Latest Posts

rssElon Musk will attempt to terminate his agreement to buy Twitter

Yesterday the Washington Post reported that Elon Musk had “stopped engaging in certain discussions around funding for the $44 billion deal” and that the deal was in serious jeopardy, so this news isn’t out of the blue.

Twitter shares were down 5.35% on the report today and closed at $34.84 — far below the $54.20 agreement. For more than a month, there have been signs that Musk has a bad case of buyer’s remorse.

What’s far less clear is that he will be able to walk away from the deal.

He accused Twitter of being “in material breach of multiple provisions” of the merger agreement.

“Mr. Musk is terminating the Merger Agreement because Twitter is in material breach of multiple provisions of that Agreement, appears to have made false and misleading representations upon which Mr. Musk relied when entering into the Merger Agreement, and is likely to suffer a Company Material Adverse Effect (as that term is defined in the Merger Agreement)”

However he signed an agreement to complete a purchase of Twitter. It wasn’t an agreement to think about buying Twitter and the social media company has said it will enforce the deal.

Delaware courts, where this will be adjudicated, have been consistent in ruling that the bar for breaking a merger agreement is extraordinarily high. Musk has said the bot count is too high but Twitter this week released a presentation saying it was below 5%. Legal expert say that even if it was 20% it will be tough to argue it’s a material adverse clause. (more…)

US major indices close the day with mixed results

A look at the final numbers shows:

- Dow industrial average fell -46.4 points or -0.15% at 31338.16

- S&P index fell -3.26 points or -0.08% at 3899.37

- NASDAQ index rose 13.97 points or 0.12% at 11635.32

- Russell 2000 fell -0.23 points or -0.01% at 1769.36

For the trading week all the indices were higher led by the NASDAQ index:

- Dow industrial average rose 0.77%

- S&P index rose 1.94%

- NASDAQ rose 4.56%

- Russell 2000 rose to 2.22%

Looking at the Dow 30 this week, the gains were led by:

- Nike, up 6.67%

- Apple up 5.84%

- Intel up 4.54%

- Salesforce up 4.34%

- Microsoft up 3.11%

The Dow losers this week included:

- Walgreens, -2.62%

- Chevron -2.55%

- Verizon -2.23%

- Coca-Cola -1.93%

- Travelers -1.27%

Some big gainers this week included:

- Beyond Meat, +24.51%

- Rivian, +24.47%

- Celcius, +18.94%

- Chewy, +18.66%

- Roblox, +17.79%

- Moderna, +17.53%

Some big losers this week included:

- Raytheon, -17.17%

- Phillip Morris -5.5%

- Schlumberger, -3.73%

- Twitter, -3.71%

- Lockheed Martin -3.04%

- Wynn resorts -2.96%

- Chevron -2.55%

Thought For A Day

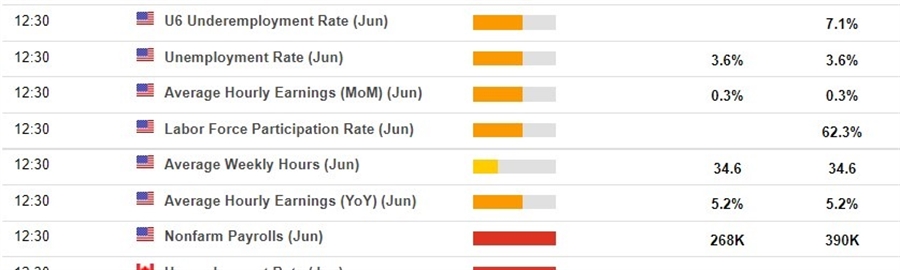

US Nonfarm payroll report due Friday, 8 July 2022

- Employment gains are slowing, and we view this as inevitable as more of the unemployed have found jobs and the unemployment rate has dropped well below 4%.

- Strong employment, however, is how we interpret an increase of nearly 300K jobs in a month.

- Trucking, delivery, food services and healthcare remain areas of recovery and growth for job markets.

- We expect the unemployment rate to edge back down to 3.5% for June, possibly very soon.

- A rising labor force participation rate (more people entering the labor force) is one pro-growth factor that can steady the unemployment rate, preventing a decline, even when the economy is strong. Later, as businesses reduce their demand for labor, smaller job gains are why the unemployment rate stabilizes or begins to rise.”

Westpac:

- payrolls should reflect moderating but still healthy jobs growth in June (Westpac f/c: +300k, market f/c +268k),

- keeping pressure on the unemployment rate (Westpac & market f/c: 3.6%)

- and supporting robust growth in average hourly earnings (Westpac & market f/c: 0.3%).

Thought For A Day

Goldman Sachs’ 3 reasons warn of a more severe recession in the U.S., U.K., and Canada

Cites 3 factors:

- “Currently, across the advanced economies, unit labor cost growth, core inflation, and the expected total increase in the policy rate are generally running at levels similar to the run-up of the typical advanced economy recession,”

- “Higher measures of economic overheating in the U.S., U.K., and Canada than in Japan and the Euro area suggest that the next recession may be somewhat less shallow in these English-speaking G10 economies.”

Hatzius’ forecasts:

- risk that “the economy enters a recession in the next year at 30% in the U.S., 40% in the Euro area, and 45% in the UK,”

USD/JPY poll – forecasts as high as 140. Bank of Japan direct intervention looks unlikely,

- median forecast was for 131 in six months’ time, compared with 126.84 in last month’s forecast

- Seven of 61 respondents projected the yen to be at a weaker level than that six months from now, including four forecasting it to be at 140.

Japan was unlikely to intervene in the FX market to stop it from sliding, 45% of 22 poll respondents said.

- “The BOJ will probably be forced to abandon the yield curve control policy in the coming months if JPY depreciates further. However, direct intervention looks unlikely,” said Roberto Cobo Garcia, head of FX strategy at BBVA.

Ten of 22 poll respondents said Japan would not intervene.

- six respondents predicted intervention at the 140

- four chose 145 as the likely trigger level

- One selected 150

- another said 155 or weaker

—

USD/JPY update:

FOMC minutes response: “unsurprisingly hawkish”

- FOMC minutes … unsurprisingly hawkish

- Fed appears set on hiking the policy rate by either 50bps or 75bps at the upcoming meeting later this month

- a restrictive policy stance was seen as warranted given the strength of inflation and tightness in the labour market

- the minutes flagged the possibility of an “even more restrictive stance” if elevated inflation pressures were to persist

- there was no sign in the minutes that the Fed is thinking of wavering from its strategy, even with a growth slowdown in train and equity markets in ‘bear market’ territory … participants “recognized that policy firming could slow the pace of economic growth for a time, but they saw the return of inflation to 2% as critical to achieving maximum employment on a sustained basis.”

Daily USD index:

Thought For A Day