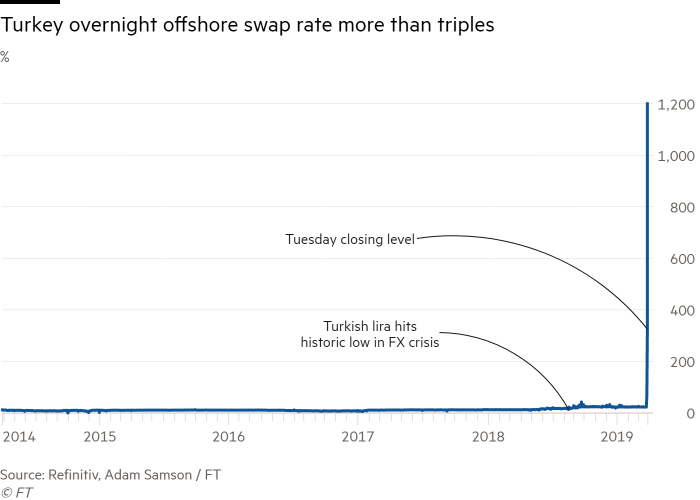

The cost to borrow Turkish liras overnight more than tripled to above 1,000 per cent on Wednesday in a sign of how money markets have seized up after an apparent bid to stymie foreign short sellers.

The offshore overnight swap rate, the cost to investors of exchanging foreign currency for lira over a set period, soared to 1,200 per cent, after hitting 325 per cent, the highest level since 2001, in the previous session. It was 22.6 per cent at the end of last week, Refinitiv data show.

The rising cost highlights what some analysts say is an attempt by Turkey’s government to arrest a decline in the lira, after the currency on Friday faced its heaviest plunge since the economic crisis during the summer of 2018. It rose both on Monday and Tuesday this week. On Wednesday, it repeatedly swung lower by two per cent before repeatedly picking up — an unusual pattern that suggests systematic buying. “The stress is hard to overstate,” said one Turkey-specialist at a European bank in London.