|

Latest Posts

rssQuotes from :The Logical Trader

Recently, I just read a book authored by Mark B. Fisher, The Logical Trader. There are some good trading quotes that I like from that book. So, I think it may be good to share them here too.

Here are the trading quotes:

In trading, as in life, you need a plan. This plan includes not only the micro – a strategy for each and every trade you make – but also the macro – meaning why you trade, how you intend to reach that goal (your means to the desired end), and what you’ll do as an alternative if that doesn’t work out.

Know what you want to accomplish, how you intend to get there, and what you will do if it does – or does not – work out. Have a plan and stick with it. That works in trading, as well as in life. (more…)

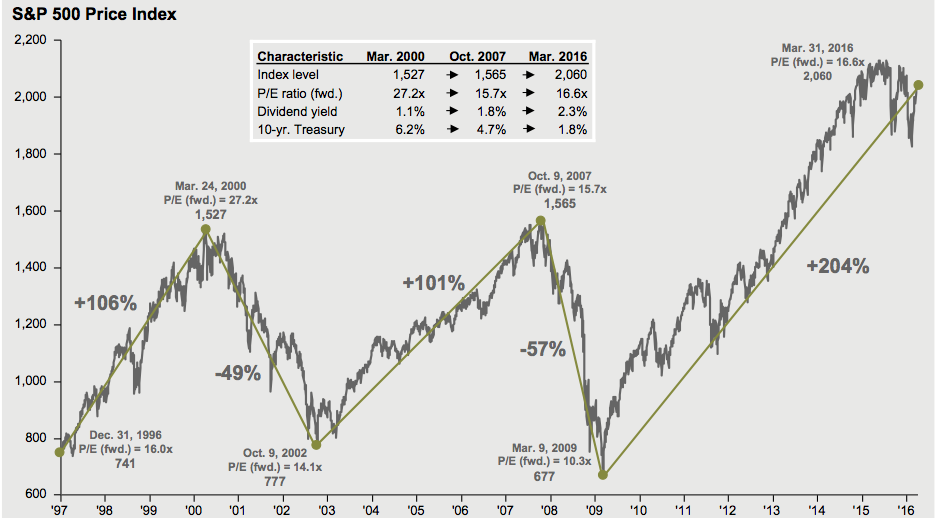

S&P500 Cycle Trend, 1997-2016

10 Questions to ask Yourself Before Every Trade

What is the overall direction the market is moving with in your time frame and the larger time frame?

- What time frame will you be trading with your next trade?

- What is your entry signal and what is its historical performance as a winning set up?

- How much money will you risk on this trade?

- How big will your position be for this trade?

- How will you know you are wrong and stop your loss?

- How much profit do you believe is possible if it moves in your favor?

- How will you know when it is time to exit with a profit?

- What is your ratio of reward versus risk?

How many trades will you have on at any one time?

Year 1915 – Some perspective by looking at the world 100 years ago

Some Suggestions for Traders

Have you written down your trading rules? Do you have rules for entry and for exit with a profit and with a loss? Do you have a rule telling you whether a market is trending and what the trend is? Do you have rules stating when the market is in a trading range and what that range is? Do you have rules saying what markets you will trade and what has to happen to trade them?

Have you written down your trading rules? Do you have rules for entry and for exit with a profit and with a loss? Do you have a rule telling you whether a market is trending and what the trend is? Do you have rules stating when the market is in a trading range and what that range is? Do you have rules saying what markets you will trade and what has to happen to trade them?

Or do you simply shoot from the hip and call it artistry or intuition? Does this work for you?

Do you follow your rules rigidly without flexibility or discretion? Does this serve you over time?

Do you abandon your rules in the heat of trading, only to regret it? Do you stubbornly go against your rules thinking this time you know better? What would happen if you didn’t do this?

Some people don’t like rules. They don’t want to be told what to do even if it’s themselves telling themselves what to do. They even more don’t like following rules that came with a system for which they paid good (any or excessive) money. They have a polarity response to direction even after it becomes apparent that they’d be more profitable simply following the rules.

Others like to be told what to do, but somehow their rules are conflicting, obscure, or so bound up with discretion as to be meaningless. These traders may not even be aware that in essence they have no rules.

Whatever your situation turns out to be, it may be helpful to think in terms of commandments or suggestions. You may think in terms of absolute rules or simple guidelines.

Do you like clear directions as to what to do? In this case you can think in terms of commandments. For example, when The Ten Commandments says, “Thou shalt not kill,” it doesn’t leave much discretion. Reword your rules as commandments that are precise and clear and easy to follow.

Do you resist being dictated to and bossed around by outside forces? In this case, reformulate your rules as guidelines or suggestions. Give yourself some leeway in certain situations. Reword it so that when you read it, it sounds like a good idea and not a demand.

However, be certain in advance that whether you choose a suggestion or command, the results will be profitable if followed consistently or even most of the time. There’s nothing worse than a bad idea or a rule that doesn’t work. Remember the basics: Find out what works. Verify that it works. And do it.

Teach Your Children About Tax

Risk :Reward Ratio vs Winrate

Successful traders think differently than the rest and they never quit…win, lose, or draw.

Your long term success will be based on your willingness to keep on speculating while managing uncertainty, fear and greed, losses and gains, the knowns and the unknowns. Success is about speculating again after multiple, managed losses knowing that the next big winner may just be the next trade. Success is about speculating again after a winner, not fearing that the next trade may chip away at your recent gains.

Successful traders think differently than the rest and they never quit…win, lose, or draw.

Get Out When You’re Wrong

Successful traders know that discipline is what allows them to enter their trades when the odds are in their favor and, more importantly, to get out when they’re wrong.

Successful traders know that discipline is what allows them to enter their trades when the odds are in their favor and, more importantly, to get out when they’re wrong.

Being right is not the problem. What you do when you’re wrong is the crucial issue.

There are a lot of traders who buy then pray while the market goes against them, because they think that it will eventually go their way.

Most traders average down and wait for the market to turn their way.

Trading my way, I always have defined amount of money that I am willing to lose.

I let the market decide how much money I’m going to make.