Three solid days of gains on the trot for the Nikkei

The Nikkei closes at its highs for the day as equities are getting a boost from the US reaching a stimulus deal to combat the economic fallout from the virus outbreak.

The mood among Asian equities is also more positive after solid gains from Europe and Wall Street yesterday, with the Dow posting 11% gains – the most since 1933.

The Hang Seng is up by just over 3% with Chinese indices also up by just over 2% as we approach the closing stages of Asia Pacific trading.

The overall risk mood is leaning more positive but again, a deal in Washington is very much expected so can this stay the course and keep the risk mood upbeat today?

We’ll have to wait and see. The timing couldn’t be more tricky as we have seen three weeks of carnage in the market and bear market bounces tend to be among the sharpest.

In the currencies space, the aussie and kiwi are leading the charge as they both surged higher after the US agreement. The dollar remains on the back foot still as the market seeks a calmer mood so far on the trading week.

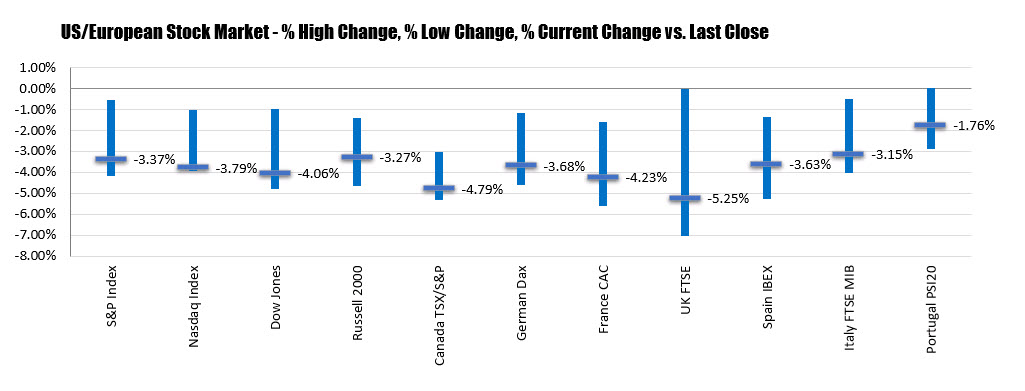

Although lower for the day for all major indices closed with gains.

Although lower for the day for all major indices closed with gains.