Decide that you are not going to stay where you are

Correction Starts…

Yesterday closed 10897 level.

Now below 10938 level ,Bears will have upperhand.

Iam expecting DOW to crash upto 10788-10738 level in this slide.

I will update more on Sunday about DOW ,S&P 500 !!

Updated at 16:17/08th April/Baroda

Every trader is different, and only you know your risk tolerance. Are you the type of trader who can risk 20% to make 20%, or do you feel the need to have a much higher risk/reward payout in order to enter a trade? Be sure to define your risk before placing any trade orders. Doing so helps ensure that you have an exit strategy, which is arguably just as important as your entrance strategy. A little extra work in the beginning can make all the difference in the end.

Annual salary in national currency: 16.7 million krónur

> Time in office: 2 years 9 months

> GDP per capita: $44,029

> Annual salary in national currency: 140,904 euros

> Time in office: 9 months

> GDP per capita: $40,661

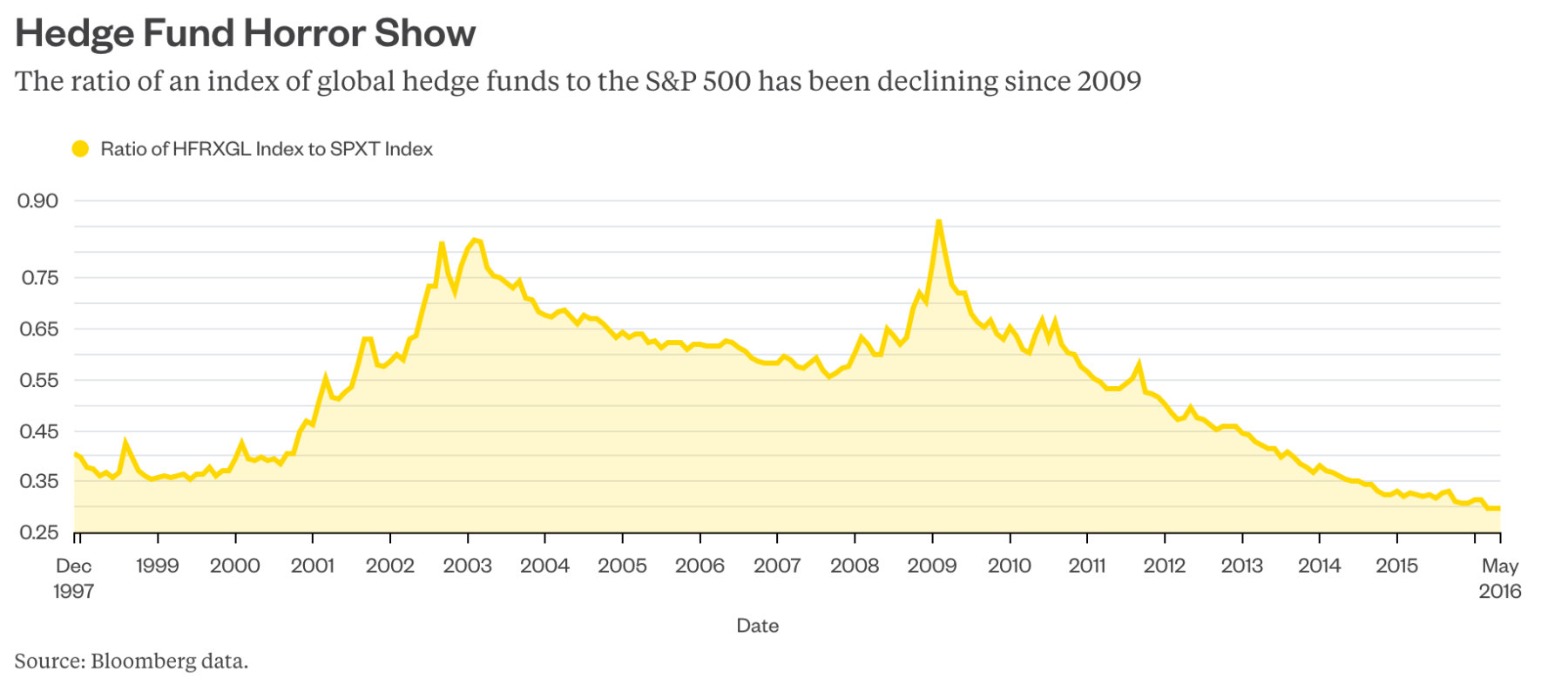

Really interesting analysis via Gadfly about under performance in the hedge fund community:

Just last week, the U.S. bull market in stocks became the second longest on record, which — fair or not — leaves it vulnerable to some age discrimination. Over that stretch, equity hedge funds as a group have underperformed the S&P 500, which is a comparison that many fund managers will insist is apples to oranges but which nonetheless is a comparison that will probably continue to be made forever by investors perusing the fruit salad of investment options.

Look at this chart, which shows a ratio of the HFRX Global Hedge Fund Index to a total-return version of the S&P 500. When the line is falling, it means the hedge funds tracked by the index are getting beaten by the S&P 500. And, whoa boy, it has been falling for the last seven years: