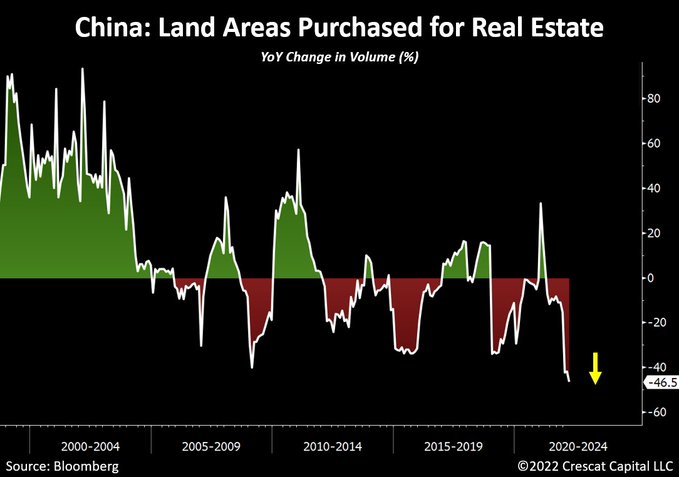

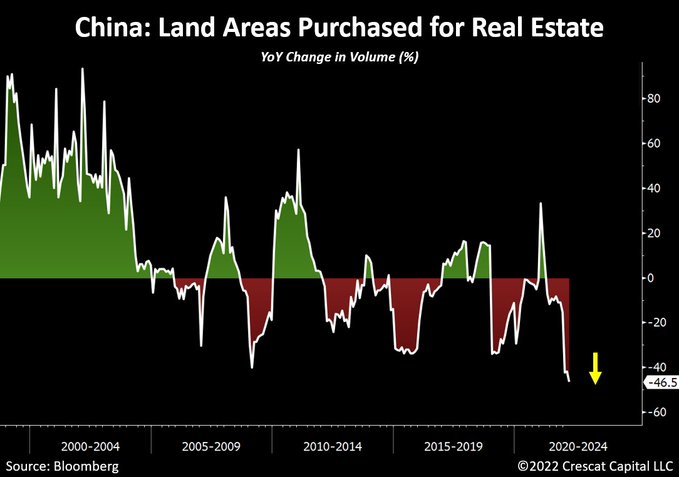

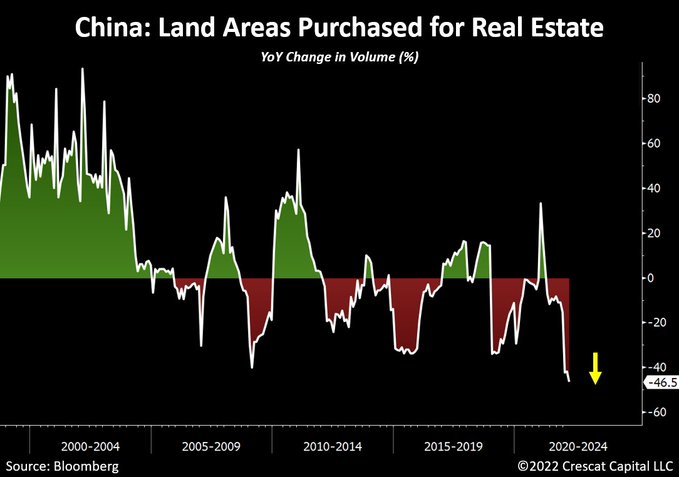

China land purchases for real estate just collapsed -46.5%.

Risk sentiment is keeping steadier as we get into European morning trade, after a bit of a sluggish showing by equities yesterday. The recent bounce in stocks may have some added breathing room but the storm clouds are still staying the course. Elsewhere, S&P 500 futures are up 0.2%, Nasdaq futures flat, and Dow futures up 0.4% currently.

South China Morning Post (gated) with:

Chinese People’s Liberation Army Navy will be launching its 3rd Full-Sized Aircraft Carrier

The major US indices had an up and down trading day. The major indices are closing lower on the day. The markets were influenced by profit taking after the run higher last week that saw the major indices up greater than 6%. Admittedly, those oversized gains came after 7 straight weeks of declines for the S&P and Nasdaq and 8 straight weeks for the Dow. A gain was due in an oversold market.

This week will be challenged by the run up to the US jobs report on Friday. A lot of times, traders/investors want to see what that story tells.

What is more relevant currently is weaker data is better as it has the benefit of potentially slowing the Fed hikes, and with a little luck, slowing the tightness in the economy that is leading to higher inflation, and tighter employment.

The Dow closed lower for the first time after 6 straight days of gains. The Nasdaq and S&P snapped 3 days of gains.

The final number are showing:

How can you improve your stock trading skills? Tony Swartz’s article Six Keys to Being Excellent at Anything, which I read yesterday, provoked this question. I linked to the story in my following THINKING TRADER piece, which will be published on Friday, and also supposed to build on it because it was such a thought-provoking piece. After all, according to Mr. Swartz, the keys can be utilized for anything.

On the month:

The euro gained 1.7% in the month and the pound 0.2%. The S&P 500 is on track for a 0.2% decline this month.

On my way home from New York a few weeks ago I was listening to Cat Stevens “Moonshadow” on my Ipod and thinking about how simple, philosophically grounded thinking can impact a trader’s bottom line.

We tend to think that taking a loss on a trade is the end of the world when it is not. It is just a trade that did not work out. Period. No need to re-invent the wheel, throw out the baby with the bath water, or cry wolf one too many times. Maybe we should simply have the attitude of Cat.

… if I ever lost my hands

Lose my plough, lose my land

Oh, if I ever lose my hands- Oh, if…

I wont have to work no more

And if I ever lose my eyes

If my colors all run dry

And if I ever lose my eyes – Oh,

I won’t have to cry no more

And if I ever lose my legs

I won’t moan and I won’t beg

Oh if I ever lose my legs- Oh if…

I won’t have to walk no more

And if I ever lose my mouth

All my teeth, north and south

Yes, if I ever lose my mouth- Oh if…

I won’t have to talk…

Let’s add another stanza here for the stock trader…

… if I ever lose a trade

The Market takes the money I could have made

Oh, if I ever lose a trade…

I won’t have to brag no more!

Kind of puts things in their proper perspective doesn’t it?