How low can you go?

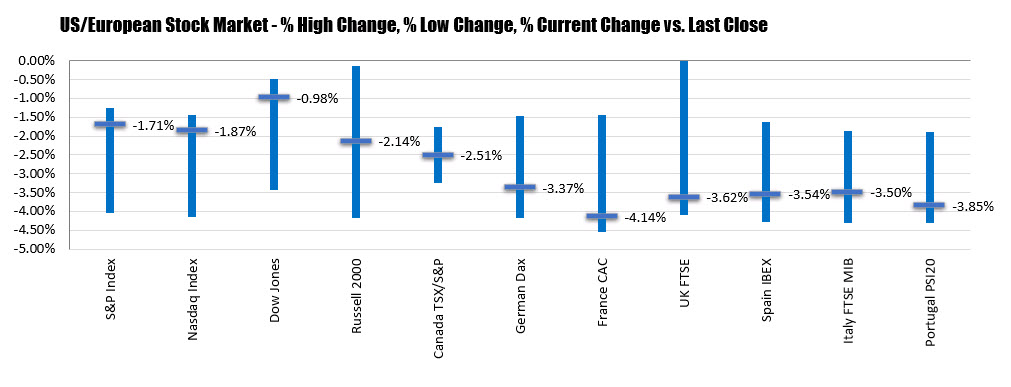

US futures hit limit down very early in the trading day and with European equities pointing to a 8-9% drop across the board, it looks like US stocks will be headed for an extremely rough open later in the cash market (S&P ETF down by nearly 10% now).

Here are the key circuit breaker levels to watch today:

- Level 1: 2,521.25 or down 7% from Friday close

- Level 2: 2,358.59 or down 13% from Friday close

- Level 3: 2,168.82 or down 20% from Friday close

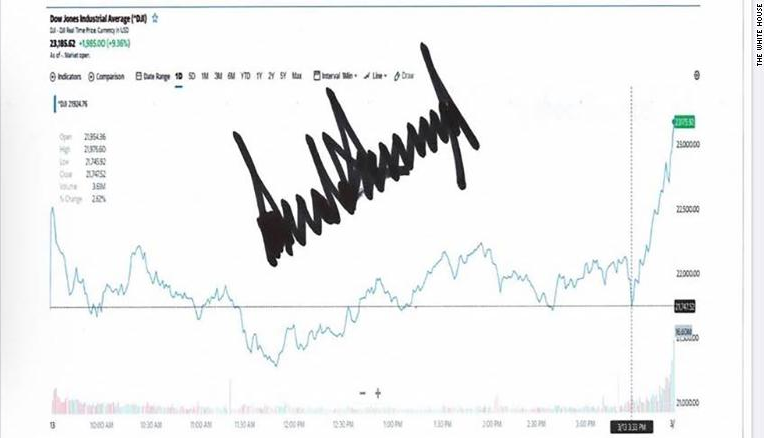

If anything else, also keep an eye out on the key trendline support that stretches back all the way to 2009, currently near the 2,500 level. Clearly, this did not age very well:

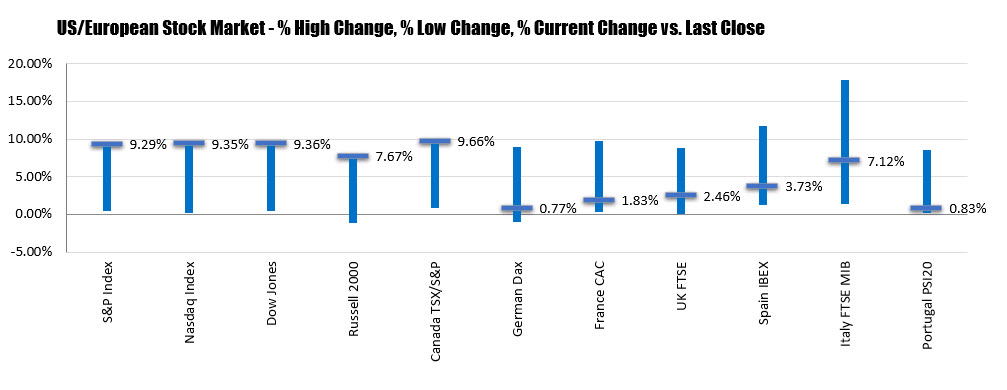

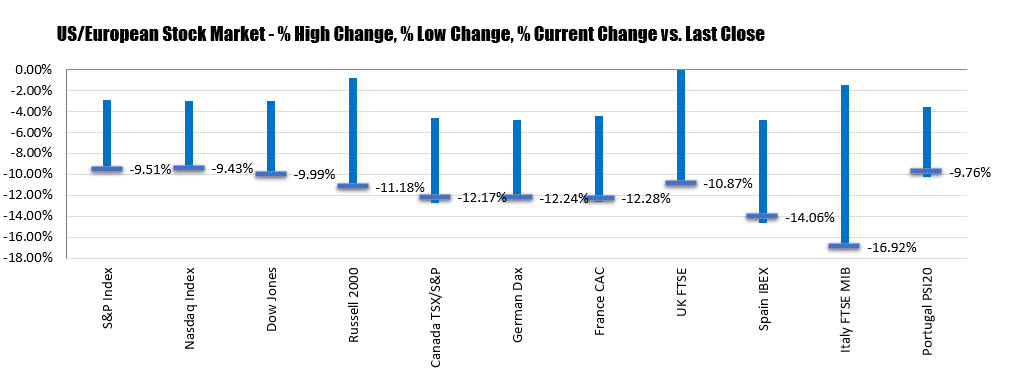

Year to date numbers are showing:

Year to date numbers are showing: