NASDAQ index up 1.12%. S&P index also up nicely

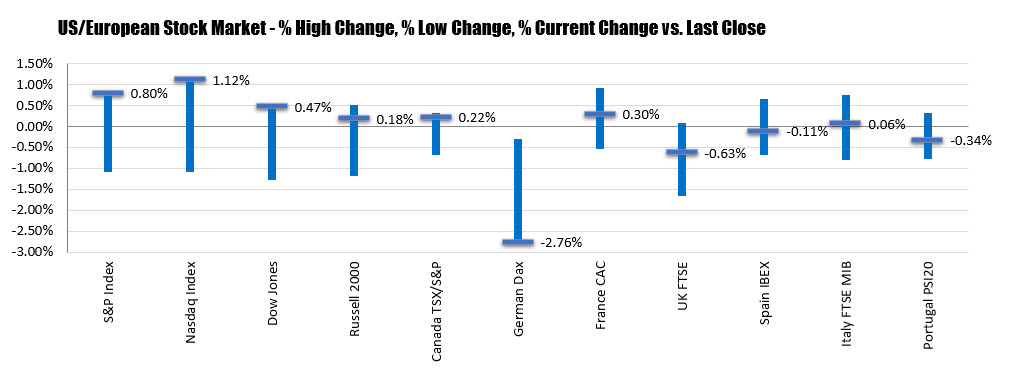

The US stocks fell sharply after the worse than expected ISM nonmanufacturing index. The NASDAQ and S&P index fell -1.1% added slows. The Dow industrial average was down -1.29%. However, buyers into the market by the close, the major indices were trading at session highs.

The final numbers are showing:

- The S&P index rose 23.02 points or 0.80% at 2910.63

- The NASDAQ index rose 87.02 points or 1.12% at 7872.26

- The Dow industrial average rose 122.42 points or 0.47% at 26201

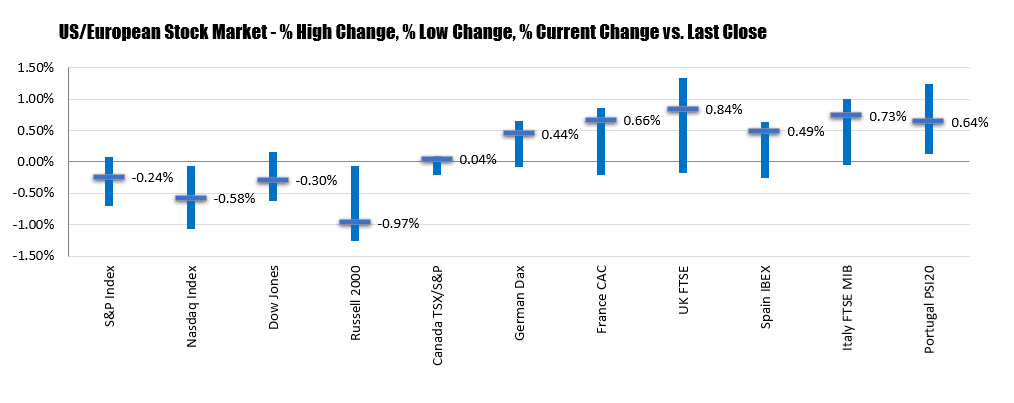

The percentage change ranges for the major indices in the North America and Europe are outline below. In Europe, the German DAX got creamed falling -2.76%. The UK FTSE was also lower but a more modest -0.63%.

Some winners today:

- Slack, +6.27%

- Nvidia, +4.83%

- Micron, +3.57%

- Square, +3.25%

- Pepsi, +2.95%

- Facebook, plus a 2.75%

- Pfizer +2.22%

Some losers on the day included

- Tesla -4.16%

- Charles Schwab, -3.83%

- Delta Air Lines, -2.8%

- Alcoa, -1.35%

- Disney, -0.76%

- UnitedHealth, -0.66%

- Johnson & Johnson, -0.5%

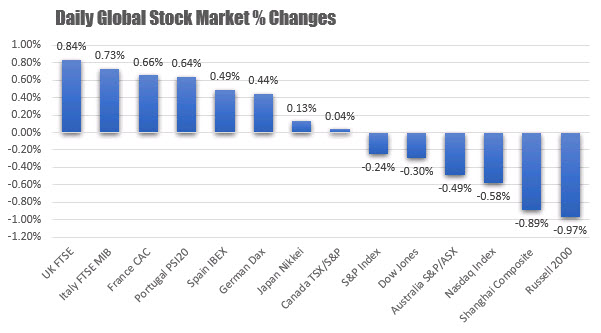

Ranking the winners and losers globaly, the UK FTSE was the biggest winner, while the Russell 2000 in the US was the weakest.

Ranking the winners and losers globaly, the UK FTSE was the biggest winner, while the Russell 2000 in the US was the weakest.