronger and badder than you. Always respect it for the beast it is. |