Latest Posts

rssThought For A Day

Bitcoin: Has a Future as a Medium of Exchange ?

It was interesting to hear Mr. Buffett’s take on Bitcoin in the extended CNBC interview with Becky Quick this week. That single interview on CNBC is probably the best 3 hours of financial media that viewers get a few times a year.

Mr. Buffett’s comment on Bitcoin: “If you sit there and watch it, it doesn’t do anything, it doesn’t reproduce”, which is actually pretty humorous. (I couldn’t help but think that Mr. Buffett was thinking about farmland, which he as always said he would prefer to own, rather than a similar quantity of gold.)

One important lesson learned from Economics 101 I still remember from freshman year of college, 1978, is that in economics, a currency or money is either a “store of value” or “a medium of exchange”. (It was surprising to read Wikipedia’s “store of value” definition since it seems very similar to Investopedia’s “medium of exchange” definition.)

Are the the “store of value” versus “medium of exchange” terms really all that different ? On their face, it doesn’t appear to be the case, but my own definition of store of value was that it was intended to mean “intrinsic value”, which paper currency, gold and bitcoin lack.

As JP Morgan demonstrated this week, cryptocurrency likely has a future as a medium of exchange (in my opinion). It seems like a product looking for a market, the last few years, and that market needs to develop around the cryptocurrency and Bitcoin over time.

Trump says ‘maybe’ he will get a China deal

The usual stuff from Trump

- China trade deal may happen soon, may not happen at all

The cold war – Barron’s

Thai baht soars to post-coup high, threatening local business

The Thai baht has soared to its highest level against the dollar since the current junta government seized power in a coup in 2014, jeopardizing the nation’s exports and tourism-dependent economic growth just a month before the country’s long-awaited election in March.

The baht traded at 31.19 to the U.S. dollar on Friday, up 4% since the start of the year, as one point reaching its highest level since November 2013.

The appreciation of the Thai currency was steeper compared to regional peers. The Indonesian rupiah and Philippine peso have risen by 2% and 1%, respectively, since the start of the year. The baht was the strongest performer of all regional currencies in 2018.

While the risk appetite of investors around the world turned positive since U.S. Federal Reserve Chairman Jerome Powell signaled a halt in rate rises in January, the Bank of Thailand has maintained its hawkish stance. The country’s central bank held rates at its policy meeting in early February, although two out of six committee members present voted for a rise, even though the bank had already raised rates for the first time in seven years in December.

The difference in policy direction of the U.S. and Thai central banks drew money to the latter market, causing the baht’s rise. A constant current account surplus since late 2014 has also contributed to the currency’s rise.

Yoichiro Yamaguchi, chief economist at Sumitomo Mitsui Banking Corp., said that while currencies of countries with a current-account deficit tend to be vulnerable to market shocks, “Thai baht-based assets are considered safer in the Southeast Asia region.”

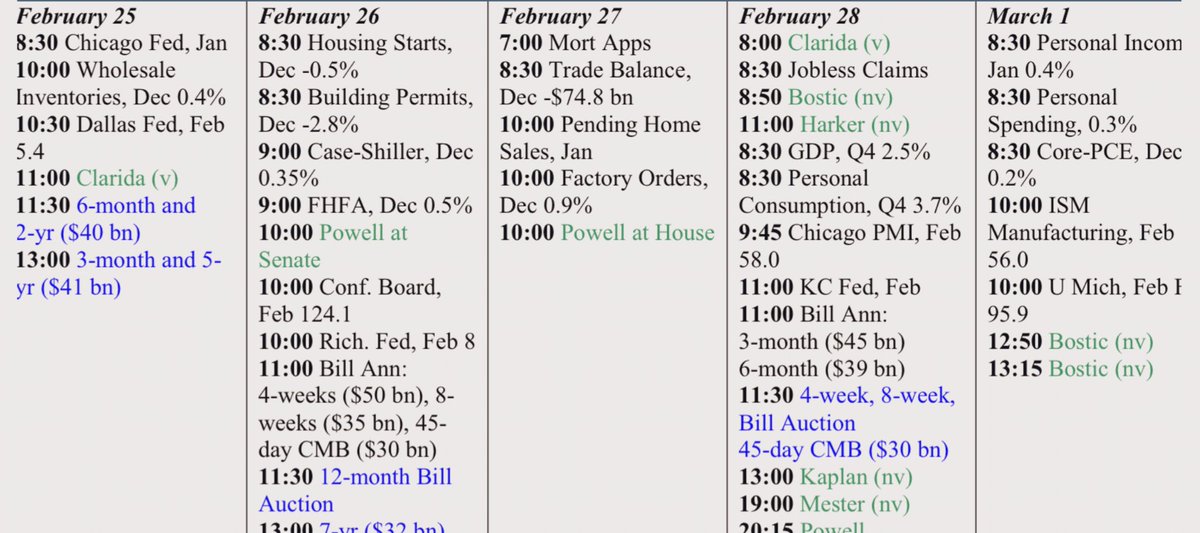

Lots of new data next week

12 Wisdom Thoughts for Traders-Video

Trading Book VS Reality

THINK LIKE A FUNDAMENTALIST;TRADE LIKE A TECHNICIAN

To trade/invest successfully, think like a fundamentalist; trade like a technician. It is obviously imperative that we understand the economic fundamentals that will drive a market higher or lower, but we must understand the technicals as well. When we do, then and only then can we, or should we, trade. If the market fundamentals as we understand them are bullish and the trend is down, it is illogical to buy; conversely, if the fundamentals as we understand them are bearish but the market’s trend is up, it is illogical to sell that market short. Ah, but if we understand the market’s fundamentals to be bullish and if the trend is up, it is even more illogicalnot to trade bullishly. |