US futures pare gains to turn negative as bonds gain further

The shift in the risk mood is helping the dollar push higher against the euro and commodity currencies on the day. EUR/USD just fell to a low of 1.1162 with AUD/USD and NZD/USD both falling to lows of 0.6765 and 0.6450 respectively.

Of note, EUR/USD is now challenging the 200-hour MA (blue line) and if sellers can find a break below that, then they will seize near-term control of the pair.

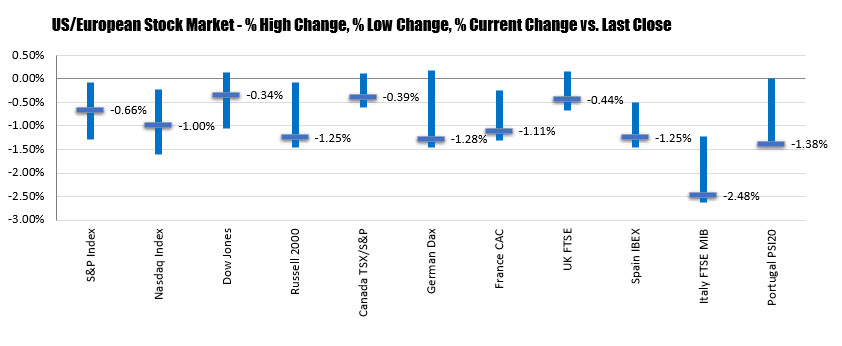

S&P 500 futures are now down by 0.1% while US 10-year yields have extended earlier weakness and is now lower by 4 bps to 1.703%.